Robinhood FX EA works on all types of brokers and uses a virtual stop loss to hide the exit points. The robot requires a minimum balance of $100 for proper functioning. The developer tries to convince customers through the 30-day money-back guarantee. We will go through each feature of the EA and analyze the pros and cons to see if it is profitable for us in the long run.

Product offering

The seller shares all the information about the algorithm under a single page which is a poor approach. He puts forward multiple features of the EA and refuses to share its drawbacks to attract customers. We had to go deep into the FXBlue records to find out the trading strategy and multiple other points.

Vendor transparency

There is no information regarding the producer of the system. The developers are not keen on sharing their whereabouts and trading experience with us. There are two ways to contact them, i.e., the phone number available on the website and through the email id. This is a poor practice which is a common way of scammers in the industry.

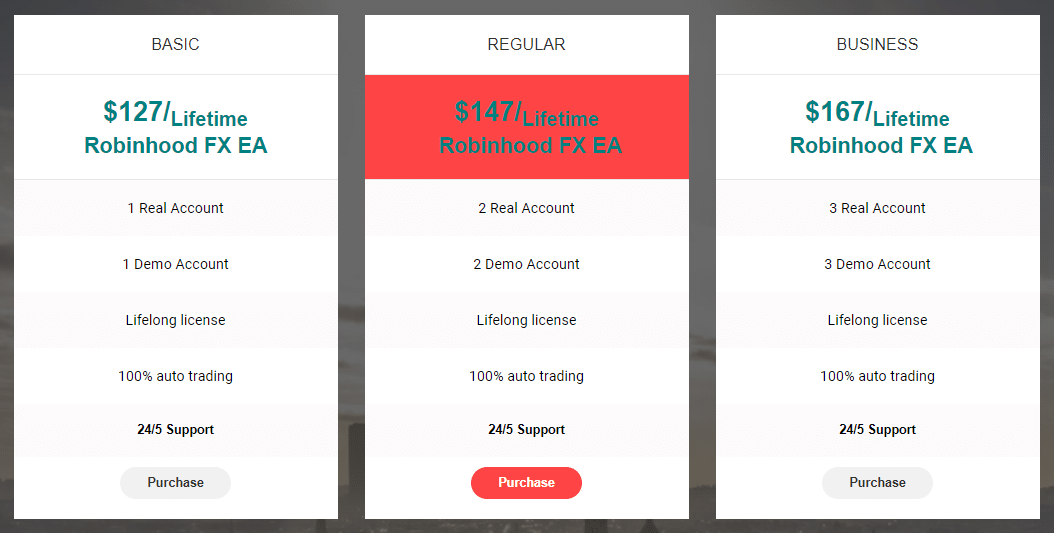

Price

The robot is only available through multiple packages. Traders can get it for $127 that gives a license for one real and demo account. Two and three licenses are available for $147 and $167, respectively.

Trading strategy

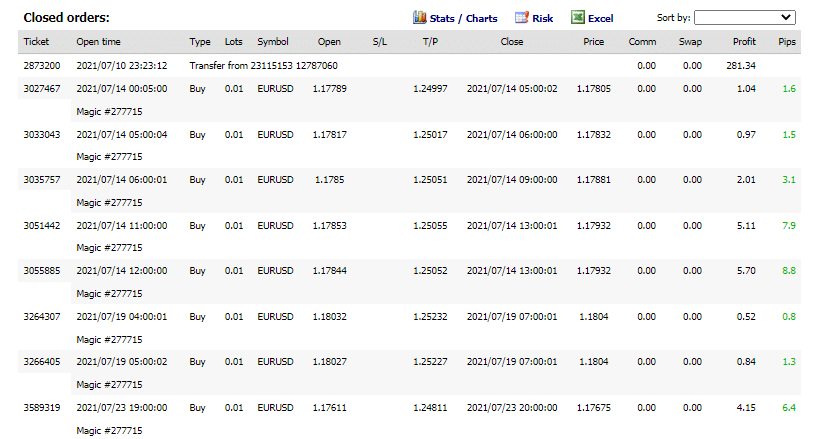

The expert advisor works on the H1 time frame on EURUSD. It can trade through news releases and requires a minimum balance of $200. The robot does not use martingale, according to the developer. From the history of FXBlue, we can see that the EA uses a grid strategy for trading. There is no information about this on the website which means that the providers are trying to hide risky game plans.

Trading results

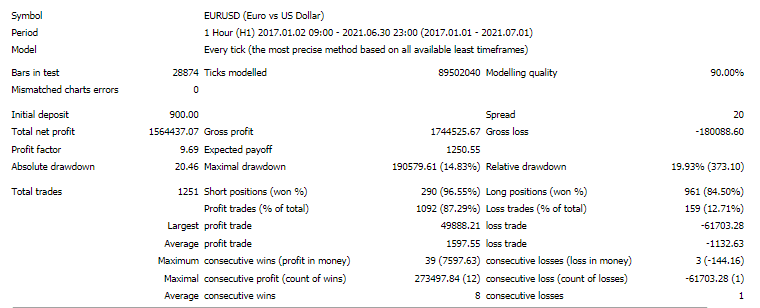

Backtesting results are available for EURUSD. The relative drawdown was around 19.93%. The winning rate was 87.29%, with a profit factor of about 9.69. The test was done on the 1-hour chart with a starting balance of $900. The robot tanked an average profit of $1564437.07 during this period. There were 1251 trades in total. The best trade was $49888.21, while the worst one was -$61703.28.

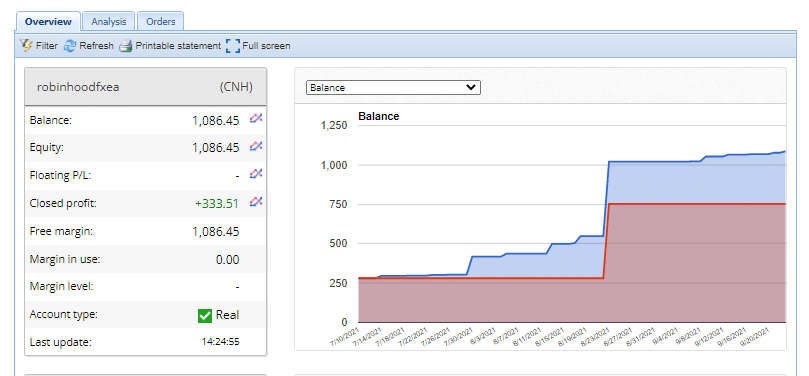

Verified trading records are available on FXBlue that show performance from July 07, 2021, till the current date. The system made an average monthly gain of 34.3%, with an unknown value of drawdown. The winning rate stood at 81.3%, with a profit factor of 2.37. The best trade was $44.69, while the worst was -$33.28. There were a total of 64 trades. The developer made $281in deposits and $0 in withdrawals. The average trade duration hangs at 21.7 hours which points out towards the day trading methodology.

The system has been online for a short duration; therefore, we can not confirm the output. The FXBlue also fails to show us the drawdown value.

Customer reviews

There is only a single review available on Forex Peace Army. A customer states that he has used the EA for about two weeks. Such duration of testing is not enough to provide feedback and make a statement on the performance.