R Factor is a recently released expert advisor that claims to have ‘3 years of real positive results’ showing a positively performed trading strategy. This Forex trading tool possesses a dynamic portfolio-balancing algorithm that automatically manages traders’ portfolios providing them with the best possible trading results. Although it sounds great, we cannot trust these words blindly. Therefore, we will analyze all the information available on this system to see what we can expect from this trading tool.

Product Offering

R Factor EA has not its official website. A digital copy of this MT4 tool is available to buy on the MQL5 market only. The product was released on January 9, 2021. It was updated to V1,6 on March 5, 2021. From the MQL5 page, we know that the developer of this expert advisor is Raphael Minato who has an extremely high 3778 rating among the MQL5 community. He is from Brazil. Raphael has been trading in Forex for 7 years. About R Factor EA he says that he had been working on it for 4 years before it was finally released. On his profile, we have found a link to a YouTube video that shows impressive backtesting results for the R Factor robot. Raphael promises the robot can generate $3,5M with deposited $1K per 1 year. He tries to convince us that it is the ‘best-undiscovered trading robot’ that can generate consistent profits, adding more weight to the winning pairs, ‘while lessening the impact of losses by losing pairs in the period’.

The vendor recommends using an ECN account because it is characterized by low spreads and fair commission. The minimum deposit to trade with R Factor EA is small – only $30 for 1 pair and $100 for the entire portfolio. Interested in the trading system traders can buy the EA on MQL5 for $499. Frankly saying, the price is too high for a recently launched EA. There is also a free Demo account for traders desiring to test the EA before purchase.

The vendor does not provide a money-back guarantee, which, we must say, is a red flag for this EA.

Trading Strategy

R Factor EA uses a proprietary dynamic portfolio-balancing algorithm based on the Kelly Criterion Management, which provides more weight to the winning currency pairs, while simultaneously lessening the extent to which the losing pairs affect the trader’s portfolio.

With the help of this trading approach, traders can grow their present and future profits. The vendor also points out that this tends to increase the volatility of the portfolio, but because of the promise of high gain, traders have much higher chances to get high returns by ‘taking an optimum amount of risk’. The other features of the trading approach are dynamic SL and TP. The system does not use Martingale or Averaging for trading and trades one single currency pair for a particular trading occasion. The robot has an intelligent Exit system. The minimal deposit to trade 1 currency pair is $30 and $100 for trading 12 currency pairs (complete portfolio).

Trading Results

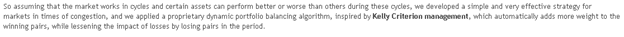

Raphael provides backtest reports in the video published on the MQL5 page where the product is sold. The backtest was performed on GBPCHF currency on the M15 timeframe. The modeling quality was 99, 90%. It was deposited at $1000 and from this, the system generated a profit of $3.5M. A profit factor was high – 6, 87. R Factor EA traded with low drawdown – 6, 78%. For 1 year of trading, it has traded 589 deals and won 529 out of them. Its win rate for Long positions was 88, 58% when for Short positions it was 91, 74%.

Unfortunately, the dev did not attach verified live trading account results to the mql5 page. Therefore, we’ve conducted additional research and, as a result, found a live trading account on myfxbook.com.

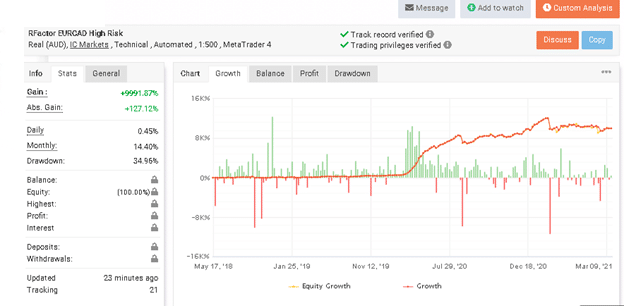

This is a Real AUD trading account that has been run by IC Markets brokerage on the MT4 platform. The robot trades with 1:500 leverage with high trading risk. Its track record, as well as trading privileges, are verified. The account is tracked by 21 traders.

It was added to myfxbook on May 17, 2018. Its deposit, balance, and profit data are unavailable and hidden from the other traders. The one thing we know is that for 3 years of trading, the absolute gain has grown to over 9991,87%. An average daily gain is 0, 45% when an average monthly gain is 14, 40%. The robot trades with a high drawdown – 34, 96%.

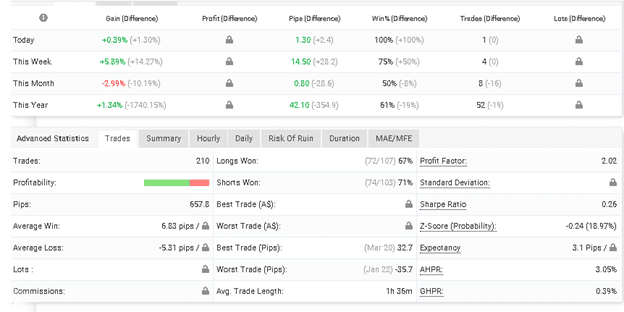

The robot trades 1 currency pair – EURCAD. It has traded 210 trades and 657, 8 pips. Its average win rate is 70% – there were 146 out of 210 deals won. An average win is 6.83 pips when an average loss is -5.44 pips. The win rate for Long and Short trading positions is mostly the same – 67% and 71%. The profit factor is 2. 02. The robot uses scalping for placing orders, as the average trade length is 1 hour and 36 minutes.

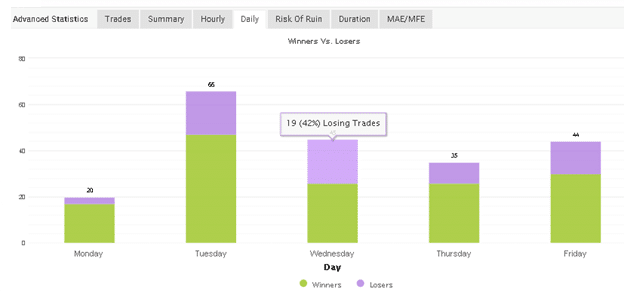

It trades daily, from Monday to Friday. The most trades were placed on Tuesday (66 deals), Wednesday (45 deals), and Friday (44 deals).

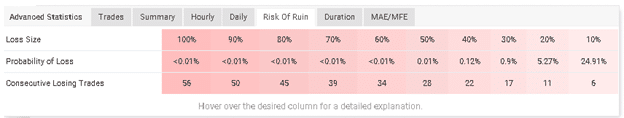

It trades with high risk to the account balance. In the case of 6 consecutive losses, the account will lose 10% of the balance (probability of loss is 34, 91%).

The trading activity of the robot is hidden.

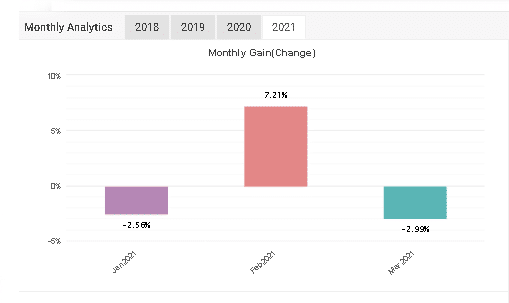

As you can see the trading results of 2021 look unstable.

Customer Reviews

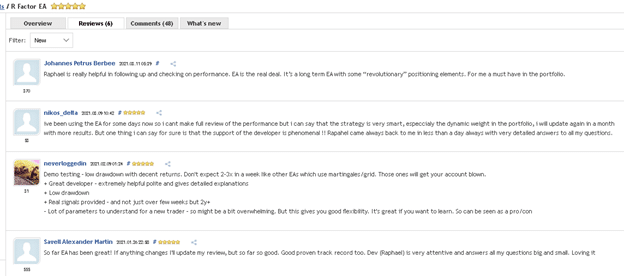

There are 6 customer reviews on MQL5. One person admits that it is what he needs. The other one claims that the dev provides great customer support. One trader says that the robot trades with ‘low drawdowns’ – this statement is wrong.

To get more details about the trading performance of the EA, support, vendor transparency, etc. we have to see more customer reviews on the other third-party websites like Trustpilot, FPA, or Quora. Unfortunately, we did not find any customer review for R Factor EA on these websites.