If we are talking about stable currencies, the euro and the pound are two of them. On the one hand, the euro is the second most popular currency worldwide. However, on the other hand, the pound enjoys a good reputation and power in the international market.

If you are an experienced Forex trader or just starting off, you may find the EURGBP currency pair interesting to add to your portfolio. This pair is one of the least volatile in the market, but it is still attractive to investors and intraday traders.

With an average movement of 60 pips in the last ten years, this pair needs to be traded with a good strategy, especially if you want to profit with as much movement as possible.

This article will explain the main technical and fundamental aspects you need to know to trade it efficiently.

Fundamental aspects

Historically, the British pound is more growth-oriented and a risky investment than the euro. But, why?

Basically, it is due to political changes such as the Brexit issue. For some analysts and economists, the exit of the United Kingdom from the European Union represents a risk.

On the other hand, the euro is a slower and steady currency than the GBP. So, investors will be looking to buy the euro instead of the pound in times of market slowdowns or extreme fear because the euro is more popular worldwide.

So, the first thing you will notice when looking at the charts is that the EURGBP price will rise in times of crisis and uncertainty in the market because traders and investors prefer the robust currency as an economic haven.

In March 2020, with the pandemic crisis, this pair had a remarkable upward momentum in just a few days. We can see it in the following chart.

Other fundamental aspects are the economic reports. In the case of the United Kingdom, the data and policies announced by the Bank of England should be taken into account. For example, the measures taken in an economic crisis could lead to inflation, interest rate hikes, among other essential things that will help us predict the price.

Concerning the euro, the European Central Bank, based in Frankfurt, Germany, periodically announces economic data of interest to traders and investors, so traders should keep an eye on this news.

As two currencies are located on the same continent, data such as employment and unemployment figures across Europe can impact the price of the pair.

Technical aspects

EURGBP is positioned among the top 5 most traded pairs in the Forex market, which offers excellent bid and ask spreads and can be found in most authorized brokers.

As a pair that is not very volatile, traders prefer to perform swing trades rather than scalping trades.

What’s the best time to trade EURGBP?

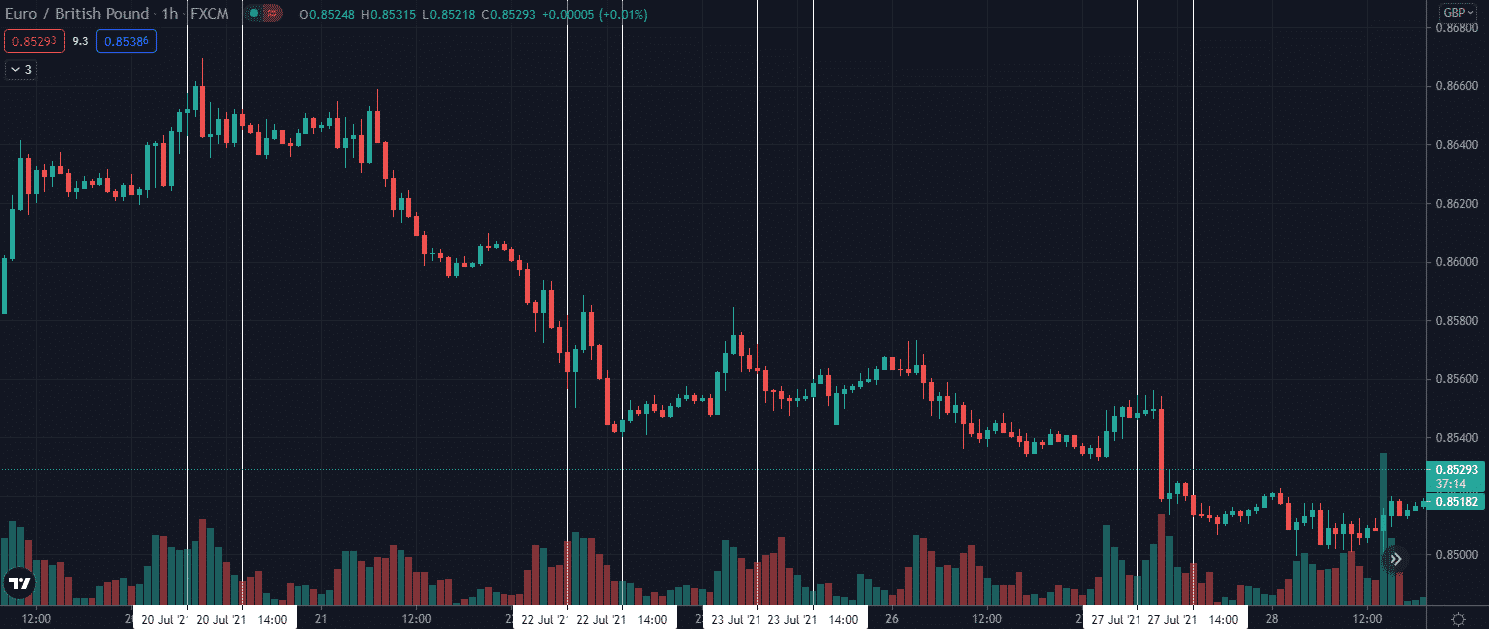

If you decide to scalp this pair, the best times are before important economic announcements or during the opening hours of the London Stock Exchange (07:00-14:00 UTC).

At this time, there will be more liquidity during the day. Also, at certain times during the early hours of UTC, there are good movements that can be extended to the opening hours of the New York Stock Exchange.

Best indicators and strategies to trade the EURGBP

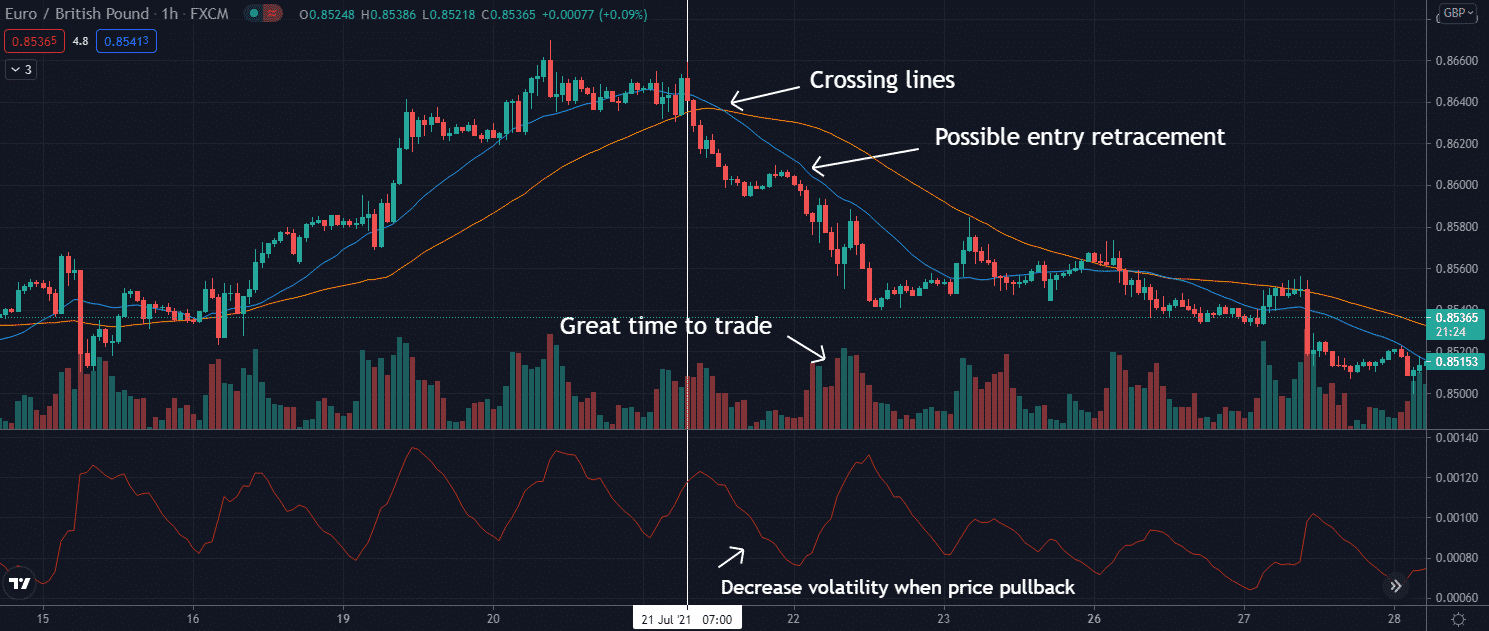

Due to its liquidity, there is a wide variety of indicators and strategies for this pair. Most traders operate in the intraday or micro swing mode. Looking for possible breakouts of support or resistance at times of high volume is one of the strategies that can generate profitability in this pair.

Volatility indicators such as the Average True Range (ATR) or volume indicators such as the Money Flow Index (MFI) are the main ones to consider. Secondarily, you can use indicators such as Moving Averages, which will help you with the timing to enter trends.

Identifying the beginning of a trend based on the increase of volatility in the hours of higher volume will give us an excellent opportunity to make a trade with a reasonable risk/reward.

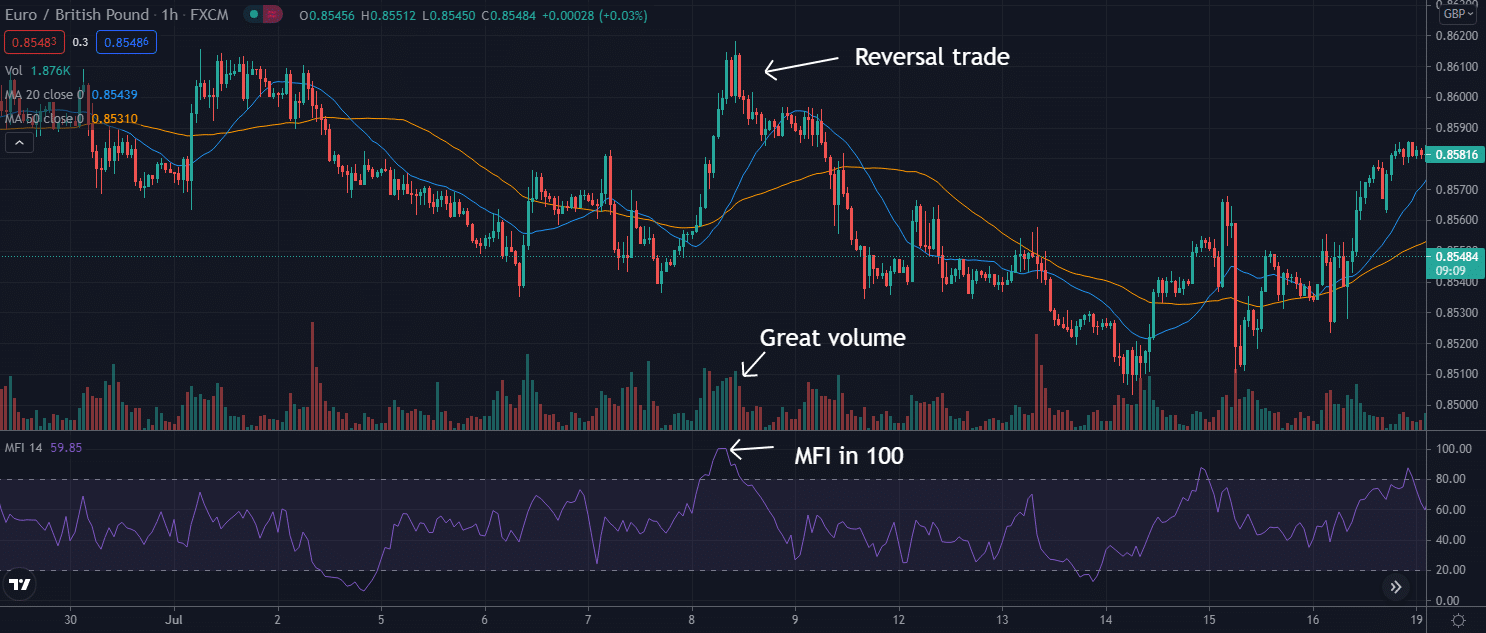

Suppose you decide to use the Money Flow Index (MFI) indicator. In that case, you can look at the overbought or oversold levels to make a reversal trade.

As you can see in the chart below, the MFI has reached the maximum overbought level, a sign that the trend may be ending and a pullback may happen soon. Therefore, at this point, a short trade could generate profits.

As explained above, once you identify the overbought or oversold level, remember to place stop losses above the last price low or high.

Conclusion

If you live in Europe, it will be easy to identify patterns of movements related to economic reports, political changes, and cross-border commerce between EU countries and the UK.

It is advisable to check the most important economic news during the day. Also, pay attention to the days when important announcements are expected from the financial institutions that regulate the European and world markets.

In terms of technical analysis, it is a pair that does not stand out for its volatility. However, it will allow you to plan your strategy and execute it with adequate timing.