Struggling with making efficient trades? A trading journal is a powerful tool that can save you a lot of worry and time spent on research. Whether you are a novice or an experienced trader, here is a guide to the basics of a trading journal and how you can use it to optimise your profits.

What is a Trading Journal?

Like any other journal, a trading journal is simply a regular record of your trades. In your journal, you can mention all the decisions that you have taken regarding your investments. This includes buying or selling of assets, making plans regarding your investment, different strategies you have used, etc. It can also have a record of your entry and exit points and the profits or losses you may have incurred in a given time period. Since it can be difficult to remember every action and lesson in a market as uncertain as the forex market, a comprehensive planning guide will be a powerful tool. A trading journal is an indispensable tool for the more inexperienced trader , especially those who may not be familiar with all the ins and outs of the fluctuating forex market. By keeping a record of your trades, decisions and the notes of why you took an action can help you to see your past mistakes and learn from them to improve your skills significantly in the future. Maintaining a trading journal regularly can prove to be a very useful device that will help you improve your trading mechanism and make better investment decisions in the long run.

Advantages of Having a Trading Journal

There are a lot of advantages of having a trading journal. It is a powerhouse of information that you can tap into, whenever you want.

Listed below are the pros of having your own trading journal:

- It can help you plan and organise your investments more efficiently. You can mention your investment strategies and how you want to break down your portfolio in the long run.

- It keeps a record of all your ventures for reference at any given time. You have access to all your investments in one place.

- You can learn from your own mistakes. With your journal, you can back track to historical investments and see where you went wrong.

- It is much easier to do a S.W.O.T analysis when you have a comprehensive record of your trades. You can see patterns of your strengths which you can repeat in the future appropriately and you can also see your weaknesses so that you can work on them for a better portfolio.

- It is an effective device for risk management and risk allocation. By using a trading journal, you can identify risks effectively and diversify your portfolio in an efficient manner to reduce uncertainties. It can help you recognise risks and tackle them first-hand to prevent incurring major losses.

Maintain a Successful Trading Journal

Making and maintaining a successful journal is not a difficult task. With a little practice and some basic tips, you can also make and maintain your very own trading journal. Given below are a few tips that can help you achieve that:

- Make some time before and after your trading day to note down all significant details. Everyday before you begin your trading, go through your journal to put you in the righ frame of mind and also strategize for the day.

- Make sure you mention every minute detail of your trades in the journal regularly. This can help you analyze each step properly and see where you went wrong or what steps helped you optimise your profits.

- Keep a track of the strategies you have used over time, create a comprehensive framework of which strategy suits your investment goals most appropriately.

- With each trade, try to recognise your strengths and use them to your advantage in the future. Pay attention to what you do best and try your hand in those areas.

- Mention how any particular market condition affects your perspective on trading. This can help you steer clear off of unwanted climates.

- Try to study other available trading journals to see what you are doing wrong, learn how others are managing their performances and allocating risks.

Reviewing your Trading Journal

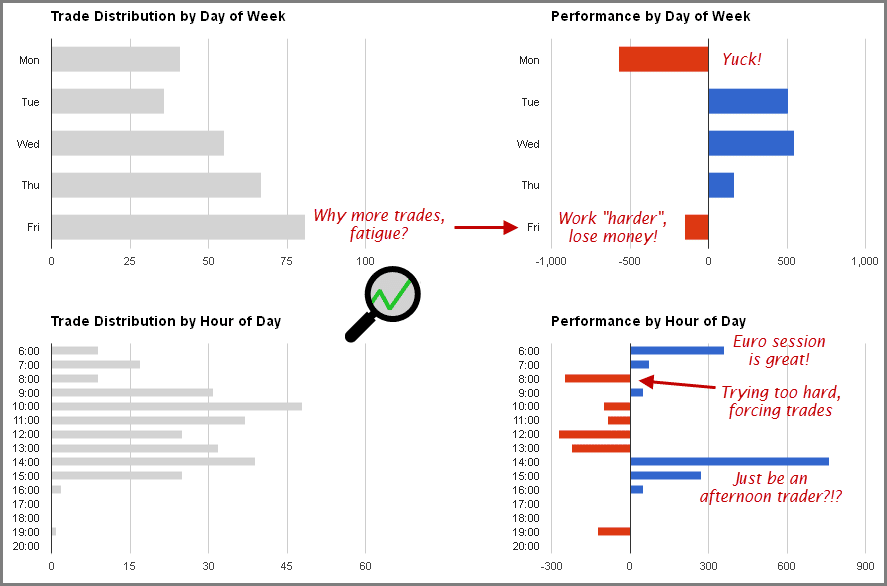

Here is an excerpt from a trader’s personal trade journal to help you understand how you can review your own journal.

He has used comprehensive charts to distribute his trading process over each hour and also accumulated them over the week. Further, he has analysed how various trades have worked for him at different points of time. He has also mentioned his thought process through each trade to review strengths and weaknesses for future reference. In a similar manner, you can use a customised system to create your trading journal where you can use charts, graphs and notes to analyse and review your performance consistently.

Final Thoughts

If you want to have a smooth and stress free trading experience, a trading journal is a must-have tool for all you as a trader. It is simply an extensive record of your entire trading thought process and investment strategy. It offers many advantages, including faster and better decision making, performance review and risk management. On top of that, it can help you realise your own strengths and weaknesses and analyse trade patterns that work in your favour. By reviewing your journal regularly, you can see how particular market conditions affect your portfolio and prepare better for any uncertain times. A comprehensive study of your trading scheme can create your overall trading experience more holistic and help you grow from past mistakes. Whether you are a novice or an experienced trader, start your own trading journal today to be your personal investment adviser.