In the forex market, people have made millions while following simple trading strategies. Similarly, millions in equal measure have seen their hard-earned money and dreams go down their drain. Amid the risks involved, it is still very much possible to succeed in forex trading and make a living out of it.

The quickest and smartest way to become profitable in forex trading is investing time, studying, and analyzing the markets. The idea is to learn various strategies that experienced traders leverage to determine profitable trading opportunities. Likewise, this would be the best time to consider some systems and tools that traders use to gain an edge in forex trading.

Forex Education vs. Copy Trading

Forex education is critical to trading the forex market effectively. Forex education is the only way one can master the art of managing risk and taking winning trades. Similarly, it provides a way to set oneself for success.

Nothing beats experience in the forex market. Contrary to perception, one does not need to enroll in a fancy forex course to master the trade. The internet has made it easy and possible to learn from the best at no extra cost.

Reading forex trading books and watching videos of how successful traders go about trading is a sure way of acquiring the much-needed experience for trading. Similarly, one can test various trading strategies, risk-free, in demo accounts before venturing into the live markets.

Copy trading is a common trend that is becoming increasingly popular as more people look to venture into the forex market in pursuit of passive income. The trading strategy entails traders mimicking the actions done by other traders. In this case, one only has to copy positions opened by more experienced traders.

Copy trading is especially useful for new traders trying to make it in the forex market. The strategy allows new traders to see how others trade and succeed in the process by essentially copying their actions.

While copy trading is an ideal trading strategy for beginners, it cannot be relied for long on when it comes to forex trading. Traders need to master the art of trading on their own and develop strategies.

Becoming a successful forex trader is all about mastering the market and developing strategies that balance risk-reward. Being in full control is the only way to succeed instead of relying on other trading opportunities.

Using leverage and diversification

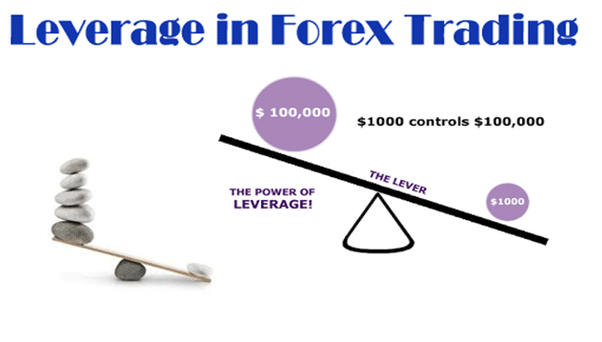

Leverage is another essential tool for generating quick and smart profits in the market. It allows the borrowing of a certain amount of money against underlying capital. Similarly, one can place much bigger trades while using a small amount of capital.

With leverage of 100:1, one only needs to invest $1,000 in a trading account to place trades worth $100,000. Leverage makes it possible to earn more profit with less effort or capital, no matter the traded instruments. It is because leverage multiplies profits.

By increasing the amount of money that one can earn on each trade, leverage enhances capital efficiency. For instance, if it takes three days to generate $100 with underlying capital, it might take much less to generate the same amount in a leveraged account.

Leverage also provides a quick and smart way to generate profits in the forex market by mitigating low volatility. While volatile markets deliver the greatest degrees of profit, leverage also shrugs off low volatility. Given the multiplying effects of leverage, one can generate significant profits even with small price movement.

In addition to using leverage in the forex market, it is important to diversify the currency pairs one trades to succeed and generate consistent profits. Understanding the correlation of different currency pairs is crucial and the most important factor to risk diversification.

Understanding currency pair’s correlation is important as it allows traders to reduce exposure to one particular currency. The idea is to ensure that one currency does not dictate the amount of profit or losses one generates with diversification. The idea is to provide a balance such that a downturn in one currency does not lead to the pilling of losses.

Bad Habits vs. Good Habits in Forex Trading

While trading the forex market, certain habits determine whether one will succeed or fail miserably. Ultra successful traders have perfected the art of relying on certain habits while shunning some, thus the reason they are always on top of their game when it comes to generating consistent profits.

Trading without emotions is the only way one can stay objective and succeed in forex trading. Professional traders treat winners and losers with the same reaction, which allows them to execute their trading plan, thus remaining consistently profitable.

Given how difficult it is to stay competitive in the financial markets, cutting losses early and letting winners run is another essential trait that successful traders depict time and time. When the market goes against you, you don’t rely on hope for a reversal. Likewise, when you find a winning trade, stick to it, and let the trade run for optimum returns.

As good habits are vital to generating consistent profits in the markets, bad habits are the enemy of peak productivity that has seen traders struggle to generate profits. Emotional trading is one of the worst trading traits that have seen traders lose a fortune. Trading is a probability game whereby one can win and lose in equal measure. Likewise, never have an emotional attachment to any trade.

Some traders also make a common mistake of trading without a trading plan. Straying away from a strategy is a precursor to disaster. Lack of belief on a trading plan, especially for beginners, also makes it impossible to make it in forex trading.

Conclusion

Contrary to perception, there is no single formula for success in forex trading. Good analysis discipline and proper risk management are the only way to accrue an edge and become profitable while trading the currency market. Any successful forex trading career hallmarks are having discipline, carrying out intensive analysis, and trading appropriate currency pairs.