Forex grid trading can be extremely lucrative in any direction, and although it seems to be a complicated and drawn-out procedure, it is quite simple. This scheme involves placing trades at some strategic points while the market is unfavorable. It helps you pile up your profits as well as recuperate your losses.

What is the grid strategy?

It is a trading procedure where traders look to earn gains by capitalizing on the innate shifting of prices. This is usually done by placing sell stop and stop orders. The market distance for this procedure is defined beforehand, and it is termed a leg. And additionally, the sizes for the stop losses and take profits are predetermined.

Thus, you don’t have to spend time using indicators to figure out the direction in which the price is going to advance. Nevertheless, it is not easy to efficiently manage your money with this trading scheme. Additionally, the margin of error is increased since many trades need to be managed simultaneously.

Implementing the grid strategy

Prior to forming your grid trading scheme, you ought to make a promise to yourself not to exceed the maximum loss for every trade. You should consider different entries for the same pair as the same trade and each position as a mean price. It is vital that you take measures to keep the losses to a bare minimum.

If you cannot manage your stop loss efficiently, you stand to lose a certain percentage of your account or a certain amount of pips. You should enforce it religiously and avoid adding more weight and performing additional averaging. Upon adding more, your position may become unfavorable, and this might even cause a margin call.

Although the grid strategy is profitable, there are a few dangers that you need to keep in mind. The principal issue is that it doesn’t require you to possess a fixed program for managing your trades. While grid trading, you don’t have to be responsible for technical and fundamental analysis.

This essentially means that individuals using this scheme refuse to accept any losses. Now, this is problematic because every trader should be allowing occasional losses. If you aim to eliminate losses completely from your trading, it may lead to disastrous consequences.

Although averaging prices offer you more than one chance to make profits, it might take several tries before you manage to recuperate the losses suffered due to incorrect entry and poor market analysis.

Why is the grid strategy used?

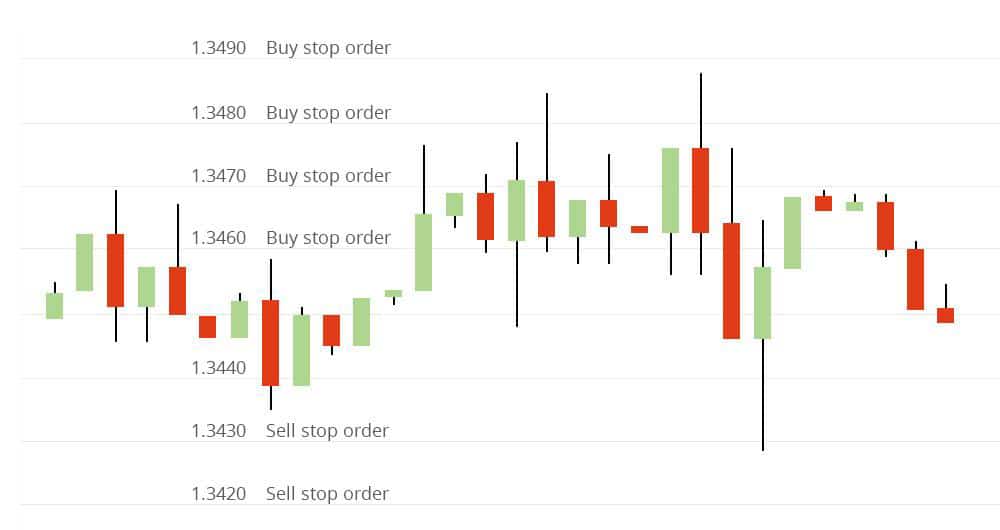

In grid trading, the pending orders are situated at fixed intervals on top of the market value. Before you start working with this scheme, you need to know a thing or two about pending orders. The majority of trading platforms let individuals place orders without being present physically by using stop orders and limit orders.

While a purchase limit order is used for purchasing a pair for a specified price or below, a sell limit is used for selling it at or above a fixed value. Conversely, a buy stop lets you purchase a security at a price exceeding the current value, while a sell stop lets you sell a pair for a value less than the current one.

For using the grid trading scheme, it is not necessary to know about the fundamental indicators like the GDP, inflation rates, industrial output, etc. Individuals using conventional trading schemes have to continuously monitor financial data and developments. For ranging markets, the grid trading strategy has proven to be efficacious and experienced traders have used it time and time again to make huge gains.

Risk management

While grid trading, you need to remember the following things in regards to risk management:

- In case non-opposing pairs are individually inaccessible to one another, the hedging functionality of the system might be lost, and unprecedented losses might follow. Setting wide stop losses is one way you can prevent this.

- When the investor interest is high or when the currencies are highly liquid, you should keep in mind that the execution of the orders might not occur at the precise levels.

- You should possess clarity about the market range with the highest likelihood in order to decide on proper exit levels.

- Overexposure is something you should try and avoid while you’re configuring the grid and deciding on the lot sizes because it may lead to a margin call.

- You should know how much risk you can afford, and you must not unnecessarily increase your trading volume beyond it.

Which currency pairs are suitable for grid strategies?

As a general rule, you can use the grid strategy for all pairs, but there are a few exceptions. The EUR/DKK pair, for instance, is suitable for this strategy since the price difference between the two has remained more or less unchanged for several years.

Sometimes, central financial institutions intervene to adjust bank rates, leading to low volatility for pairs like EUR/CHF, and hence it is difficult to extract gains from them using grid strategies. You should use the strategy with pairs like GBP/AUD, EUR/NZD, EUR/AUD, GBP/CAD, and other pairs exhibiting high volatility.

Unhedged grid trading

Here, you study the chart to determine the direction in which the pair is moving. This scheme does not demand the trades to be set up in opposite directions, so if the pair’s value is rising, you can enter long. After that, you need to select the appropriate grid levels, setting sell limit orders at them.

Conclusion

Novice traders might find it hard to work with the grid scheme at first, and they are advised to use a demo account initially to get familiar with it. Once you master the techniques, you can trade with predetermined risk without performing any advanced analysis.