MetaTrader 4 is arguably the biggest and most commonly used trading software. Unknown to most people, the platform is designed to do much more than just support the buying and selling of currencies. While it comes with a portal that allows people to access all the latest news, it also has a portal designed to enhance the trading process.

Strategy development is an integral part of any trader or investor looking to have an edge in the market. MetaTrader 4 comes in handy in helping to create trading strategies and backtesting it to get a feel of how it is likely to do in live trading.

Contrary to perception, coming up with a strategy on MT4 does not require high-level programming skills. Instead, it requires one to know what they would like to achieve in the market by defining a few parameters crucial to integrating into the trading platform for execution.

Time frame

The first step to developing a strategy on the MT4 platform is defining the kind of trader one wants to be. It is important to settle on whether to be a day or swing trader as it greatly determines the strategy formulation process. The strategy will have to be developed on minute charts for day traders, while swing traders focus on hourly or daily charts.

Identify trend

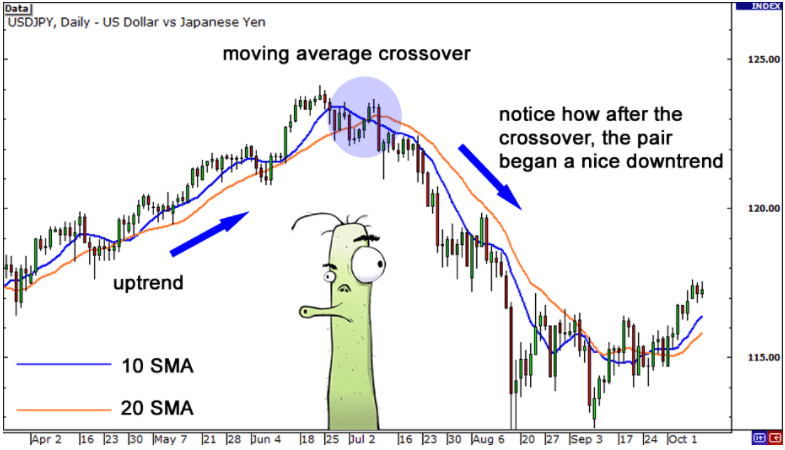

With any strategy, trend identification is crucial. Therefore, it is important to settle on the indicators that will help provide insight into the market’s direction. Moving Averages (MA) are some of the best in this case.

In most cases, people use two MA’s to ascertain whether a market is moving up or down and enter trades whenever crossovers happen.

Trend confirmation

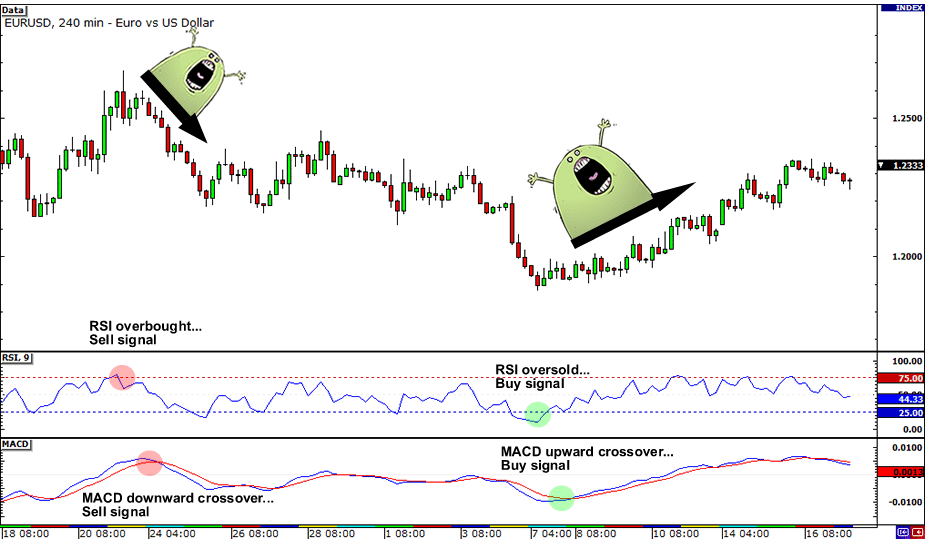

In addition to identifying the prevailing trend, it is important to select indicators that help confirm the prevailing trend.

The idea is to be sure a new trend has emerged, and it is likely to continue for some time before a reversal occurs. MACD, Stochastic, and Relative Strength Index are some of the best indicators that help affirm a given trend.

Define risk

While formulating a strategy on MT4, it is important to define the amount of money a given strategy is allowed to lose at any given time in a position. While the focus is usually on entry, it is crucial to protect capital by ensuring one single move does not wipe the entire trading account.

While defining risk, it is essential to control risk by using stop-loss orders.

Define entry and exit

The final step to coming up and testing a strategy on MT4 entails defining the ideal levels to enter or trigger a position and when to exit. While some people open positions as soon as indicators match up, others like to wait until a candlestick closes.

The exit levels, on the other hand, depend on the amount of profit one is looking to take on any given trade or the number of losses they are comfortable absorbing.

With all the parameters defined, the next step is opening up the MT4 platform and trying to integrate the same in the trading platform.

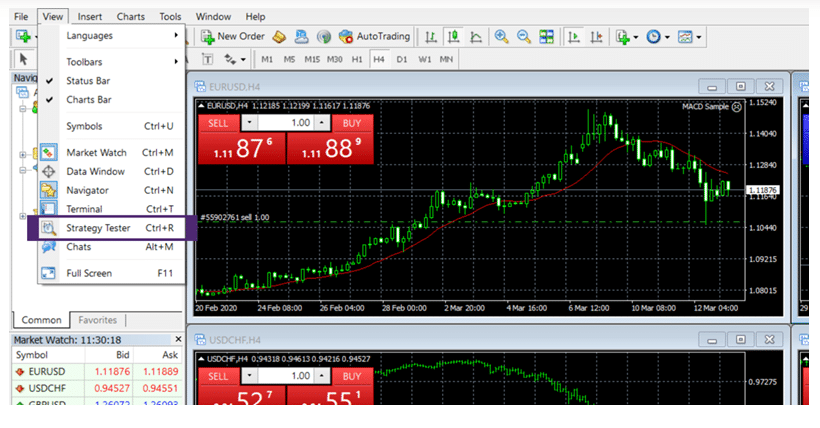

MT4 tester window

In the Tester, the window is where all the parameters of a given trading strategy are integrated to be executed automatically. The window can be accessed by clicking View and then Strategy Tester on MT4. A small window will open at the base of the MT4 window.

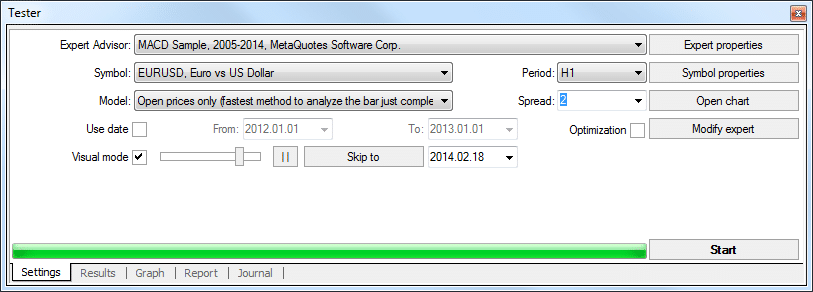

Several tabs will emerge once the Tester window is opened. Settings are the first tab that opens. It is here where one is able to select the market to trade. For instance, one can select the various currencies pairs, commodities, or even indexes as long as the broker one is trading with has added support.

In addition to selecting the instrument to trade, one can select the period the strategy is to be based on. It is also under this tab that one can select the indicators to identify and confirm trends.

You can always choose from six points 2, 5, 10, 30, 50, or 100 pips in the Spreads menu to set a spread. It is advisable to settle on the current option for a good outcome.

The Results tab under the Tester window allows one to see the results of the various trades triggered by the strategy under consideration. It is also under this window that one gets to see how the balance changes. The results will include data on total net payout, the loss, and the number of positions opened, among others.

On the other hand, the Graph showcases results of trade operations in a graph, while the Report tab details the testing report.

Strategy backtesting

Backtesting a formulated strategy on MT4 makes it easy to examine its effectiveness before engaging in live trading. Doing the same on historical data and virtual money allows one to get a feel of what to expect risk-free.

If the results from the backtesting process show significant payouts on historical data, then one can be confident of the strategy achieving almost the same results while actual money is on the line. Similarly, if the results are negative, it should be a warning sign that changes need to be carried out to polish the strategy.

Final thoughts

Formulating a trading strategy from scratch is a sure way of gaining an edge while trading any market. MT4 offers an ideal platform for programming a strategy and backtesting it using historical data to get a feel on how it is likely to perform in real life.

While coming up with a strategy, having an idea of various parameters, indicators, and other trading tools is essential if one is to develop a strategy capable of generating the desired returns.