As an active trader, you might have noticed that the price of certain commodities has a significant impact on the movement of currencies. A similar relationship can be observed between the bond yield spreads and currencies. This correlation is often strengthened by the actions of central banks and governments, which impact both the yield spreads and currencies.

When a country’s currency is stronger, the goods it imports from other countries become cheaper. For many demand-intensive countries, a significant import is often oil. Oil is a commodity whose price impacts consumers both directly and indirectly.

Hence a strong currency often brings down inflation. This also affects bond yields. Higher inflation means the investor in these bonds is effectively getting lower returns. So the investor demands higher returns which are reflected in higher yields.

What is yield spread?

Pricing in the bond market is slightly different where the bonds are quoted by their ‘yields’ and not their prices. Bonds typically return the principal at the end of their term and a periodic coupon. So the return is not just from the change in the price of the bond and also the coupon.

The combination of these two returns is known as yield. So, for example, a bond with $100 principal and a 6% coupon maturing next year is trading at $98, then the yield will be 8%. As you must have noticed, the lower the price of the bond, the higher will be the yield. So these 2 have an inverse relationship.

The yield spread is nothing but the difference between the yields of the government bonds of 2 countries. Since bonds are usually of different tenures such as one year, three years, five years, ten years, and so on, the 10-year bonds are chosen as benchmarks. For example, if someone is talking about the yield spread for the UK and the US, they would most probably mean the difference in yields of their ten-year sovereign bonds.

Yield spreads in the context of AUDUSD and NZDUSD

Now that we understand the concept of yield and yield spreads let’s find out their relation to currencies with an example. One of the most prominent examples is the tech bubble burst of 2000.

Due to the imminent recession, the Federal Reserve lowered the rates to record lows. This, in turn, also dragged down bond yields which traded at similar levels. Since investors were getting very low returns on these bonds, they started looking for markets where the sovereign bonds offered better returns.

Among the developed nations, Australia’s bonds were offering a significantly higher yield, of nearly 5%. With risk factors almost similar, several investors turned to Australian bonds in order to get better returns.

You must be aware that the sovereign bonds of a country are denominated in its domestic currency. So, investors were effectively buying AUD in order to invest in these bonds. This resulted in a huge inflow in AUD, resulting in the AUDUSD pair shooting up.

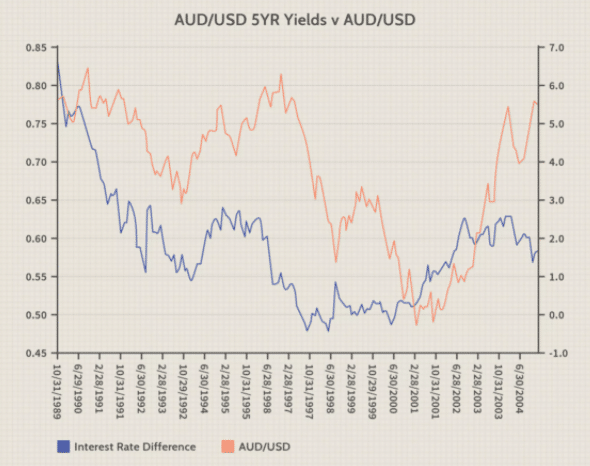

As shown in the above chart, the yield spread between the US and Australia had trended down for several years. However, post the 2000 crash, it shot up and continued to go higher. AUDUSD followed a similar trajectory as Australia saw strong inflows into its domestic bond market. Notice that the correlation is visible not just after the 2000 tech bubble burst but even before that.

So the traders who were able to get early in this trade enjoyed two benefits. One was, of course, the additional yield offered by Australian bonds, which was the motivation of the trade. The second was the returns due to appreciation in AUD. Since the AUDUSD pair also went up, traders also earned returns on their FX position.

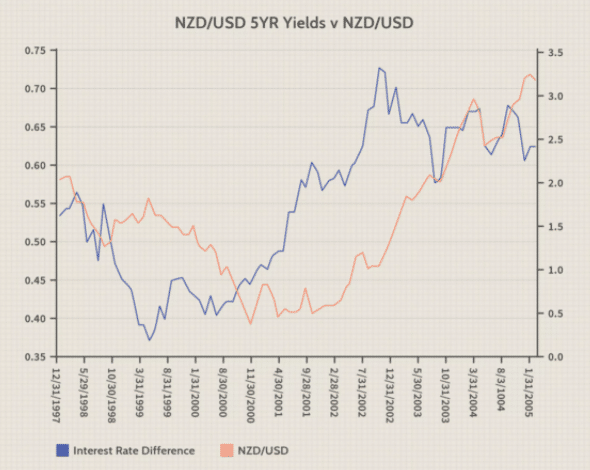

It goes without saying that such correlation is not unique to AUDUSD. It can be seen in several other currency pairs where the yield spread is significant. For example, refer to the chart below for the NZDUSD pair. The yield spread for the US and New Zealand started picking up in 2000. As you can see, the currency pair followed the direction as well, and the trend continued for several years.

Now that we have seen how yield spreads are strong indicators for FX direction over a long period, let us see some caveats as well.

How do yield spreads work in practice?

First of all, the correlation between yield spreads and FX is due to underlying fundamental factors. While that means that there is a high probability of the correlation materializing, it also means that it happens over the long term. So as a trader, one should not expect the FX pair to follow the direction of the yield spreads immediately.

While using yield spreads, certain traders panic when they can’t see the price movement that they expect. As a result, they end up exiting their position early. This means that they leave a lot of money at the table. As seen above, while these price moves take time to materialize, once they do start moving, it results in a huge price move. This means that potential profits in this strategy are high if the trader is patient and has conviction.

Secondly, just like any other indicator, the yield spread isn’t the only factor dictating FX price moves. There are a number of other macroeconomic factors, such as a central bank’s direct purchases in the FX market, that can drive the FX price in the opposite direction. Additionally, given bond yield is a long-term indicator, it is better to couple it with short-term technical indicators. This will help the trader to judge the timing as to when exactly the yield spreads start driving the FX price.

Overall, bond yield spreads are powerful indicators for FX trading. A trader who keeps this indicator in the arsenal will have a definite edge in the market, especially when it comes to predicting long-term trends.