Beat the Market (BTM) is a very popular free trading system for the MetaTrader 4 trading platform. It can be found and downloaded from leading forex forums. It is designed for swing scalp trading (on a 15-minute time-frame) and it can be applied to all trading instruments. It is easy to use, as entries and exits are clearly defined, so it is suitable for both beginners and for more experienced traders.

Remember, the system is completely free. Beware, some scammers are trying to sell it. I have noticed that on forums you can find the system’s indicators that are time-limited, that you need to purchase to have them for unlimited use. Don’t get fooled. It is possible to find those indicators even with the source code. The package includes 7 indicators and a template file. Beat the market uses the combination of standard pivot points and custom indicators.

How to install BTM system

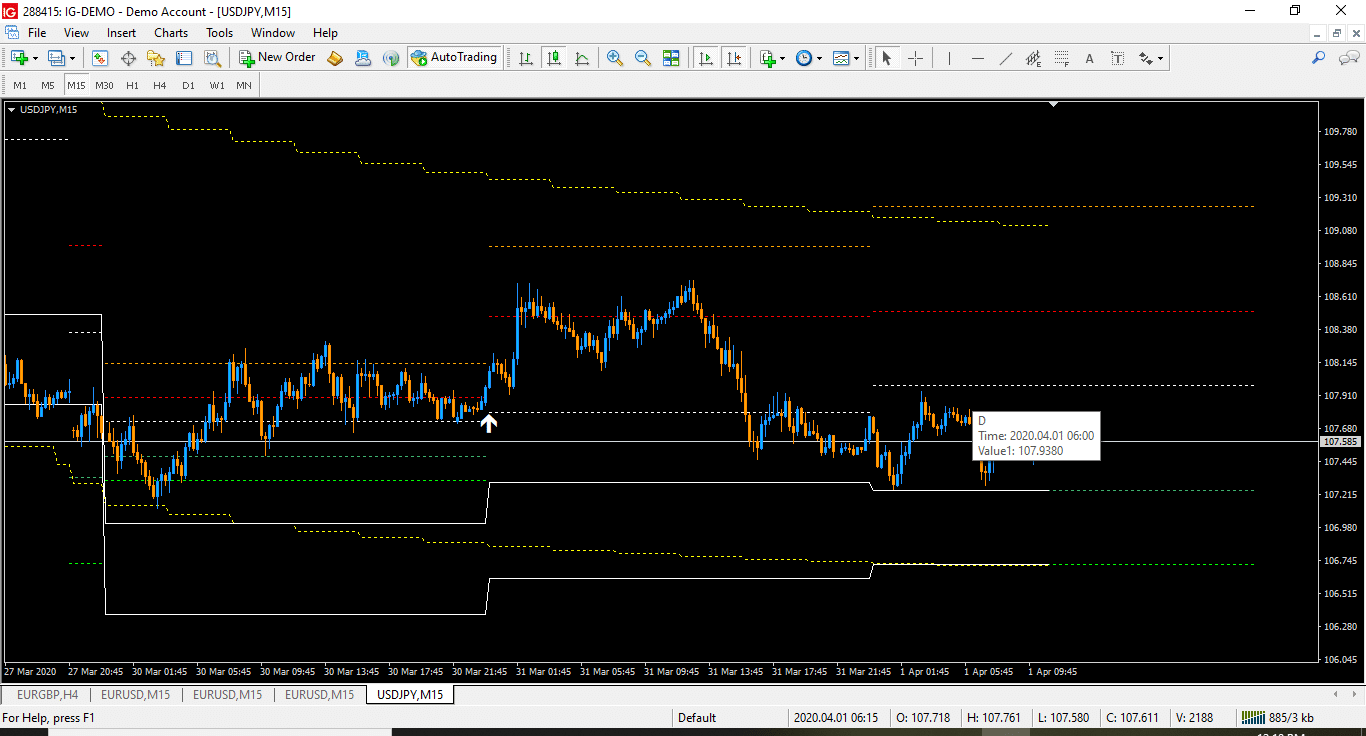

To install the system you have to follow a standard procedure. In your MT4 go to File – Open Data Folder and copy the template file in the Templates folder and all indicators in the MQL4/Indicators folder. Then you should restart your MT4. To use the system open a new chart and apply it to Beat the Market template. If you have installed everything correctly your screen should look like an image below.

How to use Beat The Market signals

Entry rules are clearly defined. All entries are taken on a closed candle when the white arrow indicator appears. You will only take the trades that are in accordance with the long-term trend that is determined by the TMA indicator. If TMA is bullish you take only long trades, if TMA is bearish you only take short trades. In case, TMA is sideways, the trend is not clear you do not trade. Pivot points are used for setting targets and stop-loss levels. If there is a long entry signal when the price is above the pivot a trade is considered less risky then when the price is below the pivot point. So, it is advisable to enter less risky trade with more resources than a more risky one. In opposite, a short trade when the price is below the pivot point is considered less risky than when the price is above the pivot point. Additionally, long trades are filtered out when the price is above the resistance level or close to the upper TMA band. Similarly, short trades are filtered out when the price is below the support level or close to the lower TMA band. For long trades stop loss level is set 2 to 3 pips below the resistance level and for short trades 2 to 3 pips above the support level. Finally, the upper resistance level is a target for long entries while the lower support level is a target for short entries.

I have tried the strategy trading all forex major, minors, crosses, gold, and oil. I was monitoring more than 30 trading instruments on a 15-minute time-frame. I have noticed that it takes lots of time to watch out for such a large number of trading instruments. When the signal appears you quickly have to decide whether you would accept the entry. The important thing was that I managed to trade profitably. I was satisfied with my win rate since it was around 75%. However, using the system correctly would require a little bit of practice. A good thing is that you have the possibility to turn on an alert for the arrow indicator.

Searching the forums, I managed to find a scanner expert advisor for the system. I must admit that it significantly reduced my monitoring time and it improved my performance. Though it is a trading system for a 15-minute time-frame it does not provide many entry signals. I was able to catch 2 to 3 trades per day as I was trading London and early New York session most of the days. Also, I did not want to have more than three active trades. Though it is considered as a scalping system it occurred many times that I have to leave trades opened over the night.

Final Thoughts

Beat the market is a free and potentially profitable trading system that is used for trading instruments on a 15-minute time-frame. It is suitable for both beginners and more experienced traders as it has clearly defined entry and exit rules. Trading requires a lot of monitoring, so I advise using a system scanner expert advisor. The system has a good win rate but it does not signal many entry opportunities.