Big Pippa EA is produced by traders who have more than five years of experience in the Forex market. They claim to have made the holy grail system by considering money management and probabilities vital to the financial markets. We will consider the algorithm to verify their claims and see for ourselves if the system is profitable or not.

Product offering

The seller shares all the information on the robot from their website. The vital knowledge is scattered all over, and traders may have to struggle to get the right details. There are claims about the profitability of the product all over.

Vendor transparency

Bender FX is the company behind the production of the system. They claim to have more than five years of experience in the market with three years of developing knowledge. The author states that they have spent 1623 hours in coding and have two more people in the program development.

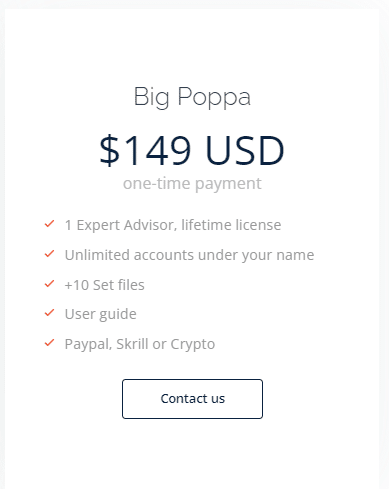

Price

Traders can get the EA for $149 that gives license for unlimited accounts under the purchaser’s name. Traders can choose to pay via crypto, Paypal, and skrill.

Trading strategy

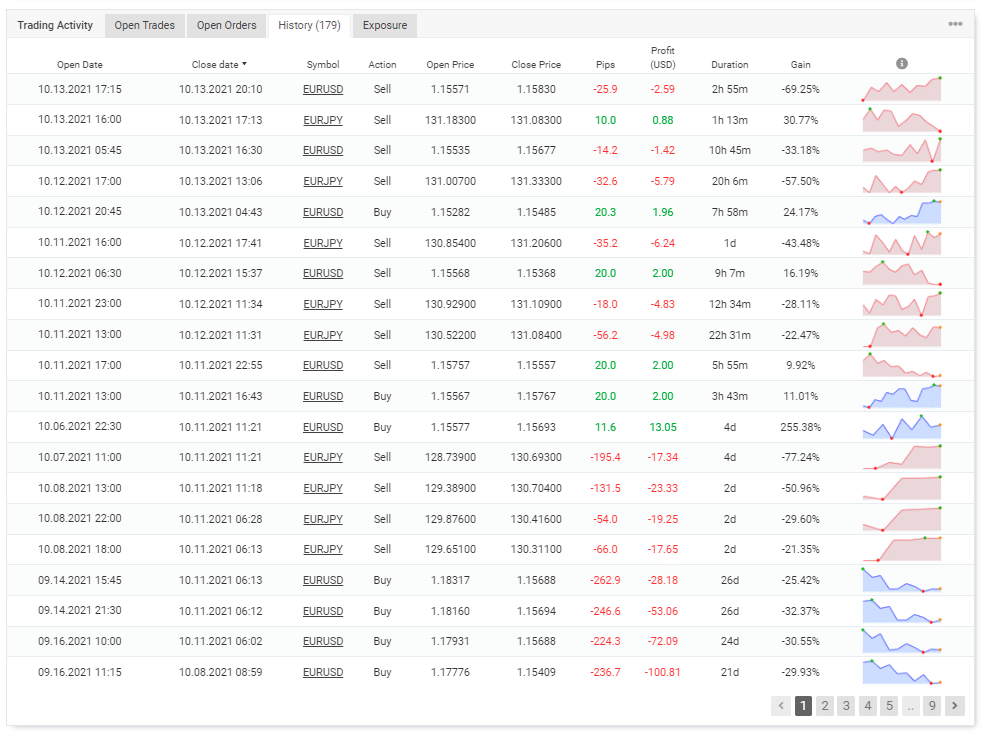

The robot works on EURUSD and EURJPY and uses Fibonacci retracements, price action, and money management techniques. Traders can choose to enable hedging, trailing stops, and equity stops to control the trading methodology. We can see more information from the Myfxbook records. The lot size for trades is hidden; therefore, it is impossible to conclude grid and martingale use. However, from the equity drops, we can confirm the implementation of averaging and lot multiplication.

Trading results

There are no backtesting records available. This goes against the developer’s claims, who states that they have tested the systems for an extensive duration. Without any proper records, we can assume that the robot might have failed on historical data.

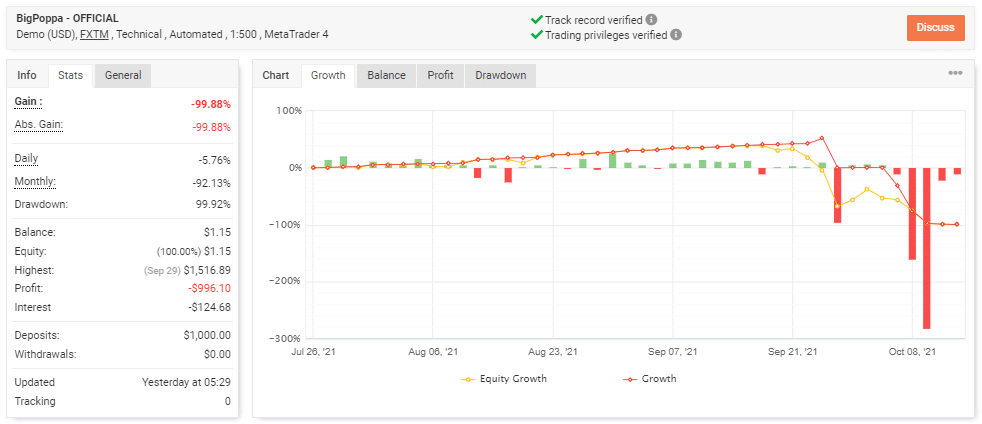

We can see the verified trading records on Myfxbook. The algorithm resulted in a margin call while trading from July 26, 2021, till October 06, 2021.

The system made an average monthly gain of around -92.13%, with a drawdown of 9.92%. The winning rate stood at 63%, with a 0.63 profit factor.

The best trade was $95.94, while the worst was -$328.54 in a total of 180 trades. The developer made $1000 on a demo account. The average trade duration was two days. Such an output states that traders should stay away from the algorithm as it cannot function properly.

Customer reviews

No customer reviews are available for the robot, which shows that traders are not interested in purchasing. This is since it has resulted in a margin all while trying to implement a strategy that can not function properly. No one is willing enough to invest in a system that can cause liquidation on their portfolio.