It is said that books shouldn’t be judged by their covers, and this is particularly true for algorithmic trading strategies. It is not a title that is extravagant or elaborate, but once you know the fundamentals, you can easily comprehend what it is all about.

It is obvious that computers are much better than humans when it comes to reacting to changes. And, by analyzing data efficiently and using the right techniques, you can make superior trading decisions through them.

Here, we shall talk about such schemes, which will allow you to make profits in the market. We shall also discuss the advantages and disadvantages of those.

What is algorithmic trading?

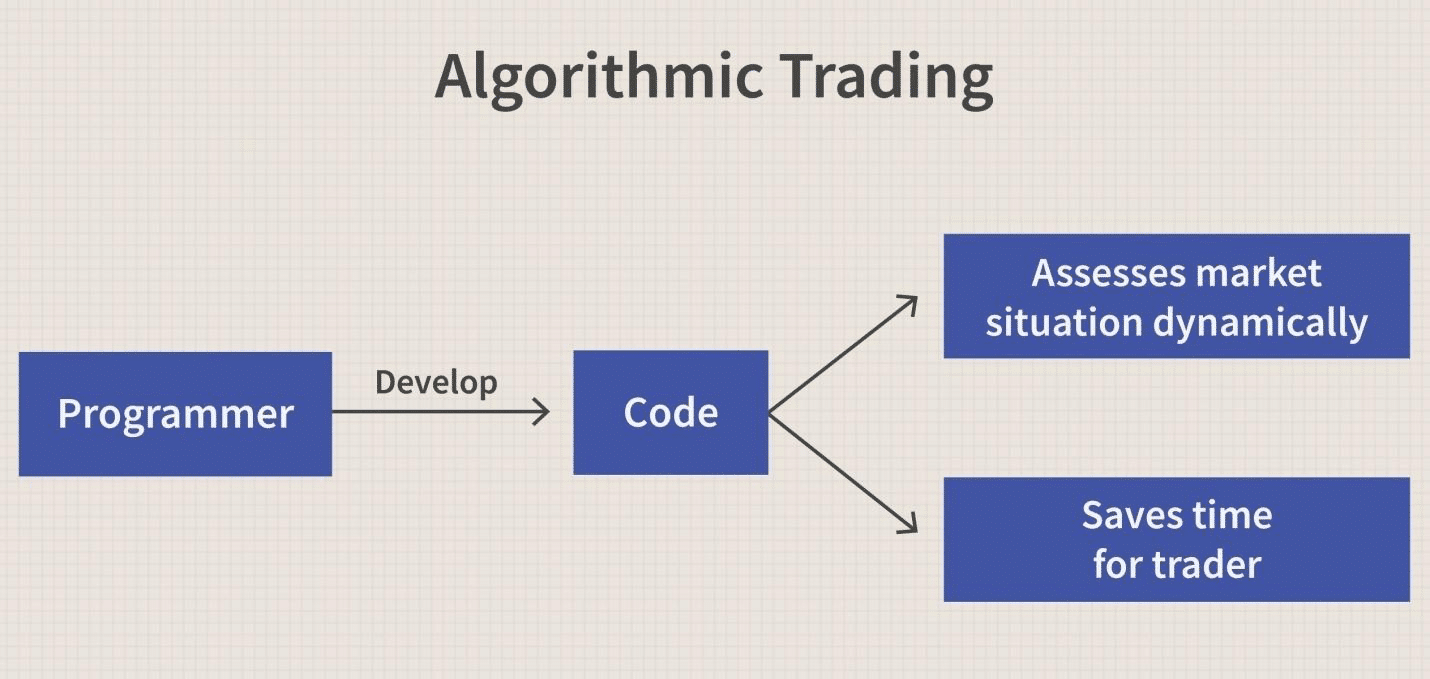

It is a trading strategy that takes the help of a computer program in order to execute the trading of cryptocurrency, Forex pairs, options, and stocks. It is possible to execute some functions automatically using a systematically designed set of code. You can use readings from indicators, financial data, time, volume, price, etc., as input in order to carry out your trading operations.

Now, let us look at the benefits and disadvantages offered by these kinds of strategies.

Pros and cons of algorithmic trading

The pros and cons of algorithmic trading are as follows:

Pros

- Negating emotions

- The historical data is analyzed quickly and efficiently

- Disciplined execution of the trading plan

- Better risk management through trade diversification

Cons

- Mistakes due to technical problems or internet failure

- The system needs to be monitored for server issues and technical problems

- A good trading plan on paper may fail in a live scenario

Know your preferences

If you wish to make big profits in the Forex market, you need to know what your personal proclivities are, in addition to assessing your strategy of choice. Algorithmic trading requires you to be emotionally detached, patient, disciplined, and not stand in the way of the trading strategy, particularly when you are losing money. You may have backtested a strategy and found out that it’s extremely effective, but due to you interfering with the trade, there might be disastrous consequences.

Time is a vital factor you should consider in this regard. The nature of your work will decide what kind of strategy would be best for you. Some strategies require you to devote a considerable amount of time, and this isn’t viable if you have a full-time job.

If time is not an issue for you, and if you possess automation skills, you can consider using an HFT strategy. It is advisable that you thoroughly research your strategies in order to make consistent profits because your scheme won’t remain unknown for too long. Before entering the trade, you should make sure you are prepared since a strategy that brings in huge profits today might lead to big losses tomorrow.

Locating algorithmic trading strategies

Thanks to the internet, it is much easier to locate effective algorithmic trading strategies these days. You can find them in places like experts’ blogs, trading magazines, forums, and journals and choose the one that suits your personal preferences.

Remember, your objective is to create a strategy channel from where you can get a continuous flow of efficient trading ideas. You wish to build a well-organized approach to locate, evaluate, and implement trading strategies that suit your requirements. The objective of your strategy is to furnish you with novel plans consistently and give you a structure where you can reject most of them with minimal emotional constraints.

If you are new to trading strategies, it might help you to consult a few textbooks first, where you can learn about the basics of automated trading. Several blogs also contain useful information that will let you assess the true effectiveness of trading techniques founded on technical analysis and make prudent decisions without emotional bias.

What do you need to formulate your own strategies?

Formulating your own trading strategies requires you to be knowledgeable about the following:

- Market microstructure. Specific techniques can be used to exploit constraints, rules, and restrictions in various markets. Since this is a complex area, it is difficult for traders to compete here without solid technical abilities.

- Fund structure. Strict rules and huge capital reserves act as constraints for mutual funds, hedge funds, and pension funds. They display a characteristic consistency that you can exploit for your benefit. Capacity restrictions apply for those funds that are quite big, and thus there is a bit of stagger involved during offloading so that the market movement can be avoided, a phenomenon that algorithms can exploit.

- AI/Machine learning. As of late, algorithms with machine learning as a basis have invaded the market and are useful in regards to improving trading strategies and foreseeing the direction of movement for assets. With some AI-based knowledge, you can better apply your algorithms based on the nature of the market.

Evaluating the strategies

The foremost criterion that’s needed to judge your scheme is its methodology, i.e., how complex the scheme is, is it resistant to new regulations, if they introduce new parameters, etc. The next thing you need to characterize the strategy’s risk vs. reward relationship is the Sharpe Ratio. This helps you determine how much you can gain in regards to the volatility that the equity curve goes through.

Additionally, you need to consider things like the leverage possessed by the strategy, its frequency, volatility, and the profit and loss ratio. There are also some performance benchmarks that you need to measure your technique against in order to judge its effectiveness.

Conclusion

While it is possible to conduct trades in a more efficient manner using algorithms, they are not perfect, and it does not mean you can leave everything up to them. Before using such systems, you must gain some expertise in and comprehension of trading processes. As a best practice, you can use a combination of manual and automated trading strategies.