There are four main types of pending orders commonly used in forex trading. Pending orders are also widely applicable in forex robo trading. You can apply them depending on your trading strategy. The correct reading of the market price action is critical for their successful application.

Buy limit

When this order is executed, it ensures that you buy a security at a low price from which you hope the security will appreciate, thereby earning you good returns. It is an order placed at a support level beyond which you hope the price won’t depreciate. Therefore, buy limits are placed by traders with the hope that prices will appreciate from that point henceforth.

For buy limit orders, the trader hopes that the price will fall low enough to touch the level set below the current price. This will enable them to buy the security at a “lower” price.

Sell limit

This order is a way of selling your securities at a profit during a price rally, just in time before their upward trajectory reverses. To execute this strategy, traders place their sell limit at a resistance level beyond which they believe the price rally won’t go.

Therefore, it is recommended that the sell limit should be placed at a price that the trader believes is the most appropriate value for the market to reverse from.

Buy stop

This type of order is placed at a resistance level with the hope that the price of a security will embark on a bullish rally afterward.

Therefore, traders place this order when they are convinced that the price is likely to appreciate further after breaking a certain barrier.

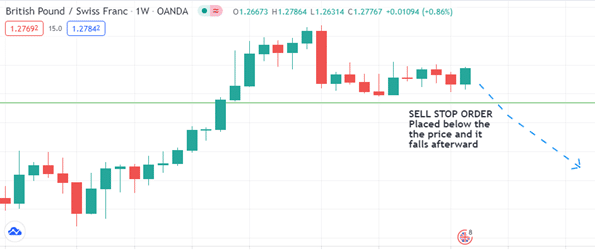

Sell stop

It is placed below a support level, beyond which a trader believes that the price is likely to plummet further. Therefore, this order is typically placed when traders have adopted a short position. Alternatively, it can be looked at as a mechanism through which traders minimize their losses when security is on a bearish run.

For pending orders to be profitably executed, the following factors have to be considered:

- Optimal entry points: These are the most appropriate points at which a trader feels that the subsequent market movements will favor them. For this to be effected, a trader has to identify the critical pivot points that will support their preferred direction of movement.

- Once a specific channel of motion has been established for a security’s price movement, it is prudent for a trader to locate support and resistance levels to guide them on where to place their orders. Under such circumstances, the breaching of the key pivot points will serve as a signal for them to enter positions.

- A trader can use both buy and sell limit orders to optimize their potential profits and minimize their risks. The buy limits will be placed below the current price, while it will be put above the current price for the sell limit order.

With this strategy, the trader has to be confident that the current price trajectory will continue. In case of a buy stop pending order, the trader has to be convinced that the price will continue on an upward ascent. Conversely, the trader using the sell stop hopes that the price will continue depreciating.

- Fundamental aspects of the market should favor the position taken by the trader. From time to time, news releases may come out and affect the price action of a security. Therefore, traders need to keep their attention on high alert and adjust their positions accordingly.

- When considering the most appropriate levels to take profits, a trader should be aware of the prevailing market conditions that may affect a particular pair, as well as the level beyond which a reversal is likely to occur.

Stop orders provide traders with opportunities to profit from breakouts. Many traders will trade the trend with specific resistance, and support levels plotted to help identify breakouts.

Limit orders are therefore appropriate to use when you have well-established support and resistance levels to work with. Note that when these levels are located using longer time frames, they are likely to be more reliable than those whose time frames are shorter.

We place a sell limit above the current price because we hope that the price will rise, but only as far as the limit level is set. Therefore traders will sell at a profit once the sell limit order’s price is reached.

However, if the price fails to reach the set higher level, the trader may end up on the losing end. That is why even experienced traders often use forex robots as an additional trading tool to eliminate the market risks as well as the impact of trading emotions.

From the design of the limit orders, they require a trader to craft a predetermined strategy for entering and exiting trades. Therefore, limit orders should be placed a few pips below the established resistance levels.

Bottom line

Limit orders streamline trader’s actions and help them to develop and stick to an entry and exit plan. It is important to incorporate all the relevant technical indicators to help you know where to locate the support and resistance levels.