Tasting success in Forex is mostly based on the skill of the trader. But pros and newbies can gain an advantage with the use of automated trading systems. Systems like the IndEX EA claim to provide the boost traders need to see big profits without risking their capital.

Managed by Phibase, which has several years’ experience in the field, this Forex robot claims to provide a higher level of market information. With the valuable information you will be able to spot the weakness or strength of a currency and the direction of its flow. The system claims to provide a guaranteed profit of 600 pips per quarter with a win rate of 95%. In this review, we bring you a thorough analysis of the expert advisor to help you make the right decision.

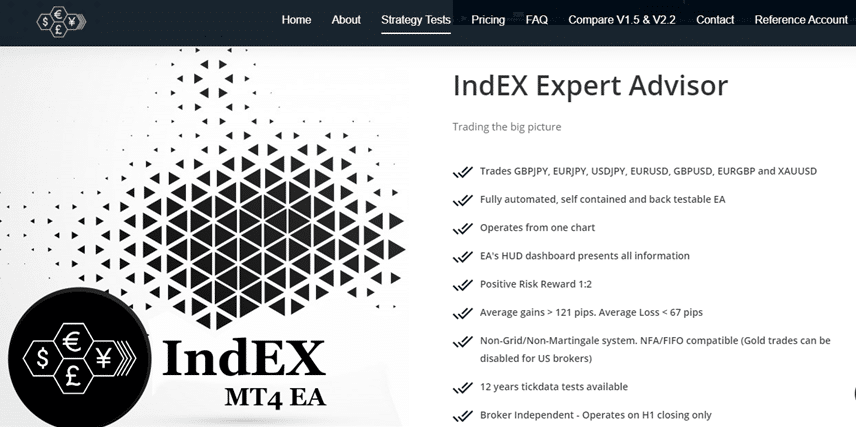

Product Offering

We could not find any information about the developer or the team responsible for creating the system. The vendor mentions Phibase of conducting several years of research and development to improve the performance of this trading software. But we could not find the location of the vendor and there is no contact number provided.

An online contact form is the only customer support the system provides. We could find details like the working mechanism, strategy tests, pricing, and trading results being posted on the site. A user is bound to find accessing the various parts of the site easy, with the simple but comprehensive design of the site.

IndEX EA Information Table

| Type | Fully-automated EA |

| Price | $260 – $540 |

| Strategy | Non-Grid, Non-Martingale |

| Compatible Platforms | MT4, MT5 |

| Currency Pairs | 7 currency pairs |

| Timeframe | H1 |

| Recommended Min. Deposit | Not disclosed |

| Recommended Deposit | Not disclosed |

| Leverage | From 1:400 |

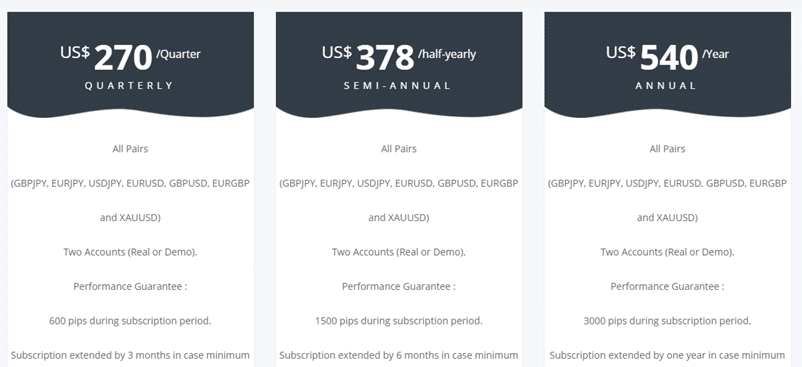

Subscription plans of the IndEX EA are available in three packages. A quarterly pack costing $270, a semi-annual pack costing $378, and an annual pack costing $540 are the three packages that the vendor offers. Some of the key features included in the packages are two real or demo accounts and a guarantee of more than 600 pips during the subscription period. No refund guarantee is provided by the vendor which makes the system look unreliable.

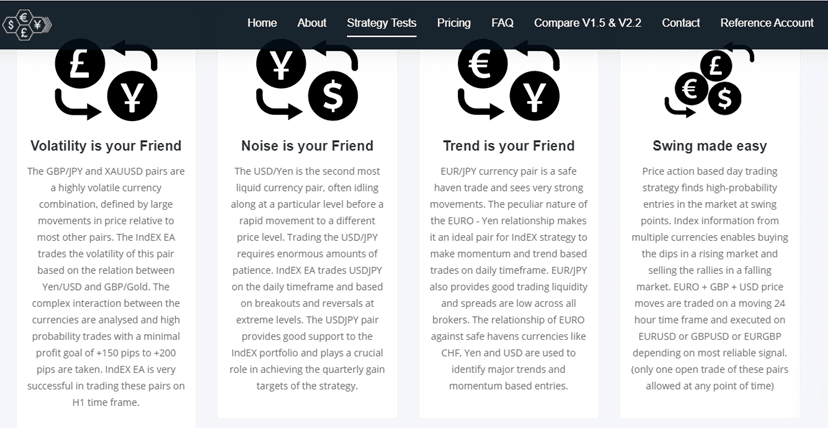

Trading Strategy

According to the vendor, this system uses a non-grid and non-Martingale strategy. While there is no mention of the exact strategy used, the vendor provides strategy highlights. A mix of market noise, trend, and volatility is used as part of the trading approach. For trading the USD, GBP, and Euro pairs, a swing trading approach is used.

The system is broker-independent using the H1 timeframe. Seven currency pairs are focused on by this system. Based on the info provided by the vendor, this system is easy to install. You attach the system to a single chart and it analyzes and configures all the main parameters automatically. There is a provision to disable or enable trading of the pair of your choice. A HUD dashboard provides all info on the trades. No mention is made about the recommended deposit and other settings.

Trading Results

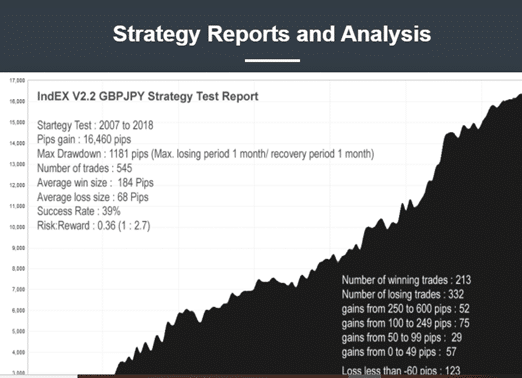

Strategy tests are provided by the vendor but they do not give information on details like modeling quality which is an important evaluation criterion.

From the screenshot shown above, the backtesting is done over 11 years and reveals a profit of 53,760 pips for a total of 2546 trades. The maximum drawdown is 1373 pips. We look for a 99.9% modeling quality for the backtesting as it reveals crucial info such as the spreads, commissions, slippage, and more.

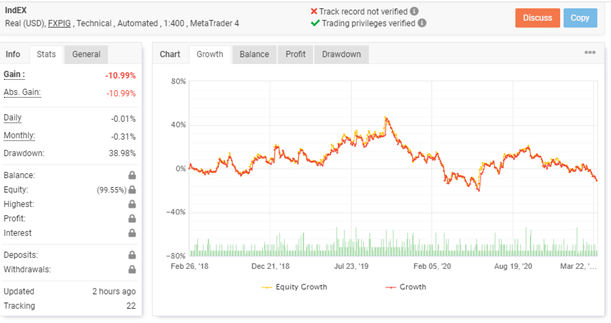

The vendor provides live real account trading results verified by the Myfxbook site. Here is a screenshot of the results:

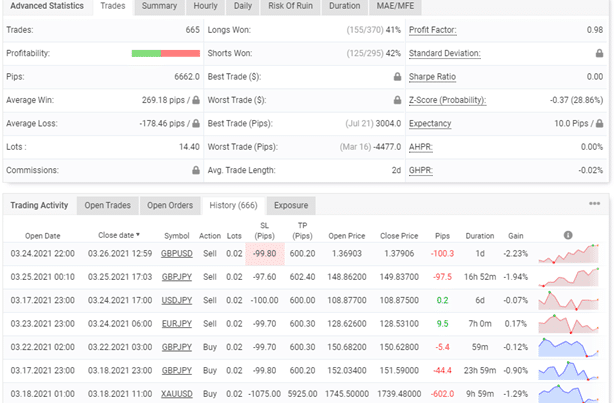

From the trading stats, we could see a total profit of -10.99% and a similar absolute gain value. A daily profit of -0.01% and a monthly return of -0.31%. The drawdown is 38.98%.

Trading for this real USD account with leverage of 1:400 started in February 2018 and up until now reveals a total of 665 trades with the average win coming at 269.18 pips and the average loss at -178.46 pips. The profit factor is 0.98 and 0.02 is the lot size. We could not find more info on details like the balance, profit, interest, deposits, and withdrawals as they are hidden by the vendor.

Customer Reviews

We could not find user reviews for this automated system on trusted third-party sites such as Forexpeacearmy, Trustpilot, myfxbook, etc. This makes it difficult for us to do an in-depth evaluation of the system.