What is Backtesting?

Backtesting refers to the process of simulating a trading strategy using historical data by a trader. It generates results which the trader uses to analyze profitability and risk before they invest any real capital. If one properly conducts a back-test on a strategy that produces positive results, it is almost always indicated that the strategy is fundamentally sound and profitable if one implements it in real markets. If the same back-test yields less- than positive results, it may be indicative of a strategy that is not profitable and should be either rejected or altered.

Traders can evaluate the effectiveness of strategies that are particularly complicated, such as those used by automated trading systems and Expert Advisors, by conducting backtests. Traders and investors who are seeking to build their own customized trading robot may employ the services of a qualified programmer. As traders generally rely on historical data when building strategies, the backtests should give different data sets from the models they train on.

Automated Backtesting vs manual Backtesting

Contrary to Automated Backtesting, manual back-testing involves studying the charts and conditions in a manual fashion and placing the trades according to pre-set rules. It differs from automatic back-testing, where the system automatically places the trades according to the strategy. Automated back-testing is ideal for those who are good at coding. However, he/she have to always keep present market conditions into consideration and tune his code and strategies accordingly.

There are several benefits to manual back-testing when one compares it to automated trading.

- Traders get a taste of how the trading system works first hand as they execute every single trade themselves. This is helpful to improve any trading system or even produce a later automated version.

- It simulates live trading mechanics as the process involves manual entry and exiting of trades as well as proper risk.

However, the potential downsides of this method include,

- It’s a time-consuming process

- Traders have to stick to a definite set of rules when they test. It will not produce accurate results if the trader keeps changing rules in the middle of a test.

- The possibility of human error is present which is not the case for automated back-testing.

Paper Trading or Real Account

Paper Trading, also known as forward performance testing, refers to live trading without incurring actual risk as no money is at stake. By using a demo brokerage account, traders can execute trades, with their wins and losses recorded “on paper” only. Paper trading provides traders with a set of out of sample data to evaluate an automated trading system. It involves following the system’s logic in a live market as it is a simulation of actual trading.

Apart from helping the trader to refine material components of his/her trading strategy, paper trading helps develop the trader’s skills for swing trading.

When comparing to back-testing on a real account, many people prefer paper trading because of its large focus on trading in the present. Testing in the current market environment can provide a more accurate prediction for the trading system in the future, compared to testing it with historical data.

When conducting paper trading, however, traders have to ensure that they’re following the system’s logic by the word. Otherwise, the evaluation may be inaccurate. Traders should avoid cherry-picking trades, be truthful about any trade entries and exits, and include even those trades which they have mistakenly executed. Any trade executed following the system’s logic should not be left out of any documentation and evaluation.

Key parameters of your trading robot’s success

- Success rate: The success ratio indicates the ratio between the number of profitable trades from and the number of unprofitable ones. This is an important indicator of a trading strategy’s effectiveness and performance and gives traders an idea of how much they need to update or optimize it to realize the full profit potential.

- Drawdown: The drawdown denotes the maximum fall in the value of an asset from its peak price and thus it is a measurement of risk. In other words, it is a measure of reduction or decline of capital, when using a specific strategy for trading. Traders can decide the amount of risk they’re willing to take after assessing and evaluating the risk involved as well as the amount of loss that they can incur by using a particular trading strategy. Normally Expert Advisors or automated trading software that show a drawdown rate of more than 20-25% is a sign that the EA implements a risky trading strategy that can jeopardize the trader’s account. Traders should realize that even though high drawdown rates can mean the potential for high gains, it can also mean that there is a higher chance of a trader’s account going broke.

- Average PNL: The Average profit or loss calculates the amount of profit or loss which a trader incurs in one unit of time over a specific period of time. The unit of time can be days, hours, or minutes.

- Total PNL: The total profit and loss is a reflection of the amount of overall profit or loss that a trading strategy incurs in similar scenarios comparable to the historical data it uses. It helps traders make the decision on whether or not a particular trading strategy is indeed viable or not.

- Sharpe Ratio: Nobel laureate William F. Sharpe developed the Sharpe Ratio to originally assist investors to understand the ROI (return of investment), as compared to its risk. It uses volatility as a measure of price fluctuations of any asset or portfolio.

When used in the context of evaluating the performance of an Expert Advisor, a trading strategy with a higher Sharpe Ratio can mean better returns for the investor in relation to the possible risk.

Alternatively, when comparing two trading strategies that generate the same returns, the Higher Sharpe ratio indicates that the strategy had less volatility in the past.

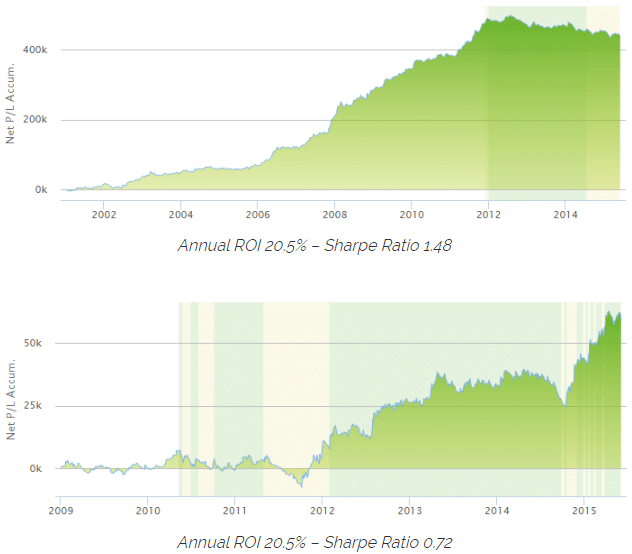

In the above example, there are two separate automated trading strategies that have identical ROIs at 20.5%. The Sharpe Ratio of the second strategy is much lower (0.72), compared to that of the first one (1.48). The lower Sharpe Ratio is indicative of the drawdowns being more frequent and significant in the case of the second strategy. The first strategy however experiences stable and steady growth.

After looking at the two strategies, investors with a more conservative and risk-averse approach go for the one with the higher Sharpe ratio. This is mainly to prevent the likelihood of taking emotional and impulsive decisions when dealing with drawdowns in the second strategy’s case, even though the past returns of the first strategy is lower.

The Bottom line

With a multitude of Expert Advisors and automated trading software available in the market, traders should be absolutely sure before choosing one. Both Paper Trading and Back-testing are great tools for evaluating the trading strategies implemented by any automated trading software. They allow traders to test these strategies without actually risking any real capital. Paper trading and back-testing should not substitute each other but used together to get a complete picture of an automated trading software’s expected performance.