What Is Passive Income?

Any type of income that requires an almost negligible effort to generate and maintain can be classified as passive income. In other words, passive income can refer to earnings derived from a property in the form of rent, any enterprise, or any investment in which the person getting the returns is not directly involved in its generation.

There is a myriad of ways you can earn passive income, including renting your property, apartment, and high yield savings accounts just to name a few. Any passive income stream you choose does involve some degree of work when starting out. You have to invest a lot of effort upfront and can expect no returns for a considerable period of time at first.

Why do people call passive Income, a Hoax?

Many people have a misconception about the nature of passive income, particularly because it contains the word “passive”. They usually think that money will be generated automatically while they sit back and enjoy. However, the truth is that no such streams of income exist.

Thus, individuals who build their business model on a false premise such as these are bound to fail. This leads many of them to conclude that passive income is a hoax. They do not consider the upfront work or any subsequent decisions one has to take to maintain a passive income stream.

People Who Have Amassed Huge Wealth With Passive Income – Examples

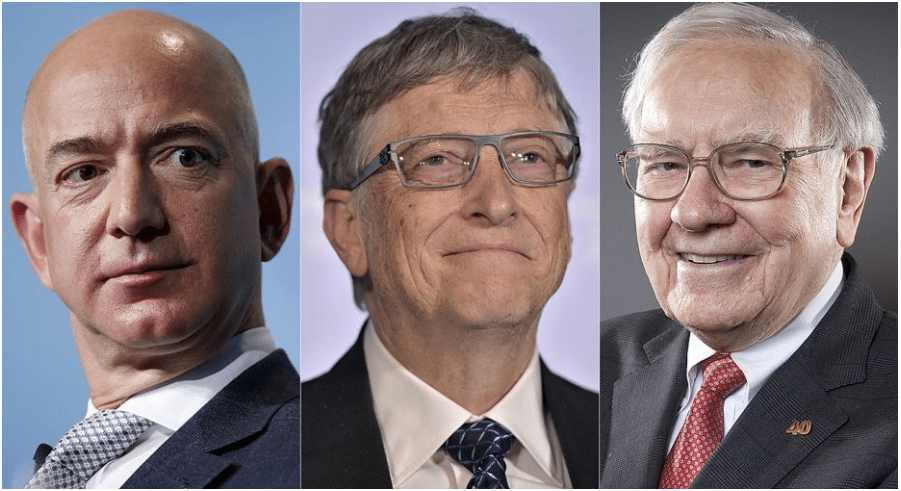

Passive income has generated wealth for a lot of the world’s top richest individuals.

- Warren Buffet: We all know Warren Buffet as one of the most famous American investors, tycoon, and billionaire, currently ranked as the world’s 7th richest person. However, a lot of people overlook the contributions of passive income in generating wealth. In fact, two of his biggest income sources are from types of passive income, namely from dividend income and capital gains. Capital gains from investing in companies in the stock market were one of the primary sources of income which contributed towards his status of becoming a millionaire.

- Bill Gates: American business magnate Bill Gates is perhaps best known as being the co-founder of Microsoft and being one of the major participants in the computer revolution of the 1970s and 80s. After the creation of Windows, a concept in which Bill Gates invested his time, effort, and expertise in building, he enjoys passive income streams generated, in the form of Royalty Income and Profit Income. These two income streams contributed significantly on his way to becoming one of the wealthiest individuals alive.

- Jeff Bezos: Jeff Bezos is arguably one of the richest people on the planet, with an estimated $121 billion. Apart from his annual salary, most of his income is generated from passive income sources. One source estimates that Bezos earns $149,000 every minute as from his passive income sources.

Passive Income Scams and How to Avoid Them

Because of the success attained by many individuals who have become millionaires through passive income, there has been an emergence of elaborate frauds, masquerading as legitimate income opportunities for people. Many of these frauds start with declaring that they provide one of the easiest passive income methods available. More often than not, however, these companies rob unsuspecting users of whatever little money they have after promising them huge returns.

To avoid such scams, you have to be sure of what passive income exactly means. Additionally, you have to keep in mind certain misconceptions regarding passive income to differentiate between legitimate offers and elaborate frauds.

There’s Nothing Easier Than Passive Income

Passive income is definitely easier than being a full-time employee or a self-employed individual. However, considering passive income as the easiest is just mischaracterization. Depending on the nature of one’s passive income, it requires a lot of time, effort, and persistence to successfully and consistently generate passive income in the future. Scams that claim to provide “easy passive income” are simply lying.

Anyone Can Make Passive Income

You may encounter Ponzi schemes that are advertised by a particularly successful person. The person may use encouraging lines such as “if I can do this, you can too” or some other type of sales lingo. This is known as the identity relationship hook. You should stay away from any schemes that are advertised in this fashion.

The Only Work Is Upfront

This is another misconception that people seem to fall for. While it is true that passive income involves the major work upfront, it’s a kind of oversimplification. In fact, generating passive income requires a degree of constant attention. This is applicable for almost all streams of passive income, including stock options, stocks, electronic ventures, books, websites, blogs, and similar activities. Even though you don’t actively have to manage your income sources, they do require follow-ups at regular intervals.

Legitimate Passive Income Sources

There are many people who have started earning passive income by following some specific strategies. However, each of these has a degree of risk associated with them.

Rental Income

You can earn passive income by investing in rental properties. You have to consider three things first before you want to earn this way. This includes how much you return you expect, the total cost and expenses related to the property, as well as the financial risks of the asset.

Information Product

Passive income can be generated if you can establish an information product, which can be a video or audio course, webinar, or an e-book. There are various sites that can help you sell your product, and the passive streams generated from these are extremely profitable, especially if you have a niche market.

High Yield Certificate of Deposit

There are many online banks that allow you to access and invest in high-yield CDs. Investing this way is one of the safest returns one can guarantee, as long as the bank is regulated by the FDIC. The biggest risk with this income stream is the cost of rising inflation.

Conclusion

There is no “one size fits all” method for generating passive income as it depends on where you are financially as well as your goals. Income from passive sources can provide a valuable lifeline in times of economic turmoil, such as in times of recession, or during the ongoing Coronavirus Pandemic.

Would like to learn more about passive income