We all know the famous proverb. “Trend is our friend”. As a new trader if you step foot into the trading world chances are high that you will give strict directions not to take any trade against the major trend. The counter-trend trading method is more like a suicide mission.

If the trend trading method was so successful no would have mastered reversal the trading method. The trend in the financial instrument would have never changed. But this has not been the case in the trading business. People are always losing money and getting frustrated. The trend trading technique is failing to save traders.

So, what might be the key reason for seeing such exponential growth in the number of losers? The answer lies within this article. People don’t know how to make a trade the counter-trend. Thus they have no idea when the trend of a certain asset is going to change. Taking trades against the trend is not necessary but having a strong knowledge to trade against the major trend is important to your success.

To be good at the trend trading method, you have to be good at reversal trading too. Since it requires complicated calculations, we are going to learn the use of EAs to trade the major reversal.

Evaluation of the news

To find the key reversal point in any asset, you have to evaluate the news properly. Sadly, rookies don’t have strong news analytical skills. They take the trade with technical knowledge and fail to deal with the reversal. However, with the help of news EAs, you can easily find the potential chance of experiencing the reversal. The EAs can extract all the major news from the reputed economic sites and compare it with the price level. Though self-explanatory news EAs are a bit complex and expensive, it can reduce the hassle to a great extent. As it can blend technical and fundamental data, the summary of the EA is pretty precise.

Relying on major news and manually assessing the EA data is also very profitable. It reduces the complexities of coding super-advanced EAs. Having a simple EA to evaluate news gives you more control over the trade. You will be able to spot the key reversal point. For instance, let’s say, the FED raises their interest rate based on 25 points. Your EA will immediately determine the gravity of this news and create an alert.

Adjustment of your trading method

Adjusting the trading method with dynamic news is a tough task. People are always advised to trade when the market is stable. In other words, the traders are advised not to trade during the news. Ignoring the news is a very big mistake and you can lose a big profit-taking opportunity. The majority of the retail traders think they can earn a huge amount of money by ignoring the news. But the EAs can help you to adjust your trading method to trade the reversal. You don’t have to learn rocket science to become good at reversal trading.

The adjustment is done in a few steps. If you are dealing with a trend trading method, the EAs will tell you to ignore some of the trades at the critical trend line zone. When the probability of making a profit from a certain trade setup is less than 65%, the EA considers it a potential price reversal zone. Based on different EAs the functions depend.

Those who are getting confused with the term “reversal” have nothing to worry about. It’s nothing but taking trades against the trend or riding a newly formed trend. As EAs can analyze thousands of key metrics without any significant latency, it can be a great tool to find the reversal point for trading.

The famous Fibonacci series

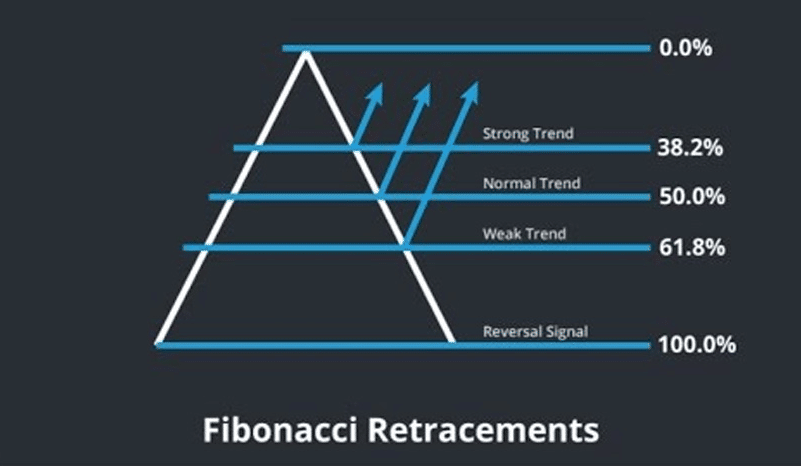

The reversal point is calculated based on many important factors and the Fibonacci series is one of the most prominent ones. The smart EAs can find the retracement level in any major asset. Break of the 61.8% retracement level can help you to trade against the trend. While taking the trades with the reversal trading technique, make sure the EAs are drawing the reversal level based on key swings. Analyzing the minute chart and trying to make some serious profit is never going to work.

Those who are dealing with the Fibonacci series EAs must know the advanced functionalities. By using the advanced functionalities and premium features, a trader can easily equip their EAs for a reversal trading system? Many EAs find the endpoint of the reversal by using the Fibonacci series and chart pattern system. The things that you can do with an advanced EA is limitless. But make sure you test in the demo account.