Hedge Forex Robot is made available by Forex Robot Trader, a company that has multiple algorithms present for the MT 4 platform. The robot trades by scanning multiple time frames and uses trends for placing positions. To better understand the profitability of the EA, its pros and cons, we will analyze this trading tool in this Hedge Forex Robot review.

Product offering

The company shares the trading logic with us on their website and shares the results. They are unclear on their backtests and do not track the live records through verified performance tracking websites.

Vendor transparency

Forex Robot Trader is the company behind Hedge Forex Robot. They do not share any details on their trading experiences. They state that Don Steinitz is the man behind the product who started forex trading after playing in the casinos. He later decided to study multiple strategies and began developing algorithms.

Price

Traders can get the EA for $49, and there are no renting options available. There is a 75% discount on the product for now. The company does not provide any money-back guarantee.

Trading strategy

The developer states that the robot scans the higher and lower time frames and detects the counter-trend. After that, it gets ready to enter the market, working on the lower chart to get the perfect entry and exit point. Unfortunately, there are no live records present that we could use to analyze the methodology of the system.

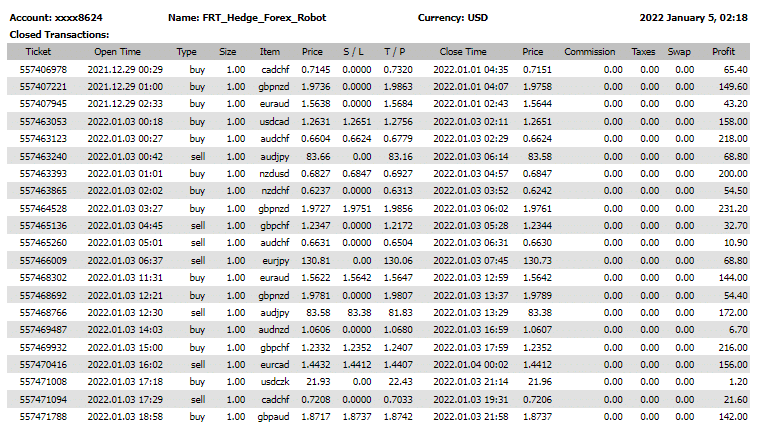

The developer shares a statement from MT 4 on the website. From there, we can observe that the EA trades on multiple currency pairs and may or may not use a fixed exit point on executions. Positions can have a stop loss value of 20 pips with a take profit of around 40 pips.

There are no swaps charged, meaning that positions are not held overnight. Multiple positions are open simultaneously, which adds to the floating loss. With an account balance of nearly $5 million, the value of the lot size is 1.

Trading results

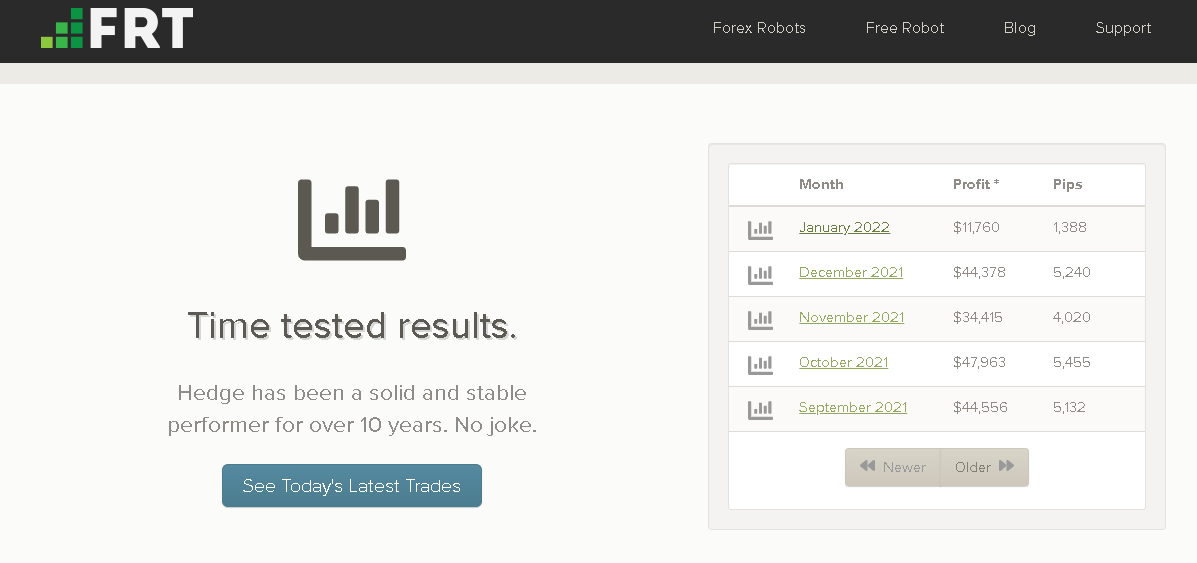

The developer does not share the backtesting records with us. We have searched the whole website but could not find any link to proper historical testing.

We can see the trading records are tracked using the MetaTrader platform. The performance of each month is available separately.

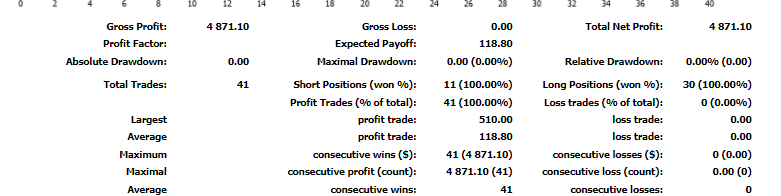

For January, the robot trades with a drawdown of 0%. The winning rate stood at 100%, with an unknown profit factor. No drawdown value and empty brackets raise many concerns about the tracking approach.

The best trade was $510, while the worst was -$0 in a total of 41 trades. The developer made an unknown deposit on the account and has a current floating loss of -$1866.

There were a total of 41 consecutive wins returning a profit of $4871.1 with losses of $0. The average profitable trade was $118.8, while the worst was $0.

Customer reviews

There are no customer reviews available on Forex Peace Army or Trustpilot that we could use to understand the product’s performance. We do not know how other investors feel about the product. Lack of feedback also indicates that traders are not interested in using the robot.