Powerhouse EA is a trading system that comprises 4 EAs working together. In other words, the robot allows you to run the auto portion of The Comeback Kid, Vigorous, Ranger, and Gopher EA’s on a single platform. By working with Powerhouse, the vendor guarantees that you will earn an average of 5% monthly profit on default settings. You can also conduct an average of 15 trades daily.

Product offering

The system has several features, which are highlighted below:

- It’s only compatible with the MT5 terminal.

- The system incorporates flexible settings to accommodate low, medium, or high risk trading.

- It includes smart filters to ensure its strategies work flawlessly together to optimize profits and minimize drawdown.

- This trading tool utilizes protective stop-losses that the user can adjust to fit their needs.

- It is easy to set up and comes with a detailed manual.

- The devs provide free updates and support.

- The minimum trading deposit ranges from $5k, $10k, to $20k, depending on the settings.

- The recommended leverage is 200:1, 100:1, or 50:1 for high, medium, and low risk settings, respectively.

The price of this robot is $497, which is quite high when you compare it to the cost of other EAs in the market. A 30-day money-back guarantee is available to allow those dissatisfied with the system’s performance to ask to be reimbursed.

Powerhouse was created by Ryan Brown, the owner of the Responsible Forex Trading website. He has an active Youtube channel, where he engages thousands of followers regularly. Ryan says he has 18 years of trading experience, but only began trading full time more than 3 years ago. His other creations include Vigorous, The Comeback Kid EA, Ranger, and Gopher.

Trading strategy

The vendor says that Powerhouse combines the strategies of four of its other systems—Ranger, CBK, Gopher, and Vigorous EAs. These strategies trade on 13 different pairs simultaneously. However, you are not forced to use all of the strategies at the same time. You are free to select the ones that appeal to you the most.

Trading results

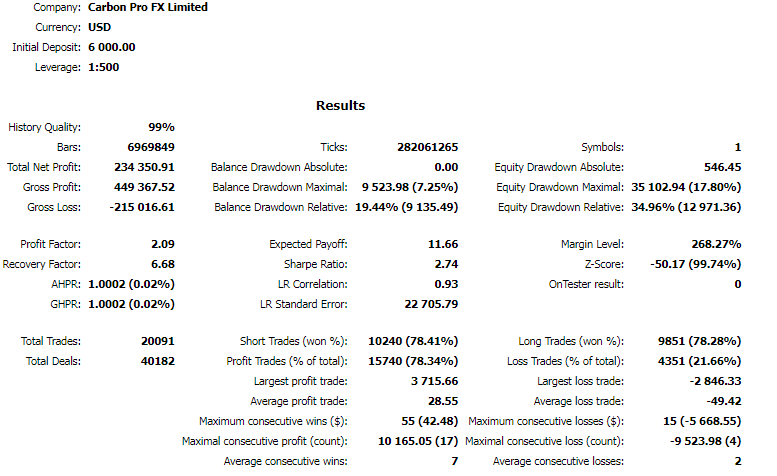

Based on the above backtest report, the EA conducted a total of 20091 trades using a $6000 deposit. The profitability rate achieved was 78.34%, and this translated to a total net profit of $234350.91. A maximum drawdown of 17.8% was generated, a sign that the system applied low trading risks. An average profit trade of $28.55 against an average loss trade of -$49.42 was reported. The profit factor was 2.09.

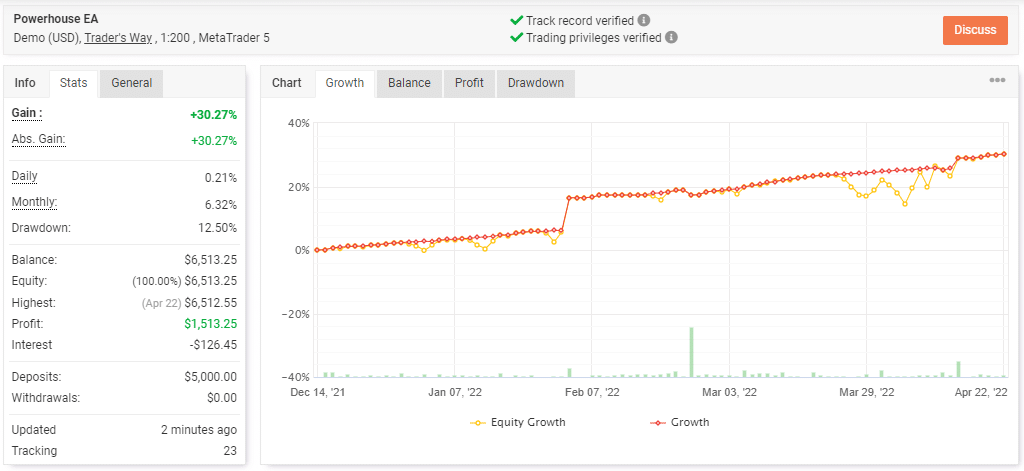

The vendor has provided us with demo results. As you can see above, the account was launched in December 2021, and 4+ months later, the EA has generated a profit of $1513.25 for it. Subsequently, the deposit amount has risen from $5000 to $6513.25. Now, we have a total gain of 30.27%. The daily and monthly profit rates currently stand at 0.21% and 6.32%, respectively. The drawdown of 12.50% tells us that the system works with low risks to the balance.

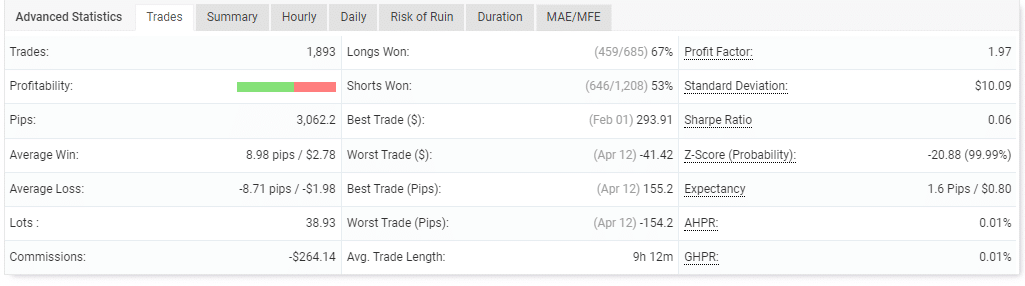

To date, the system has placed 1893 orders, and the win rates for long and short positions are 67% and 53%, respectively. These outcomes are average and uninspiring. A total of -$264.14 has been paid out in commissions.

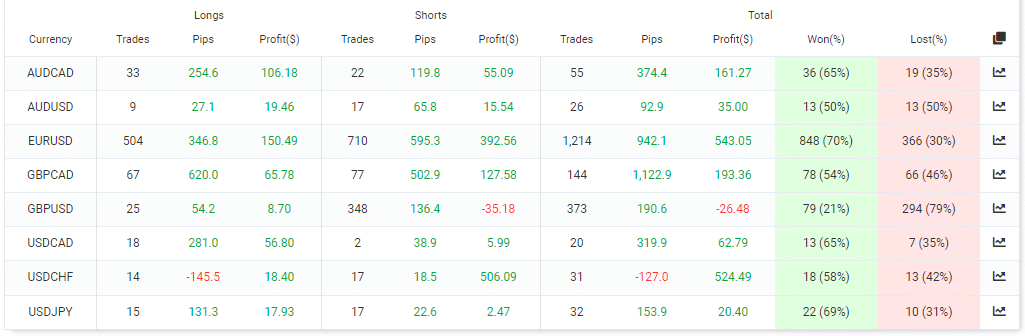

The system indeed works with multiple currency pairs, but the EURUSD pair appears to be the preferred instrument of trading, with 1214 orders placed so far. All the pairs have brought in substantial profits, apart from the GBPUSD symbol, which has reported a loss of -$26.48.

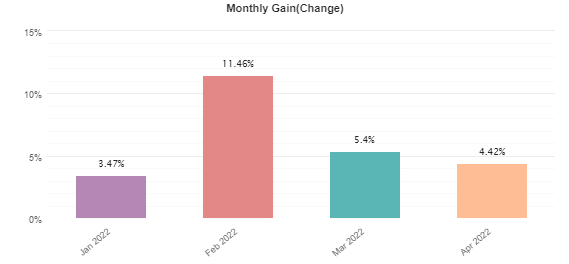

The EA has made profits throughout this year, with February generating the highest profitability rate at 11.46%.

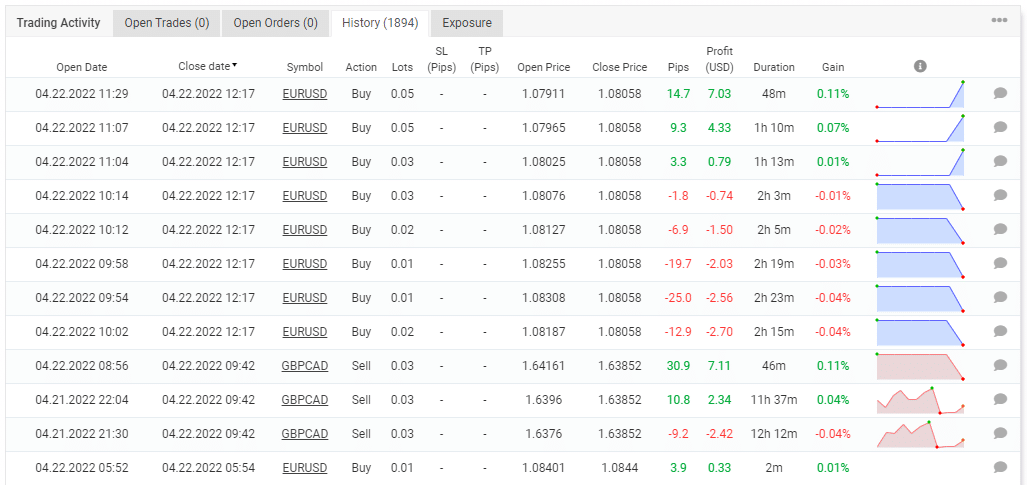

The grid and martingale strategies are applied in trading. The account suffered a series of losses recently.

Customer reviews

This EA has not been reviewed by customers as of now. However, the vendor is praised on Trustpilot for producing solid and reliable trading tools. Customer support is also said to be awesome.