Optimizing your trading strategy is a very tricky task. Without having specialized skills and deep knowledge about the market dynamics, it is impossible to bring your system to a perfect shape. As the price action method is more sophisticated, fixing the problems in the trading system becomes nearly impossible for many intermediate and advanced traders.

The advanced traders start thinking the price action trading method is not all profitable after losing a few trades. They blame the market and the system. If the system was faulty, no one would have made a profit by taking the trades with the price action.

The fact you are still unable to identify faults in the price action method reflects your lack of knowledge. But the good news is, you can use a smart trading bot to optimize your price action trading method. The bots can do a series of analyses and point out the weakness and strengths of your trading model. Let’s explore the details.

Analyzing statistical data

The candlestick pattern tells us where the price is most likely to head. The reliability of different patterns greatly varies depending on the position and anatomy of the candles. The trading bots can easily identify the reliable price action candlestick in the chart by using the statistical data. Programming a bot to identify the bullish and bearish candle is not that tough. The bot will evaluate the opening and closing price and determine the reliability percentage of each pattern. Things are really simple when you deploy a price action bot that depends on statistical data.

Optimization of the risk to reward ratio

Optimization of the risk to reward ratio is critical to your success. No matter which trading method you use, you must optimize the risk to reward ratio, or else you can’t survive in the trading business. People often use a tight stop loss while taking trades with the price action pattern. But using too tight a stop increases the risk. To be on the safe side, using a wide stop loss is also getting popular. But such unrealistic stops don’t work in the optimization of the trading system.

The price action bots can easily identify the pattern in the higher time frame. It can also set the take profit and stop loss maintaining a minimum 1:3 risk to reward ratio. Being a rookie trader, you can even set a higher risk to reward ratio so that you can recover the trades with a great level of ease. Think about the conservative method to keep your fund safe.

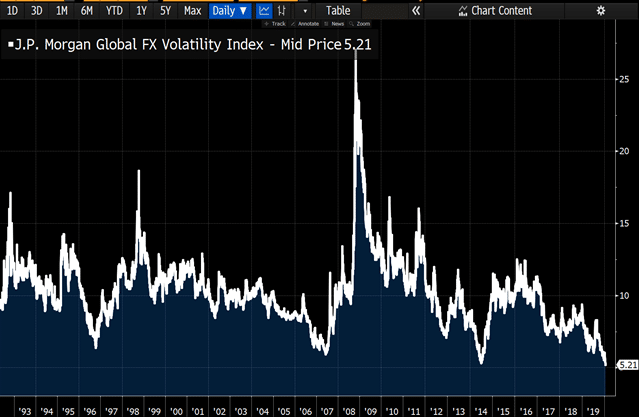

Analyzing the volatility index

The professional price action traders depend a lot on the market volatility. They never take the unnecessary risk even though they are good at managing the losses. On the contrary, amateurs are biased to trade the volatile state of the market. But trying to trade in the volatile market without knowing about the volatility index is a great mistake. Determination of the volatility index is a bit trickier as you have to focus on the rate of change in price and evaluate it to the historic price movement.

As a novice trader, you can assign a trading bot to determine the volatility of the market. The bot can create a small report based on market volatility and you can know whether the tight stops trades are perfect for such market conditions. Avoid taking the trades in insane volatility even though you have the best quality-price action trading signals.

Automate your stop loss

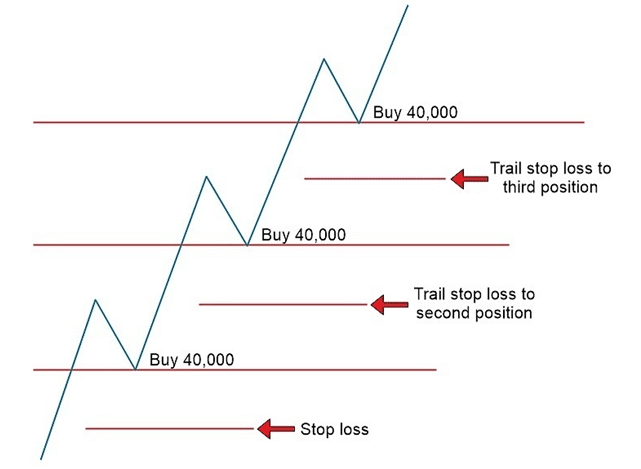

The best thing about the price action trading method is the trend riding opportunity. Sadly, people don’t know how to ride the trend as it requires precise knowledge of support and resistance. Trailing the stops based on some arbitrary number is not going to work. In order to keep the fund the safe, you have logically placed the stop. The smart traders often give this responsibility to the trading bots. The bots atomically adjust the stop loss based on the price movement.

Scaling the trades

Scaling trades to secure big profit might be the most complicated task for the price action traders. It’s very normal you won’t have any clear idea whether to trail the stops or close the trade with profit. At times, it is required to close the trades early prior to hitting the stop loss. But all these processes require deep knowledge of money management.

The elite traders often assign such tasks to the trading bots as they can do such work with a high level of precision. In fact, it can close the trades partially and move the stops to the breakeven point. The price action trading method might offer you a powerful way to make money but you must use an advanced bot to take advantage of this system.