Based on your trading method and preferences, you will need to choose the best currency pairs to trade. With that being said, specific Forex pairs are ideal from the perspective of volume, volatility, and other particular characteristics.

One of the most popular currencies among traders is the Japanese yen (JPY). Since the financial crisis in 2008, it has proven to be a safe haven in times of market uncertainty and became the third most traded currency behind the dollar and the euro.

Due to its high trading volume, the Japanese yen is the most traded in Asia. Traders and investors worldwide use this currency for their day-to-day operations.

As for the dollar, there is no need for much introduction. We know that it is the world’s leading currency and with which most international payments are made.

Trading USDJPY is easy if we take into account both fundamental and technical analysis. Therefore, in this article, we will discuss what to consider when trading this well-known forex pair.

Fundamental aspects

As we have already mentioned, the Japanese yen has functioned in recent years as a safe haven for investors. Traders should keep in mind the special role of the currency in terms of the risk sentiment.

Keeping an eye on economic news from the US and Japan is critical. If there is a bad news week in either of these markets, the price of the pair will be affected.

A fall in the New York Stock Exchange would also affect the USDJPY. The example is in the following chart.

Keeping interest rates low is the job of the Bank of Japan; the bank usually keeps the rates lower compared to most of the other countries’ banks. If those rates rise at some point, demand for the JPY is likely to increase, affecting the USDJPY liquidity.

Other economic factors that may affect this pair are Gross Domestic Product, wage growth, and the consumer price index.

Major economic events in China or South Korea may have a minor impact on the price of this pair.

The majority of Japan’s imports are oil, while the United States’ imports meet only half of the country’s needs; this is why the price of oil influences the pair.

Therefore, when the price of oil rises, it can often lead to a yen devaluation against the US dollar. Thus, the USDJPY is particularly sensitive to global energy prices, especially crude oil.

Technical aspects

In general, the USDJPY should be traded in hours of higher volume. Therefore, if you can recognize the right setup, you can make profits, especially if you are a scalper or intraday trader.

What’s the best time to trade USDJPY?

Keep in mind that even though the Forex market is open 24 hours a day, it is ideal to avoid lower-volume times. For example, it would be best to avoid trading between 21:00 and 00:00 GMT, when the Tokyo Stock Exchange and the New York Stock Exchange are closing. A very calm market offers little opportunity for profit.

Knowing which hours to avoid, we should trade when the markets are active. Thus, increasing the chances of making good moves and not getting trapped in ranges when the volume is low.

Best indicators and strategies to trade the USDJPY

When it comes to markets with high volume, our leading indicators have to be volume and momentum. Therefore, indicators such as the Money Flow Index (MFI) or the Volume Weighted Average Price (VWAP) consider all that volume during the peak hours of the currency pair.

Secondarily, we can use indicators such as the Relative Strength Index (RSI) or Moving Averages such as the 20, 50, or 200-period Moving Averages to identify reversal points and impulses in upward or downward trends.

In the following chart, you can see an uptrend in a 5-minute time frame. Again, the VWAP indicator marks the trend because the price stays above it during the whole session.

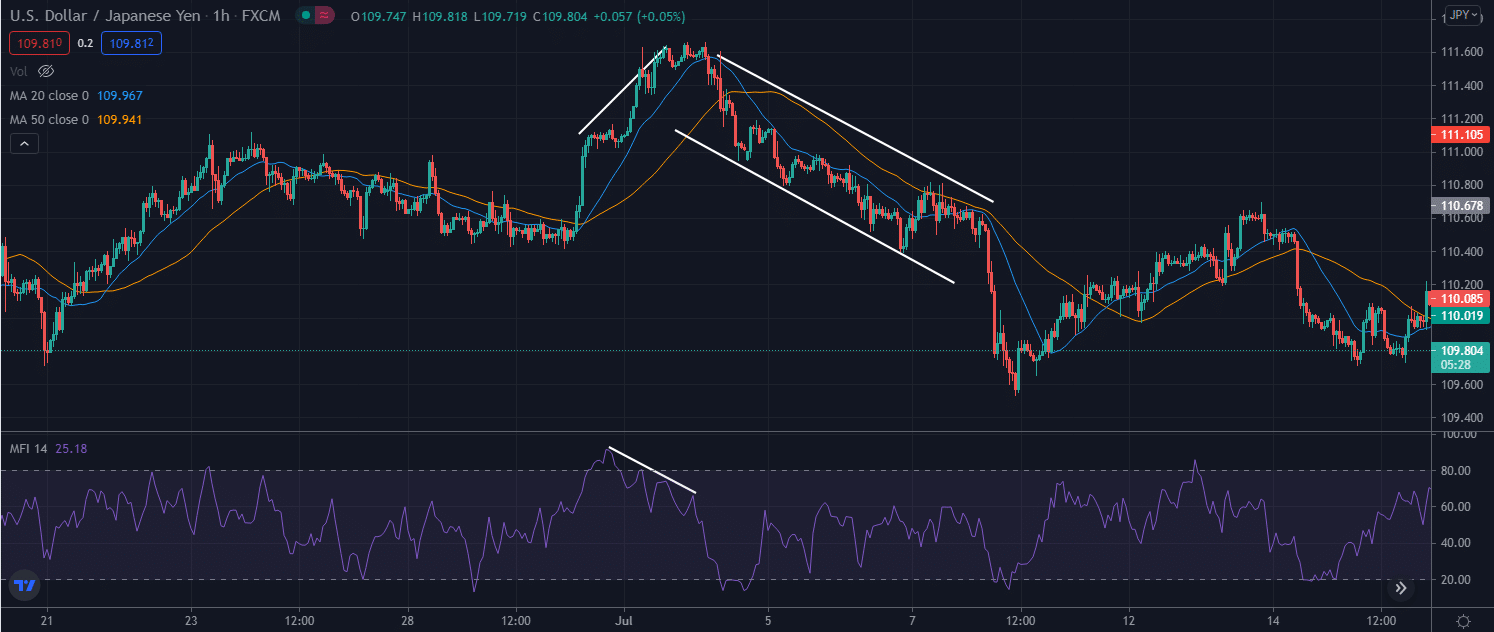

Combining a volume indicator such as the Money Flow Index and an indicator such as Moving Averages is another strategy we will show you.

Identifying the trend with Moving Averages and looking for divergences between the price and the MFI is one of the examples you can see in the following chart.

After divergence, the pair’s price starts a downward trend identified with the Moving Average of 50 periods above the 20.

Selling at the top is ideal because the MFI shows a loss of strength, and the Moving Averages are crossing, indicating a change in the trend.

Conclusion

In recent years the Japanese yen has positioned itself as a stable and attractive currency for trading with leverage.

High liquidity allows traders to enjoy trading the pair that you can find at almost all brokers.

To daytrade the USDJPY pair, we must consider both the technical and the fundamental analysis. If we only operate based on one of them, the chances of success in trading will be lower.

Therefore, analyzing the New York and Tokyo stock exchanges and the oil-related news can give us a better perspective when placing positions.

In the same way, you should know that there is no specific method or indicators that constantly work on trading in this pair. However, considering what we have described in this article will undoubtedly help you face the market.