In Forex trading, backtesting is one of the most underutilized tools in a modern trader’s arsenal. It refers to the process of testing one’s trading strategy over historical price data. It lets you test the strategy over thousands of past price fluctations and accumulate important data.

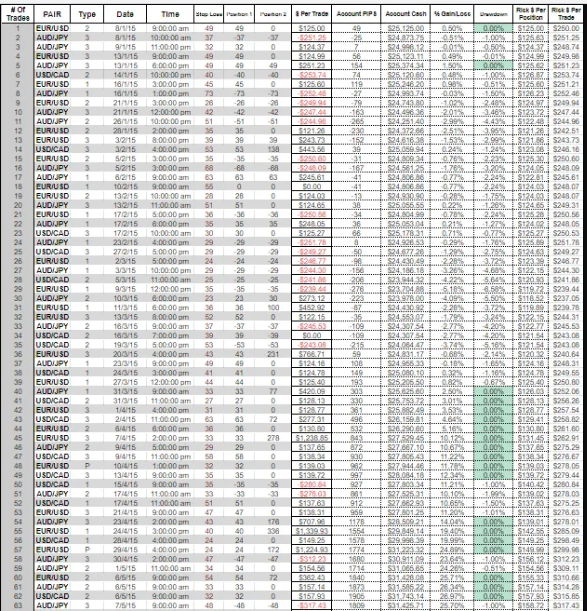

You can do this by preparing a spreadsheet and going through price action one candle at a time, noting their occurrences. Then you objectively track how your strategy is doing over the various market conditions found in past years of price action data. Once equipped with this information, you can adjust your existing strategy and optimize your edge over other traders.

Because many people find it monotonous, boring, and difficult to perform, it remains one of the most underutilised ways to sure up one’s strategy. However, there are reasons why backtesting should be taken seriously if you want to succeed as a trader.

Performance numbers you need to know

Before testing a strategy, you need to be aware of a few performance numbers which are explained in brief below

- Net Profit (Total): The total amount of money you can expect to produce while trading this strategy.

- Average number of trades: The number of trades per day, per week, or month, executed by the trading strategy should be known. Higher trading opportunities per day will allow you to accept a smaller average daily profit.

- Maximum Drawdown: A drawdown is caused by a series of trades during a particular period of time, when that trading strategy underperforms. No trading strategy produces a straight line and can produce both winning and losing trades, However, the drawdown percentage should always be low.

- Average profit per trade: This can be calculated by dividing the total net profit by the total number of trades. You have to make sure that the average profit per trade is large enough to accommodate your slippage and commission.

Five Reasons for Backtesting

1. Training your reticular activating system

Backtesting helps you train your RAS or reticular activating system. This helps you recognize patterns and occurrences much faster than other traders. All technical traders rely on their ability to recognise trading opportunities as well as danger in the markets on their charts. The best way to achieve this is through repetition and practice.

Backtesting helps traders train their senses to quickly tell the difference between a bear and a bull flag. They can easily start to get an idea about where the price will head next or what zones are likely to react to the price.

2. It Confirms the Effectiveness of Your Strategy

The amount of time taken to test one’s strategies through demo trading is a lot. Backtesting provides a quicker way to check the effectiveness of the strategy you’re developing. You can test multiple strategies across several markets in just a week. This allows you the time to develop a profitable new trading plan within a few months.

The time taken by backtesting to properly test a strategy is minimal compared to live trading. By testing it on historical data, it gives you a theoretical picture of how your plan would’ve performed in the past few years. Its recommended that one test at least 200 to 300 trades per market for any strategy to be absolutely sure. You’ll know your strategy is suited for live markets when it produces a satisfactory return and a reasonable drawdown rate over the large sample size of trades.

3. It Optimizes your Trading Approach

Finding a strategy that’s compatible with your most prominent personality traits is the most difficult part of trading. A balance between comfort and profitability has to be achieved. It provides a no-cost way pf determining which strategy is worth investing money in it. For instance, if a strategy produces a drawdown rate of 30 % returning 120 % in 200 trades, the strategy must be either changed or discarded. A lot of times traders can backtest a strategy which has suddenly started performing badly after running profitably for some time. Backtests can reveal a solution to the problem easily.

4. Concrete Trading Framework

Backtesting can give you the ability to follow your simple investment framework accurately with greater confidence. For example, if backtesting confirms your strategy on dollar-cost averaging, you can follow it with more conviction. Backtesting also reminds us to stay focused even in times of panic. So, instead of exiting and abandoning a strategy altogether when markets are plummeting, traders can know exactly what to do in that crucial moment if they have tested their strategy over a huge sample size of historical prices.

5. Generating Brand New Trading Ideas

As a trader, you can get new trading strategy ideas while testing your existing strategies. As mentioned earlier, your strategy should generally match your personality traits. A good way to test this is through backtesting. It allows you to easily test the new idea and confirm whether it’s a strategy that’s worth investing time and effort into. The feedback loop that backtesting provides can assist you in tweaking and perfecting your trading approach until you find a set of rules or filters that play to your psychological strengths and are profitable at the same time.

Conclusion

Its common knowledge that a strategy can look good on paper but encounter problems once you start using them in a real-time trading environment while prices are moving. Backtesting is thus recommended before you commit any real money. There are many traders who are hesitant to push the button to place the trade when they see a signal. Besides, guessing when to enter or exit a trade can lead to losses. Backtesting your own trading strategy will give you confidence and develop your skills in the away, so that you can easily identify trading setups as they happen.