There are three main ways of making money in the crypto industry: mine, invest, and trade. In this article, we will explain how mining works and then identify some of the best cryptocurrencies to mine in 2022.

How mining works

Generally, there are two main types of protocols in the cryptocurrency industry: proof of work (POW) and proof-of-stake (POS). PoW is the oldest method and is the one that Bitcoin uses. Ideally, new coins are created by solving complex mathematical calculations. The process is usually slow, expensive, and energy inefficient.

PoS does not involve mining. Instead, new coins are minted using validators who hold a certain amount of coins. These validators use consensus to allow new blocks.

To mine Bitcoin and other PoW coins, you need to have an advanced computer that has the fastest processing power. Further, you need open-source software that will provide the interface that you need to access the network. As a result, most Bitcoin is currently mined by large companies like Marathon Digital and Riot Blockchain.

Ravencoin

Ravencoin is a unique digital currency in that it is a clone or fork of Bitcoin’s code. In other words, the developers took the BTC code and then built a cryptocurrency that is similar to BTC.

By cloning the code, they were able to solve some of the challenges that Bitcoin has. For example, they increased the size of the block reward to 5,000 RVN instead of 50 BTC. Additionally, the network boosted the total supply limit of BTC from 21 million to 21 billion and reduced the block time from 10 to 1 minute.

Today, Ravencoin has become a major cryptocurrency with a market cap of almost a billion dollars. At the time of writing, it is the 110th biggest in the world, meaning that it has more room to grow.

Also, another benefit of mining Ravencoin is that its mining difficulty and hash rates are low, meaning that you don’t need a lot of graphical processing power.

Litecoin

Like Ravencoin, Litecoin was built to solve some of the toughest challenges that Bitcoin had. For example, it has a total supply limit of 84 million, which is higher than that of Bitcoin. Already, approximately 68 million of all LTCs have already been mined.

Another improvement that Litecoin’s developers made is that they enhanced the block reward for mining a coin. At the time of mining, the reward was about 12.5 LTC, making it quite attractive.

There are other reasons why you should consider mining LTC. First, like BTC, it has been around for many years. Second, its historical performance has been great considering that its price has risen by over 3,000% in the past five years. In contrast, the S&P 500 index has risen by about 100% in the same period.

Third, Litecoin has gained corporate and investor acceptance, which has made its price more stable than other coins. Finally, and most importantly, mining LTC does not require all the processing power that BTC requires.

Bitcoin Cash

Bitcoin Cash is another great way to mine and earn rewards. For starters, BCH was created in 2017 after being forked from the main Bitcoin. At the time, there were big differences among players in the industry about the direction that Bitcoin would take. Some proponents favored a larger block size compared to what Bitcoin offered.

Bitcoin Cash has not been a good investment over the years. For one, its price has struggled to retest its all-time high of over $4,000. It is also about 92% below its all-time high while its ranking has crashed to about $6 billion. It is now the 27th biggest cryptocurrency in the world.

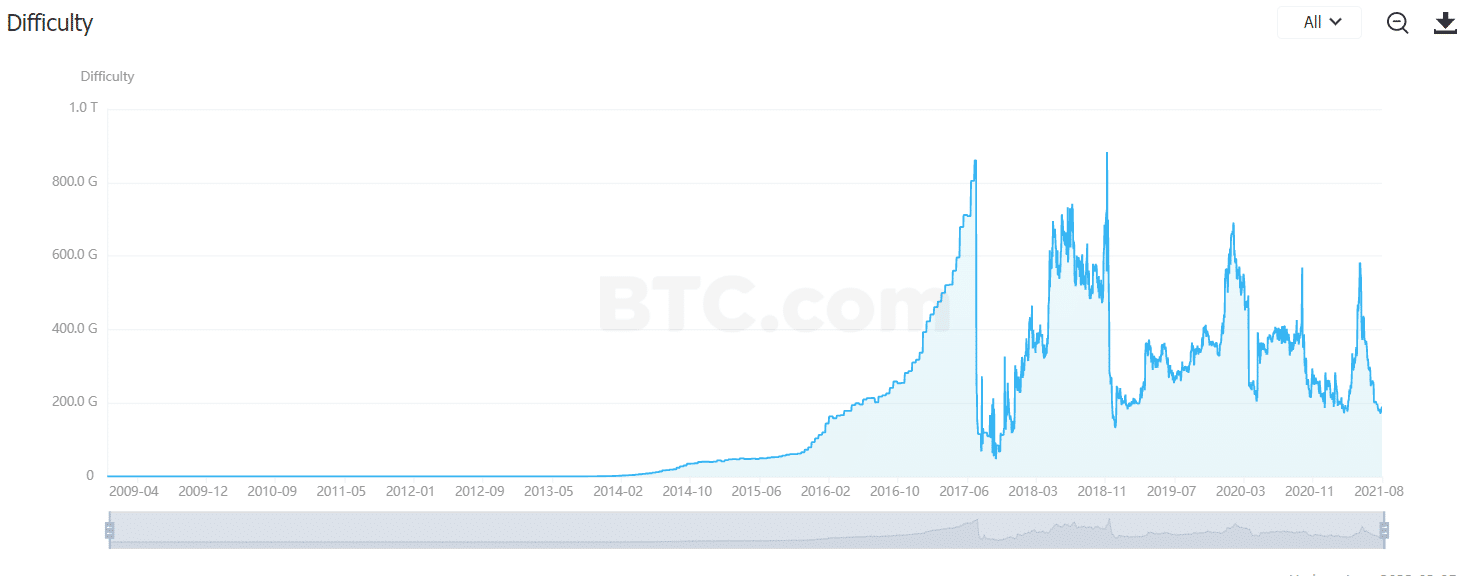

The weak performance has created an ideal opportunity for miners because the cost of mining has fallen to the lowest level since 2018. As such, it means that you don’t need a lot of processing power to mine BCH.

Another reason to mine BCH is that there is a possibility its price will rebound as other cryptocurrencies bounce back.

Monero

Monero is a popular asset that focuses on privacy. Its claim to fame is that it is one of the safest cryptocurrencies in the world. It uses advanced encryptions, which makes it almost impossible to track transactions.

Monero is widely used around the world, especially by people using the dark web. Drug dealers and people focusing on illicit items find it useful and are often willing to pay a premium.

However, Monero is not a cryptocurrency, which has seen it underperform other coins like ETH and ADA. Indeed, its price has fallen by over 65% from its all-time high, and its ranking dropped to 58.

Monero uses the RandomX hash function and has a mining reward of 2.15 XMR per block. While its mining difficulty has risen, the fact that Monero has a good future makes it a good investment.

ZCash

ZCash is another leading cryptocurrency that uses the proof-of-work concept. Like Monero, its main benefit is that it uses advanced encryption to ensure that transactions are private. Also, its transactions are faster and less expensive than those offered by Monero. ZCash has a market cap of $1.4 billion and is the 81st biggest crypto.

To mine ZCash, you need to buy a mining hardware, preferably ASIC, and then set it up. It is recommended that you join a mining pool, which provides consistent returns. After this, you should just wait to see your rewards.

ZCash is a good cryptocurrency to mine because of its liquidity and the fact that it has more room to grow in the future. In periods of high market liquidity, ZCash is usually one of the most actively traded coins in the world.

Summary

Cryptocurrency mining is a leading way of making money in the industry. In this article, we have looked at some of the best coins to mine. Others that you might want to consider are Ethereum, Dogecoin, and Dash.