The strong relationship between the EUR and USD is based on the strengths of the Eurozone and the US economies, which has effectively made EURUSD the most liquid forex pair in the world.

In addition to its high market volume, the pair has tight spreads and low volatility, making it popular among forex traders.

As discussed below, some popular strategies for trading this pair include trading market sentiment, breakout trading, fading breakouts, and trading volatility.

1. Trading Market Sentiment

Trading market sentiment is one of the universal strategies of trading EURUSD. Market sentiment is the generally agreed perspective of investors in the market. In the case of EURUSD, such sentiments are based on changes in the market fundamentals of the Eurozone and the United States.

For instance, the European Central Bank (ECB) recently retained its monetary policy, targeting an inflation rate of 2%. In the lead-up to the announcement, many traders expected the bank to remain dovish as Part of its strategy to achieve the inflation rate target. Such traders went short on EURUSD, making the euro continue its recent losing streak against the US dollar.

The market sentiment has also recently begun to turn relatively bearish against the US dollar after the US GDP missed analysts’ projection of 8.5% to grow by 6.5% in Q2 of 2021. This has weakened the USD’s momentum and slowed down its rally against the euro.

As an investor, you don’t have to come up with your way of knowing the forex market sentiment. There are various techniques or tools one could use to gauge investors’ attitudes and their likely response to changes in fundamental or technical aspects.

One of the easiest tools to use to know the feelings and attitudes of traders in the forex market is the use of social media. Social media being one of the timely news sources, can be used to get information on the general investor sentiment regarding the economic performance of the USA and European countries and its potential effects on EURUSD exchange rates, helping in decision making.

2. Using Volatility Tools

While the volatility of both the EUR and USD are relatively low, there are periods of uncertainty in the market that can make it worth trading volatility with the EURUSD pair. This can be done using the CBOE Volatility Index. It is basically a measure of fear or risk in the market.

The volatility tool indicator is used to gauge the fluctuation of prices over different times. The higher the volatility, the more substantial the risk is. Thereby, Traders can look for potential profit-making opportunities based on the risks.

US economic metrics tend to be released between 8:30 a.m. and 10 a.m. ET, generating extraordinary EUR trading volume, with high odds for strong trends in the EURUSD pair. Trading volumes at this time can spike sharply due to high volatility.

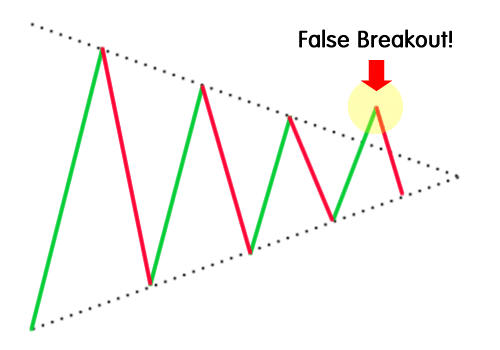

3. Fading Breakouts

Fading breakouts means trading in the opposite direction to the breakout. When market fundamentals undergo significant changes, the prices of assets usually tend to change quickly.

Fading takes advantage of the movement of prices beyond support and resistance levels.

A trader should bet against a price movement outside the normal range. In effect, fading breakouts mean interpreting a price movement beyond a support or resistance level as a false breakout.

The best time to trade is when the price goes out of the normal range, typically through the formation of a long candlestick wick.

For this strategy to be implemented when going long, the EURUSD pair must have a 14-period Average Directional Index (ADX) less than 35, or an ADX currently in a downtrend.

Secondly, wait for a price move of at least 15 pips below the low of the prior trading day, and then place an order to buy 15 pips above the high of yesterday’s range.

Finally, place a protective stop at a distance of 30 pips below the entry price. Profits are taken when the market moves upwards by at least 60 pips.

The best time to implement this kind of strategy is when there are no releases of crucial macroeconomics reports.

4. Breakout Trading

Breakout trading is another strategy for trading EURUSD in the forex market with very rewarding trades that can potentially lead to high profits.

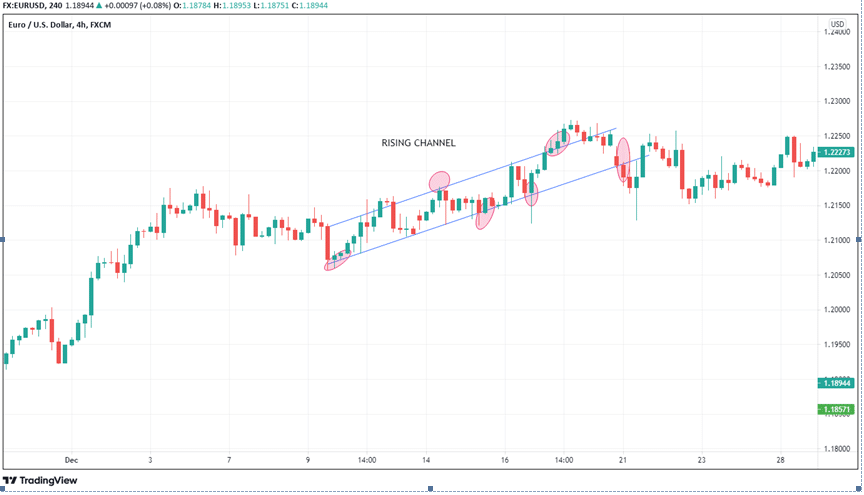

Due to the low volatility of EURUSD, it tends to establish relatively longer-lasting and steadier resistance and support levels. Breakout trading simply means monitoring the EURUSD prices movements and checking if there is any movement beyond the resistance and support levels.

When there is a price movement of the EURUSD over the resistance level, it’s the appropriate time to go long. Conversely, a price movement beyond support levels indicates a high chance of a downtrend.

Note that during a downtrend, support levels often become the new resistance levels, and during an uptrend, it is not uncommon for the previous resistance levels to become the new support levels. Therefore, you may want to keep an eye on these levels even after a breakout has been confirmed.

Breakout trading is also very flexible and can be used on all time frames. This makes it an effective strategy using various convenient timelines according to a trader’s preference.

Breakout opportunities can be spotted by drawing trend channels, as shown below. These are useful because they show the direction of the trend, providing the approximate boundaries of the price fluctuations.

Conclusion

The strategies discussed above are just some of the few available, but to be able to make good trades, one should adopt a blend of several strategies where appropriate.