The bigger picture in forex

Some traders do not care much about the bigger picture of the markets. Intraday fluctuations tend to give traders a strange sense of forex trading. In formulating a trade idea, it is not just about what is happening now, but what you hope to happen in the next day, next week, next month or whatever timescale you have. Assuming you can withstand the risk in any given position, the bigger picture is your belief about where a particular market might go to in the future.

The bigger picture is also specific economic indicators that may be at play. A few of these indicators are, to some degree, responsible for some of the biggest trends market participants have seen historically. This idea is one of the reasons that traders care to understand the bigger picture in play. However, it only matters mainly to swing and position size traders because it takes a very long time to see the bigger picture play out. Some traders like to look at the bigger picture as it’s easier to hold a bias for an extended period without altering it. Whereas some traders frequently change their biases in a day or week, other traders find it less time-consuming and active by keeping the same bias for much longer.

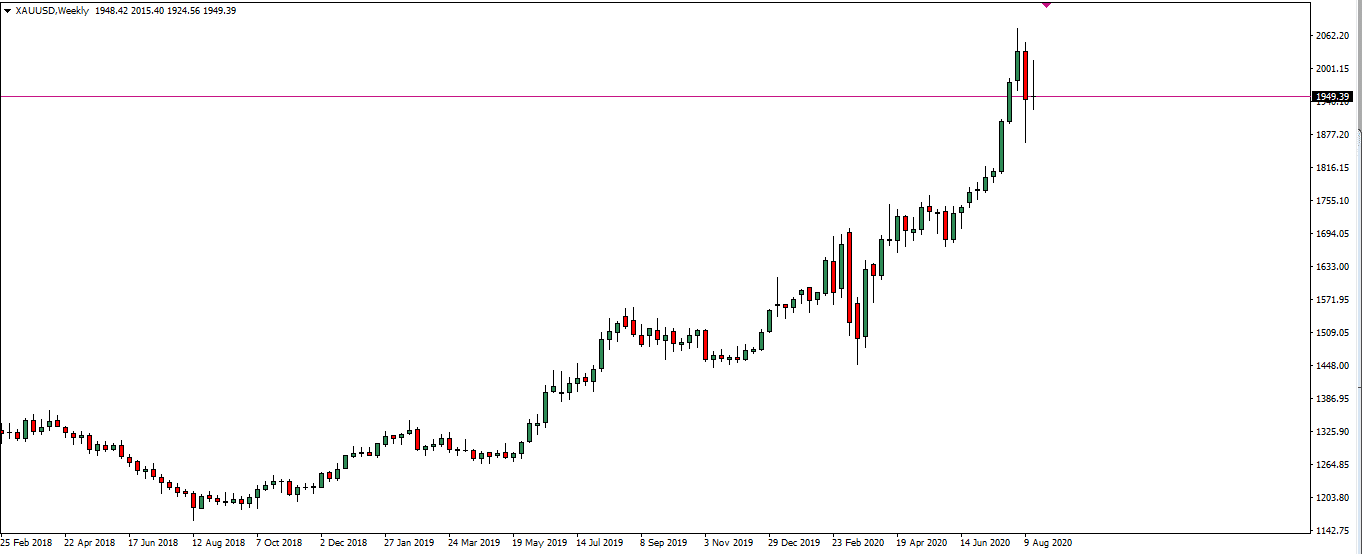

In the recent bull run on XAU/USD (gold), some analysts had already seen the big picture of gold’s potential rally over a few months. The price wildly surpassed even their own expectations when gold hit a record-high price that tipped over $2000 an ounce. This prediction was fuelled mainly by the global pandemic and the recession. In times of economic distress, gold is always thought of as a safe haven when currencies lose value. The big picture was exemplified in this scenario, though there is a high level of patience required to understand it.

Some of the economic indicators for the big picture

When we talk about fundamental analysis in forex, there are many fundamentals to consider. However, concerning the bigger picture, only a few are noteworthy, arguably the interest rate and the GDP. These indicators are one of the main driving forces of any economy.

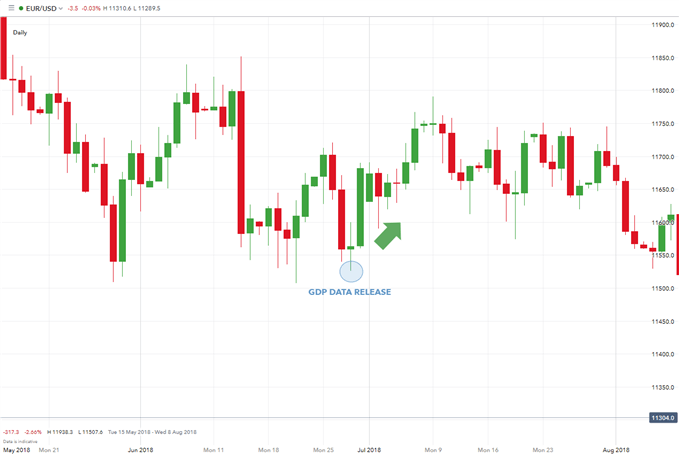

The Gross Domestic Product (GDP) represents the country’s economic activity levels as a measure of the total value of goods and services rendered for a specific period, usually per quarter. The more economic activity that happens, the higher demand for the currency that the country uses.

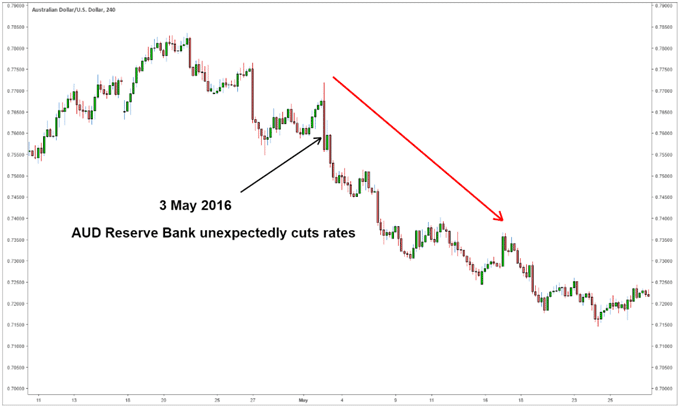

Similarly, interest rates also affect economy-related activities that can either boost or weaken a currency’s demand as time goes on. A lower interest rate can be beneficial during difficult economic periods as it encourages more borrowing and spending, though it may limit foreign investment. When the economy is stronger, because of the increased money supply, central banks will tend to raise the interest rate in keeping with their inflation target, which boosts foreign investment.

Understanding the bigger picture is rather complex when attempting to study the fundamentals of two different currencies. However, what traders desire to see are clear disparities between, for example, interest rates and/or GDP figures in comparison to the other currency.

Another element in this discussion is the difference between forecasted and the eventual figures at the time of release. The predicted number represents a pre-conceived notion towards a currency. If the final figure at release is lower or higher than what was forecasted, it can also significantly impact the currency. The example below regarding the Australian dollar illustrates this perfectly. There were speculations that the RBA (Reserve Bank of Australia) would keep the interest rate at 2%, but instead, it became 1.75% upon release. This result was arguably the primary catalyst to the downtrend soon after.

Preparing for the big picture as the world changes

Big picture thinking aims to help traders hold a sentiment over a particular market for an extended time, whether it’s days, weeks, months, or even years. Traders can achieve this by looking at changes in specific indicators like the interest rate and GDP, and even employment figures.

Historically, most central banks worldwide rarely alter their interest rates, which means they can remain unchanged for months or years. Hence why when there is the slightest change in the numbers, market sentiment can slowly start to shift to reflect that change. Interest rate decisions are one of the most anticipated fundamentals in the markets for this reason. In the seldom event that there is a noticeable difference in the figures, seeing the big picture play out in this situation will take a long time.

Other financial markets often have a bearing on forex markets. Many traders also garner interest in these markets when thinking about the broader outlook of a forex market. For example, oil prices reached record lows in 2020, mainly due to the global pandemic and the Russia-Saudi Arabia price war. Such a massive drop in oil prices inevitably affects the currencies of currencies that produce most of the world’s oil, such as the United States, Russia, China, and Canada.

Something to also look at is just the broader economic landscape of a country: how good is it or how bad is it? In spells of recessions or economic depression, investors have made considerable returns from various financial instruments, including forex. When certain economies are prospering, investors can do the same. When something starts losing a lot of value, traders have to adapt by selling – and vice versa when it starts gaining value. These actions are only possible when they keep their ear to the ground and studying several different things in line with the bigger picture.

Conclusion

Thinking about the big picture in the forex is not an easy feat. There is a lot that one can analyze in discerning what is likely to have the most significant impact. Then there’s the issue of a time horizon that requires different types of mindset. The mentality of thinking months ahead is very different from the mentality of thinking weeks or days ahead. Thus, the big picture comes in various forms in the hopes of predicting the future before it happens.