AVIA offers account management services to traders with different performance outputs for each. They follow a semi-automated trading methodology. The devs point out that 70% of the trading is carried out by the robot, while the remaining 30% is handled manually. Our article will discuss various characteristics and features of the company and decide whether it is safe to use their service .

Product offering

The account management information is presented through a single webpage. All the output, performance, and risk management information is delivered through a single web page. Although the characteristics are presented neatly, it would have been better to distribute them amongst various tabs. It can be confusing to search for the information that you need to know about the service.

Vendor transparency

The company behind the AVIA is LEEFTURN who claims to have offices in the United States and Canada. The company doesn’t provide any information on the developers of the program. They share their registration license number as #005002593 in Canada.

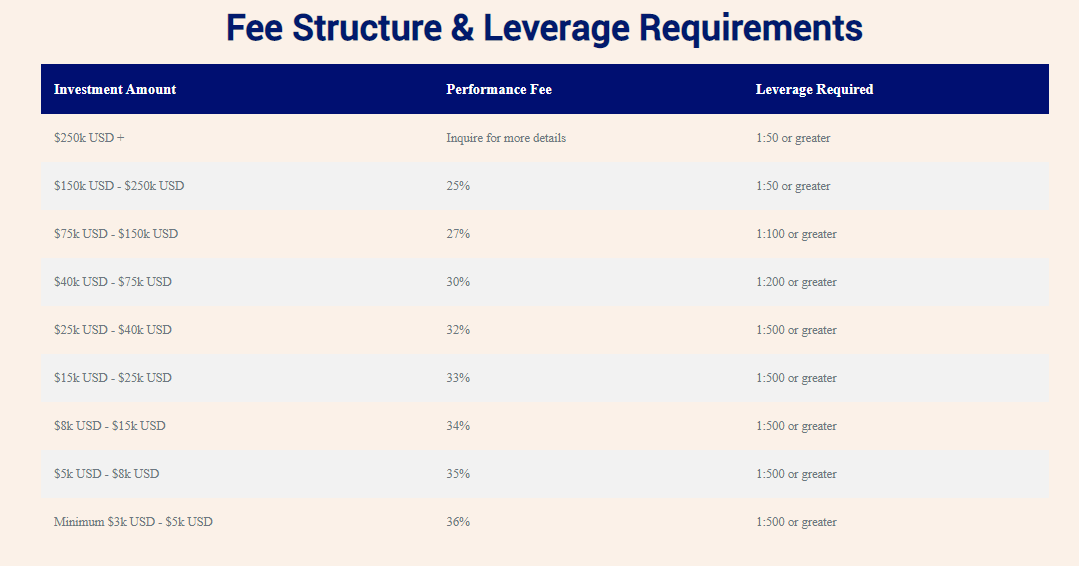

Price

The company charges performance fees that differ based on the initial investment amount. As you increase the initial investment capital, it will slightly decrease. For the minimum investment of $3000, the costs are 36% on all the profits obtained. The leverage requirement also decreases as soon as you increase your balance. There is also a 30-day risk-free trial that traders can take to understand the system’s performance.

Trading strategy

The company presents different programs that differ on the basis of the risk and percentage gains. They follow a 70% automated and 30% discretionary strategy, which involves manual intervention depending on market sentiment and defensive interventions. They state that they are focused on macro fundamentals and do not take unnecessary risks.

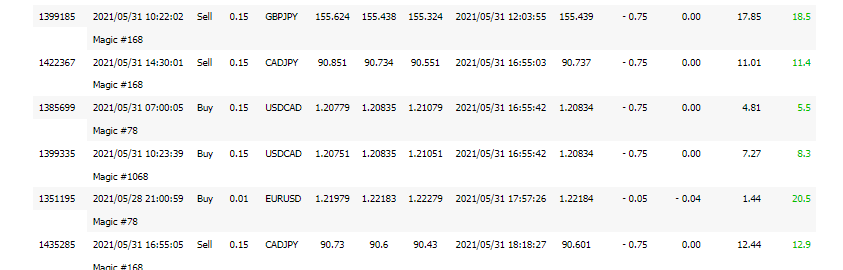

To understand their strategy better, we head over to the live records on FXBlue. We see from history that the company trades on multiple currency pairs and uses a martingale strategy to get out of the losing trades.

Trading results

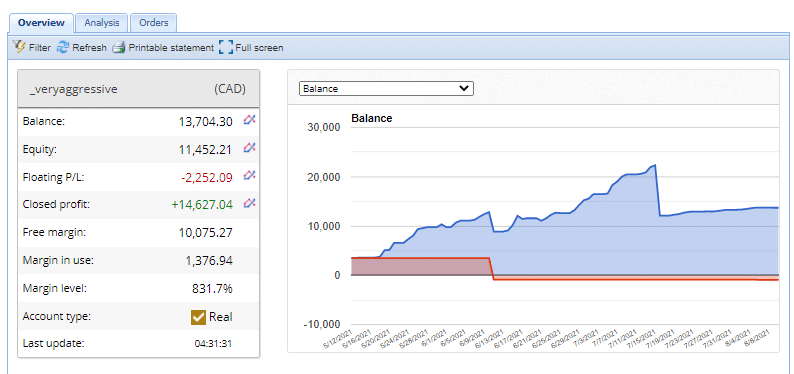

Verified trading records are available on FXBlue that show performance from May 12, 2021, till the current date for a very aggressive portfolio. The system made an average monthly gain of 77.1% during the period, with a drawdown of 48.5%. The stated drawdown is high, meaning the account loses nearly half of the initial value during trading. The winning rate stood at 77.7%, with a profit factor of 1.77. The average winning trade was $14.29, while the worst was -$28.10. There were a total of 2347 trades. The developer made $3500 in deposits and $4424.47 in withdrawals.

Customer reviews

There are no customer reviews on Forex Peace Army or TrustPilot, which shows that no one has used the service. Traders are mostly afraid to try them out as the company has recently started tracking their performance. The average drawdown on the aggressive portfolio that offers a good return is relatively high, which can induce fear amongst investors.

What’s new?

In September 2021, the team that is standing behind Avia decided to rebrand it into Alphi. The reason could be they saw the system was not as good as they claimed. It looks ridiculous, and the absence of explanation only enhances the level of distrust to the devs as well as the product they offer to the public.