ForexImba is a Forex expert advisor that was specially designed to help traders trade on the Forex exchange market without any expertise needed.

In this ForexImba review, we will have a closer look at this EA and provide you with all the necessary details so you know whether or not this robot has the potential to increase your trading accounts.

Product Offering

This EA works on AUD/USD and EUR/USD currency pairs. The good thing about this trading tool is its minimal requirement for a deposit to start trading is 60$ only. The developers of this system want traders to know that ForexImba is simple to install and anyone can use it. The vendors offer 30 days money-back guarantee and drawdown control. In addition to this, this EA has a fixed lot size, works with any broker, and does not use Martingale.

Price

ForexImba EA is available to buy for $194,99. The package includes a 1-lifetime license for a real account, 3-lifetime licenses for demo accounts, and 30 days money-back guarantee. This trading tool works on AUD/USD and EUR/USD currency pairs. In addition to this, the vendors of this expert advisor offer a detailed manual for those who need professional assistance or support.

Trading Strategy

The developers of this trading software do not provide detailed information about their trading methodology and approach. We know nothing about the trading strategy of this expert advisor except the fact that it is working on AUD/USD and EUR/USD currency pairs with a minimum deposit of 60 dollars. The developers of ForexImba wants us to know that their robot is characterized by the following features:

It looks good, but is it as effective as described? Let us dip and analyze the trading performance of this system.

ForexImba Trading Results

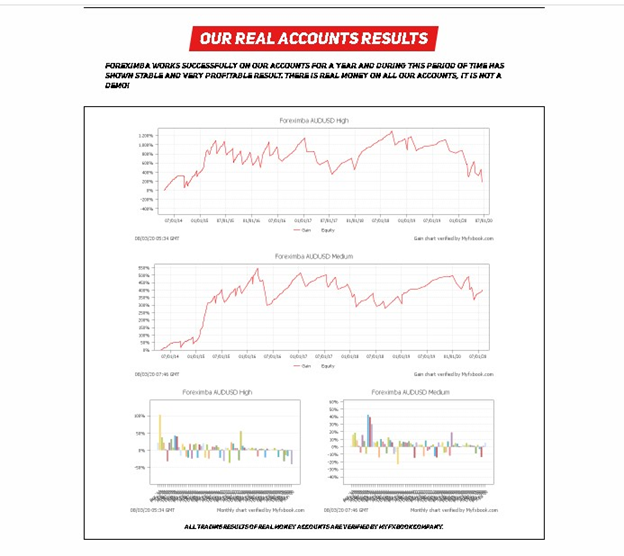

Now we will have a closer look at the trading results of this EA. The developers provide us with verified trading account results on their sales page:

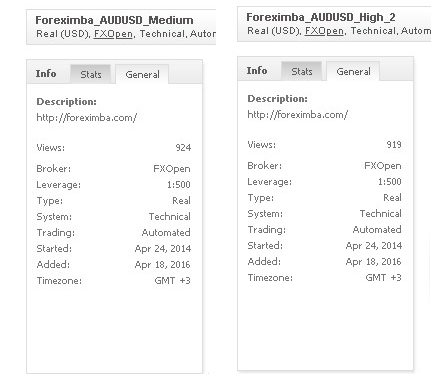

We can see 2 different accounts verified by myfxbook.com: high risk and medium risk. Both of these systems are trading with real accounts on the FXOpen broker:

The other issue we have found about both these systems is that the open trades are kept private.

Now we are going to analyze the trading performance of each of these trading accounts.

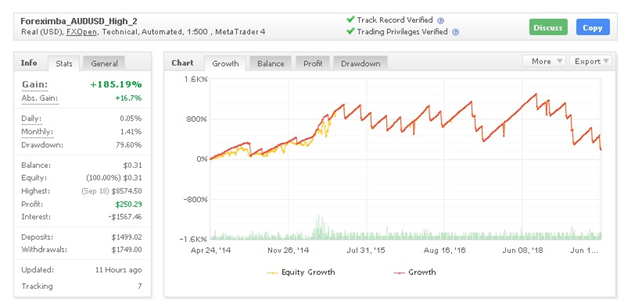

1. High-Risk Account – Foreximba_AUDUSD_High_2

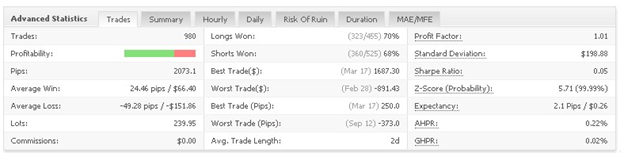

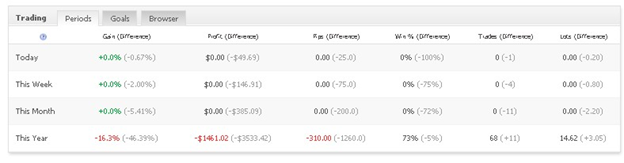

This is a real live trading account that is working on the Meta Trader 4 platform. It started trading on April 24, 2014. Its total gain is +185.19% with a daily gain of 0.05% and a monthly gain of 1.41%. It deposited $1499.02, gained $250.29 of profit, and withdrew $1749.00. Currently, its balance is $0.31. From 2014 to 2020 the account has conducted 800 deals and won 590 out of 800 trades, which represents 74%. The average trade loss ($127.57) is higher than the average win $55.57.

The average trade length is 2 days. In 6 years and 3 months, the software has accumulated 2073.1 pips with a profit factor of 1.01. However, the trading statistics of 2020 is not as impressive as the one of 2014-2018s.

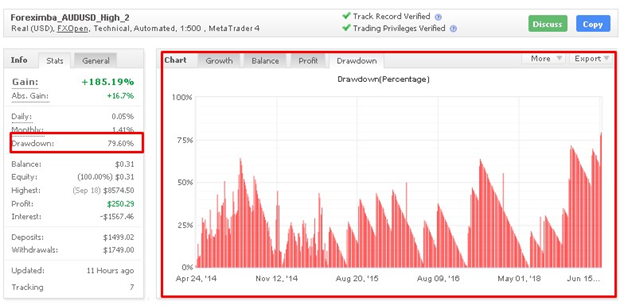

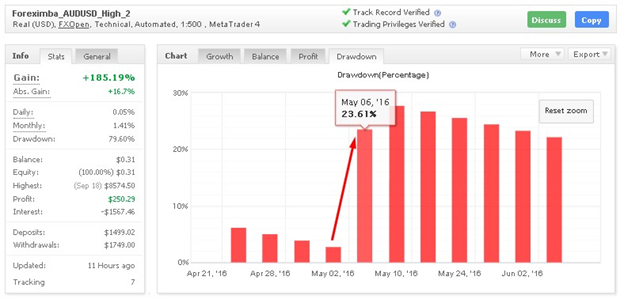

High Drawdown Performance

The drawdown performance is high and is equal to 79.60%.

We have also noticed negative vicissitudes in terms of drawdown. For example on May 3, 2016, the drawdown was 3,89%. On May 6, 2016, the drawdown jumped from 3,89% to 23,61%:

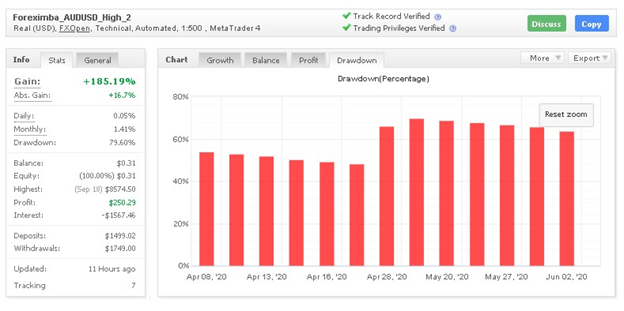

From January this year, the drawdown was not lower than 30%:

According to the drawdown charts, the drawdown is still keeping its high positions (see the screenshot above). Constant high drawdown statistics means a prospective risk of ruin and money loss.

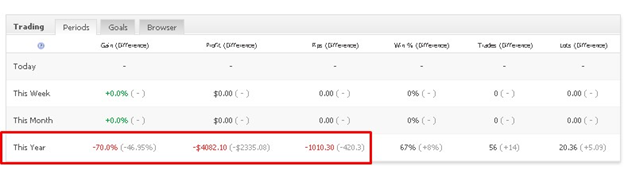

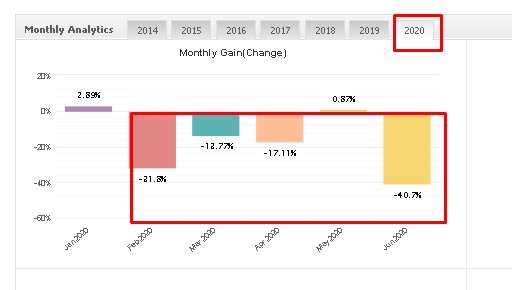

Monthly Gain Loss

We have nothing to say except the one: this robot does not bring profit. Instead of providing a trader with “stable and very profitable result”, it is showing monthly money loss:

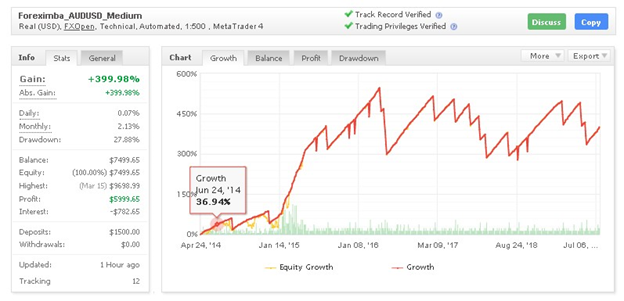

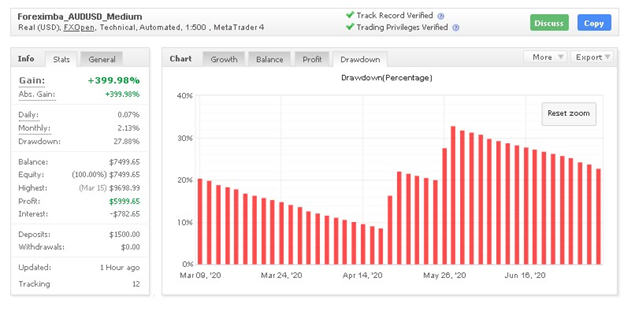

2. Medium Risk Account – Foreximba_AUDUSD_Medium

This is a real trading account, which is working on the MT 4 platform and trading with AUDUSD currency pair with FXOpen brokerage. This account started trading on April 24, 2014. Its absolute gain is +399.98% with a daily gain of 0.07% and a monthly gain of 2.13%. The account deposited $$1500.00 and gained $5999.65 of profit. The profit factor is 1.22 with an average trade length of 3 days. Since April 24, 2014, the account has traded 800 trades: 590 out of 800 trades were successful trades, which represents 74%, and 210 out of 800 trades were lost trades (26%).

The average win is $55.57, while the average loss is larger and is equal to -$127.57. In 6 years and 3 months, the trading system has accumulated 3590.6 pips.

Drawdown Performance

Its peak drawdown is 27.88%. We have also noticed that from March 2016 the drawdowns have constantly been above 8%. High drawdown performance can hurt any trading account and may increase the risk of ruin. ForexImba seems not to have any in-built mechanisms to cope with this problem.

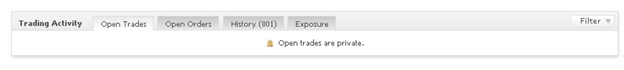

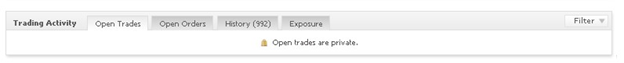

Lack of Transparency

The owners of the ForexImba robot have not been very transparent, as trading activity data (open trades and open orders) have been private, making it impossible to review trading performance data.

Foreximba_AUDUSD_Medium

Foreximba_AUDUSD_High_2

The question is what is ForexImba trying to hide from the public? Are there some hidden data that show something we need not see and know? Because of the lack of transparency, it is impossible to trust the software 100%.