In the stock market, many investors have chosen the riskier path by investing in penny stocks. Upon the growth of the companies behind these stocks, such investors stand to make impressive gains from their holdings. However, there is still a great risk of loss from the companies never outgrowing their market capitalization.

The same case applies to crypto valued under $1, which are collectively called penny crypto. Though they tend to be at higher risk compared to more established coins, some of these penny tokens hold great profit potential. This can be determined by the intrinsic value of their technology, the team behind them, or the publicity they gather.

Penny crypto 101

Often a common type of coin that falls under this category is the newly minted coins, which have not yet gathered enough publicity behind them to gain them a substantial valuation. Penny crypto may also be fallen coins, which once had a worthwhile valuation, but due to market changes or any other circumstance, they dropped in value to under a dollar.

Another type of coin that falls under this classification is plentiful crypto. These are coins that have plenty of circulating supply, and hence their demand struggles to live up to their supply. The final type of penny crypto is the stagnant coin. These are coins that have been publicly trading in the markets for a while but, for any number of reasons, can’t seem to grow or decline in value.

How to trade penny crypto

In the short-term

Since these penny cryptocurrencies tend to be characterized by extreme levels of volatility, this makes them suitable candidates for swing trading, day trading, and other short-term strategies. However, the high volatility levels also mean that they are highly risky investment vehicles. For that reason, there is a need to create a foolproof strategy to mitigate this risk.

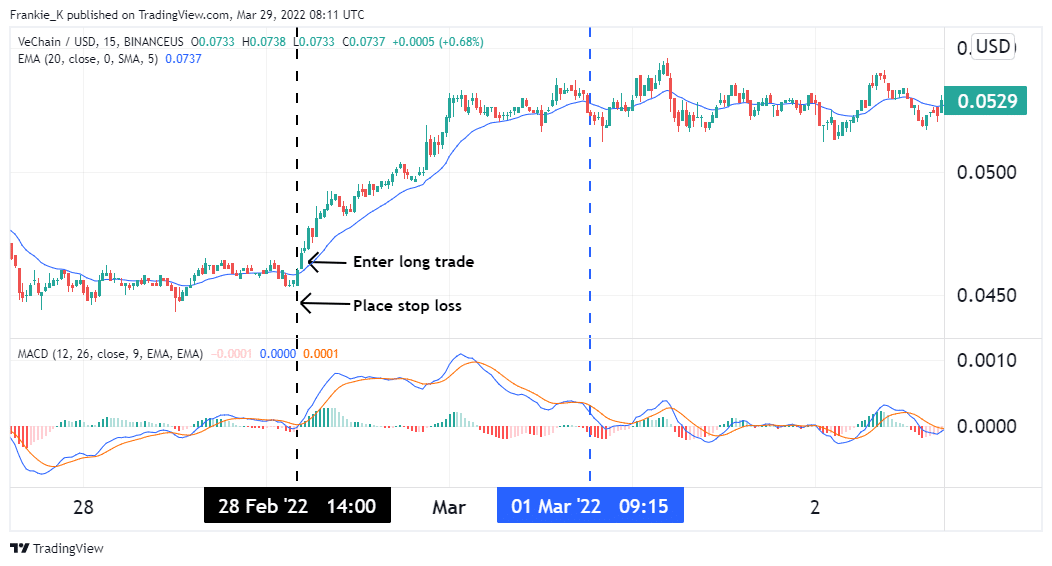

For our intents and purposes, we shall utilize the Moving Average Convergence Divergence (MACD) and the Exponential Moving Average (EMA). MACD will be used with default settings to provide entry and exit signals, while the EMA will be used with a 20-period setting to provide signal confirmation. The ideal timeframe for this strategy is the 15-minute chart.

A bullish scenario will be marked by the blue MACD line crossing above the red signal line. This will be confirmed by prices trading above the 20-period EMA and the MACD histogram going into the green (positive) zone.

In the illustration above, the VeChain coin displayed our strategy’s bullish setup on 28th February. This was the signal to buy the token. A suitable stop-loss should be placed just below the prior swing low. The profit target, on the other hand, should be placed at a 1:3 risk to reward ratio. Alternatively, we could wait till prices break below the 20-period EMA, and the subsequent candle closes below this EMA turned support. This manifested on 1st March.

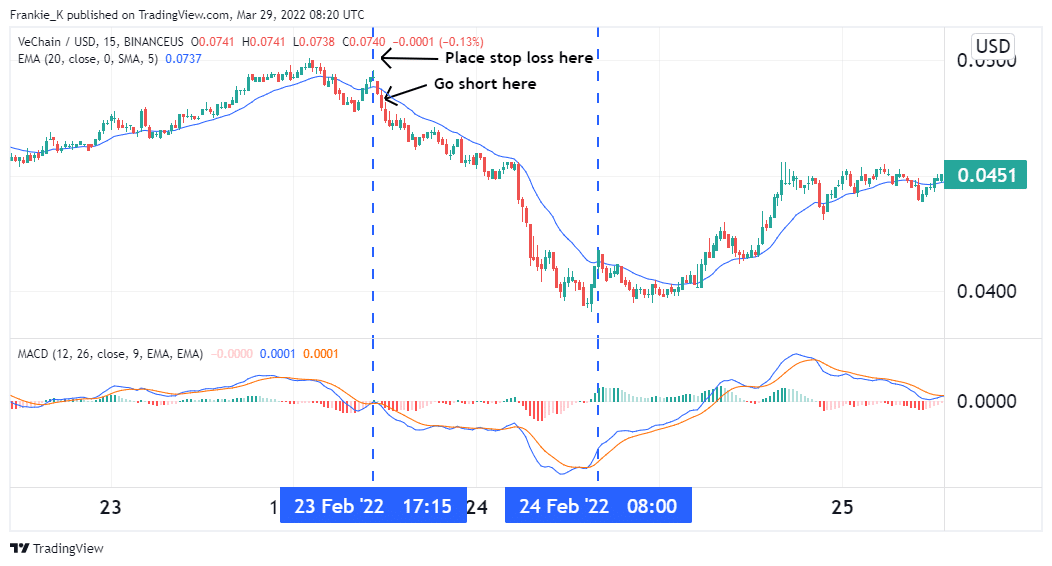

Conversely, a bearish setup would be marked by the blue MACD line crossing below the red signal line. This would be confirmed by prices crossing below the 20 EMA. Below is an illustration of this scenario.

In the chart above, the sell signal came on 23rd February when the bearish MACD crossover happened after prices had retested the MA resistance. A close below this resistance line confirmed the bearish flag and marked our entry. The take profit could have been placed at a 1:3 risk to reward ratio. Alternatively, we could have waited until prices crossed above the MA and a bullish MACD crossover manifested. This was the case on 24th February.

In the long term

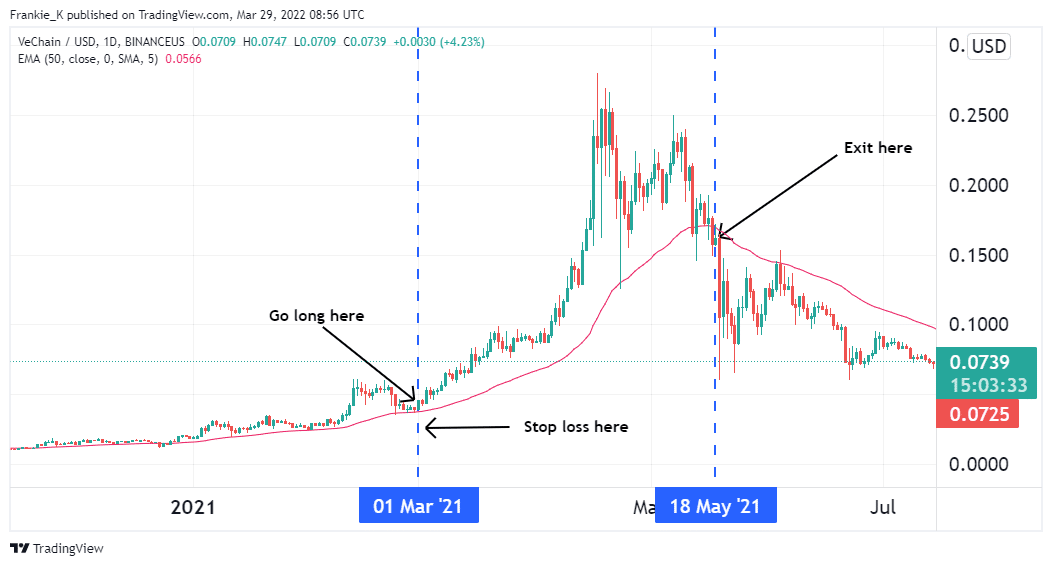

If you fancy the so-called “hodl” trading technique, you can still invest in penny crypto with a slight adjustment in your trading strategy. To demonstrate this, we’ll utilize a 50-period EMA to point out the prevailing market trends. A bullish scenario will be marked by prices trending above this MA line, while a bearish scenario would be the opposite – prices trending below the MA. The ideal timeframe for this strategy is the daily chart.

The image above illustrates how to trade a long-term bullish setup on VeChain. First, make sure prices are trending above the 50 EMA. Wait for them to rebound to this level, then resume their uptrend. This is the signal to enter a long trade. A suitable stop loss can be placed below the most recent swing low. The take profit can be placed at reasonable risk to reward ratio, or one can wait till prices close below the MA line turned support.

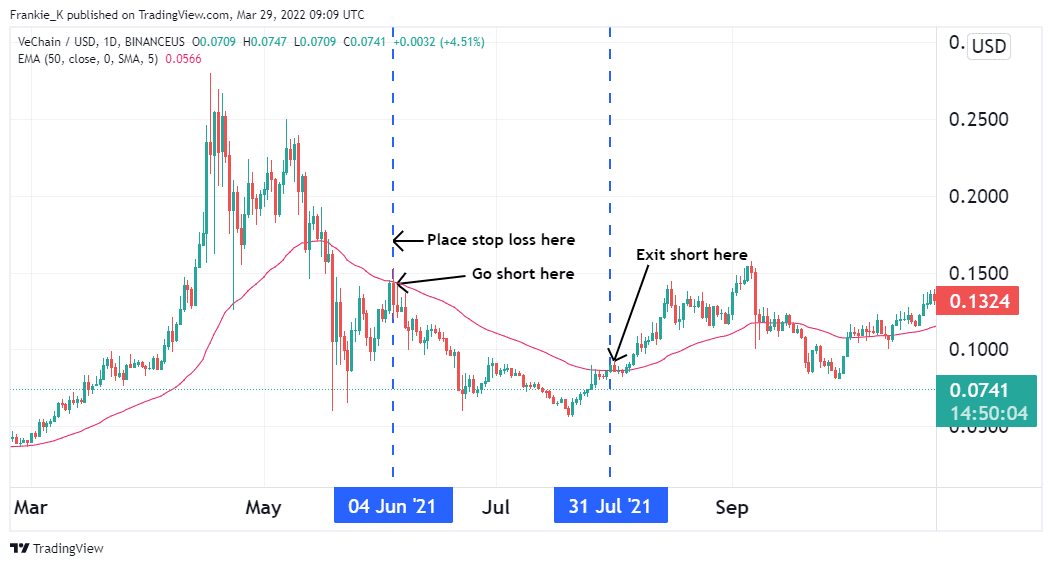

In the case of a bearish setup, the converse is true. Prices should be trending below the 50 EMA, and one should wait until an upward retracement hits this line; then, prices resume their downtrend. This is the signal to go short.

A suitable stop loss should be placed at or above the most recent swing high. The exit signal can be placed following a suitable risk to reward ratio, or one could wait until this MA line turned resistance is broken out. This is displayed in the illustration above.

In a nutshell

Penny cryptos, like their counterparts in stocks, offer unique opportunities for profit thanks to their high volatility. However, this high volatility comes with considerable risks, as the market can turn against you in an instant. This brings about the need for an airtight trading strategy, which we have duly demonstrated in this publication. However, penny crypto is a high-risk asset, and as such personal responsibility should be taken to avoid losses from this venture. Any recommendations in this article should not be construed as investment advice.