Gold is one of the mostly traded commodities in the market. Indeed, according to a report by the London Bullion Association (LBA), gold worth more than $37 billion is traded in London every day. Gold is also a beloved metal by traders because of its volatility and the vast amount of news about the metal. In this report, we will look at how to trade gold and the top strategies you can use to trade it successfully.

What moves gold prices?

Gold is unlike other commodities like crude oil, corn, and cocoa. That is because its price does not necessarily move according to the normal demand and supply dynamics. Instead, gold is both a precious metal, a store of value, and even a sort of currency. Indeed, it has been used as a currency for centuries.

Unlike other commodities, most of the mined gold is not used for consumption or in industries. Most of it is bought by investment firms and central banks. For example, in 2018, central banks bought more than 668 tons of gold, which was a record. Today, central banks like the European Central Bank (ECB), Federal Reserve, and the People’s Bank of China (PBOC) hold gold reserves worth more than $21.98 billion, $388 billion, and $111 billion respectively.

Investors are also popular owners of gold. For example, the SPDR Gold Shares ETF owns more than 40 million ounces of gold worth more than $72 billion. Similarly, the iShares Gold Trust has more than 16 million ounces. The popular Aberdeen Standard Physical Gold Shares ETF has more than 1.2 million ounces.

How Federal Reserve affects gold prices

These investors hold gold because of its store of value and its role as a hedge against inflation. Therefore, its price usually moves depending on the rate of inflation and policies of the Federal Reserve. As the leading central bank in the world, the Fed is tasked with coming up with the US monetary policy. This includes setting interest rates and implementing policies like quantitative easing.

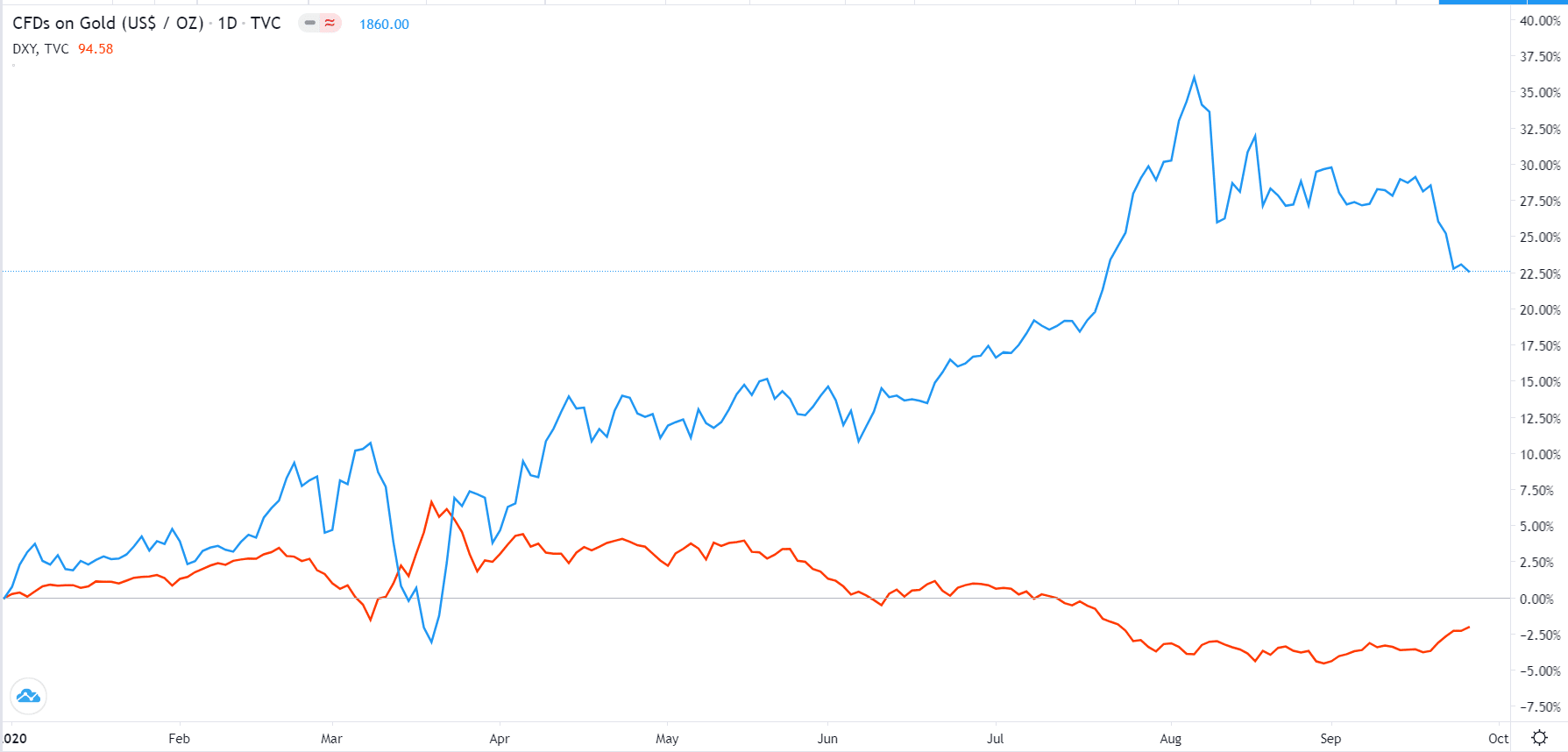

In most cases, gold prices usually moves up in times of expansionary policies by the Fed such as when interest rates are low and when the bank is implementing quantitative easing. That happens because inflation tends to rise while the dollar weakens. Gold and the US dollar have an inverse relationship. As you can see below, the price of gold rose in 2020 when the Fed implemented expansionary policies to cushion the US economy from risks. As it rose, the dollar index declined.

Gold vs US dollar

In addition to the monetary policy and the dollar, gold price usually is usually viewed as a hedge against risks. Indeed, its price usually outperforms stocks when there is a major financial or economic crisis.

How to day trade gold successfully

Now that you know what moves gold prices, let us look at the best approach to trade the metal successfully.

Find a good broker

As a popular metal, gold is offered by most brokerage firms. In the United States, it is offered by companies like Robinhood, Charles Schwab, TD Ameritrade, and Interactive Brokers. These brokers offer gold spot prices and futures. They also offer gold stocks, gold ETFs, and gold futures. Similarly, gold is offered by most of the leading forex and CFD brokers.

Therefore, if you are already trading other assets, you can just check out whether they offer gold as well. If you don’t have a trading account, we recommend that you find a broker that meets certain conditions:

- Must be a regulated broker – Check whether the company is regulated by a credible institution like the Securities and Exchange Commission (SEC) and the Financial Conduct Authority (FCA).

- Years in the industry – Ideally, a broker that has been in the industry for long is preferred.

- Charting and trading tools – You should select a broker with a good trading and charting platform.

- Pricing – Most gold brokers make money through the spread between the bid and ask prices. Others charge a commission. Do your research and find one that offers a good price.

Read more about trading

In general, if this is your first time trading, we recommend that you spend a lot of time reading about trading. This is an important step that you should not overlook because it will help you know what to expect about the industry. Indeed, we have seen many people lose money because of their failure to read. That is why more than 70% of all people who start trading lose their money.

Fortunately, there are many affordable resources that you can find for as little as $10. Some of the best books that we recommend are:

- Trend following by Michael Covel – This book will introduce you to the concepts of trend following, which is a popular trading strategy.

- Volume price analysis by Anna Culling – It will introduce you to the concept of volume and how you can use it well.

- Beyond candlesticks by Steve Nison – This book will introduce you to the concepts of candlestick analysis.

- Why gold, why now by E.B Tucker – This is a general book about gold and what moves it.

In addition to these books, you should learn more about other key terms that you will meet when trading gold. These are: leverage, margin, stop loss, trailing stop loss, take profit, bid and ask prices, and support and resistance.

Use a demo to come up with a strategy

Most trading platforms give you a free demo account. This is an account with virtual money that mirrors what is going on in the market. You should use this account to come up with a trading strategy and backtesting it. Some of the most important details you will need to learn in this step are:

- Technical analysis – This is an analysis approach that involves looking at a chart and using tools to predict the future direction of the asset. Some of the popular tools are moving averages, Relative Strength Index (RSI), Average Directional Index (ADX) and volume.

- Fundamental analysis – This is the approach of looking at the overall market and identifying the underlying news and events. For example, you will learn how to use the Fed interest rate decision to trade gold.

- Price action strategies – This is a strategy that involves looking at charts and identifying key patterns.

- Scalping – This is a trading strategy that involves opening and closing trades within a short period.

You will learn other gold strategies such as swing and day trading, and the use of tools like Fibonacci and Pitchfork.

Final thoughts

Gold is a popular trading asset that has significant volume and volatility. Unlike other commodities like cocoa and corn, there is a lot of information/news about gold that is available. All these factors make gold an ideal trading commodity. You will be a successful gold trader if you follow carefully the tips highlighted in this report.