The importance of economic indicators for trading

So when the number of market participants and the total trading volume is higher? When unexpected news come out. As most financial events are scheduled in the economic calendar and are already reviewed by crowds of analysts, the only way that the market can be surprised is when data becomes unexpected.

Here are the main examples when volatility occurs on the FX market:

- Unexpected increase in unemployment, trade and economic metrics or financial policy in specific countries;

- Political or social events, elections and changes in government;

- New sanctions, changes in import/export taxes and currency wars.

Here is a simple example. The main state income source falls on international commodity trade, such as iron ore. If one of the major ore consumers, like China implements a new tax on this country’s product it will immediately affect its currency.

Trust to a specific country is also a big factor for the Forex market. When foreign investors believe in a specific economical environment they buy government bonds, make direct investments and transactions into a country which causes more demand for a national currency. The reason of a trust or mistrust may be in government statements, election results or misleading financial policy.

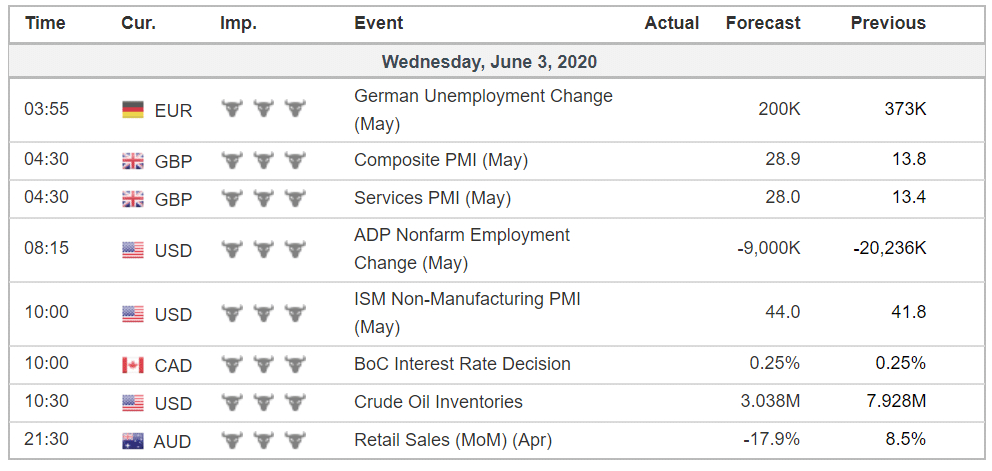

When trading forex it’s important to look at a currency performance as a representation of a state economy as a whole. This will help you to avoid additional risks and adjust your trading robots to specific events and economic releases. To watch them closely – use the economic calendar. Usually it displays 3 columns with previous data, analysts forecast and the actual number that was reported.

Each indicator can significantly affect the market in a given time period. In this case, it is imperative to use the right automated trading strategy to avoid losing money. Many newcomers to the Forex market ignore this and lose money during the trading session with important economic news. Without the correct accounting and tuning of trading robots, it is impossible to predict market movement and make money in changing conditions.

Economic indicators: estimate and surprise

Analyst estimates are the result of the analyst’s work in various companies and national banks. Before we know the clear numbers, specific institutions usually create forecasts , as well as general expectations of the economic environment in the country will look in the future. The specialists analyze various aspects of the market, economic activity in different sectors to create their estimate.

A surprise is a phenomenon that occurs when actual economical data reported does not meet analysts expectations. The larger the difference – the greater is potential for the trader. more significantly higher or lower than the predicted level. While many traders avoid trading during the publication of important financial news. Another category of traders, on the contrary, bases a strategy on a volatile market and immediately enters the transaction after the publication of indicators. First group believes that it will be difficult to predict the price increase. The second group is trying to take advantage of their knowledge. No matter which one are you in – here we described the most crucial economic indicators, so traders can maximize their profits either way:

Top 7 economic indicators that affect the FX market

GDP Growth Rate

Gross domestic product (GDP) is the most used and key indicator of a country’s economic performance. In other words, it is everything that is produced during a given period in a given country. The most reliable way for measuring GDP is usually the production method, especially for quarterly data. On the contrary, the pension method can be described as the least reliable.

If the GDP Growth Rate rises or falls within the expected range, then the market reacts relatively neutrally, taking spikes in volatility. Overstated numbers indicate a more successful economy of a particular country. This may affect the growth of the national currency against others in pairs. If this indicator is lower than expected, then the market may see a decrease in quotations of a certain currency.

For many traders, gross domestic product indicators are a critical and most acceptable option of all economic news. In fact, this is the main measure of the success of the economy and how the currency pair will behave in the future. Weak growth rate are always the reason for the strengthening of other currency pairs against the background of an outsider. It is also worth noting that all economic news related to the gross domestic product are critical and are noted in the economic calendar on many trading platforms.

Central bank or (FED) interest rate

The FED interest rate displays monetary policy of the main world’s central bank. This indicator can significantly affect various currency pairs during the daily trading session. Cut in the FED interest rate may show the support to a world economy using cheaper loans and money for business. The rise in interest rate may signal that the FED is trying to fight inflation by cutting support to the economy. Traders should pay attention to this indicator because it affects all the currency pairs with the dollar.

Interest rate is a key monetary policy indicator of national banks of many countries as well as European Central Bank (ECB). Therefore, it sets the tone for the entire world economy.

Inflation rate

This indicator is responsible for statistical information about the increase in the general level of prices for goods and services. As a rule, minimal inflation contributes to growth in the market, a predicted indicator during trading, and the ability to draw up the right strategy. At the same time, a negative indicator very quickly changes the disposition of forces in the market. Traders should consider the inflation rate from leading countries like the United States, Canada, Japan, and a number of European countries.

It should be considered when trading due to transparent display of how investors money will devalue in a given currency. The less the indicator – the bigger is trust to currency by investors and traders. But when inflation is about to get negative it can cause problems for the economy. That is because deflation of currency doesn’t motivate people to invest and to buy, because products and services are just getting cheaper. So the population postpones all the major purchases, and decreases economic activity.

Unemployment Rate

Unemployment Rate is one of the key indicators that are important for the financial market. It reflects the total number of unemployed as a percentage of the total number of the working population. The higher the indicator is, the worse the situation on the market will be. It will affect the economy, population’s purchasing power and forex trading. The fact is that a large number of unemployed means a large burden on the state system and subsidies. It directly affects the currency quotes from a certain currency of the country. It can be a good way to make money in the short term due to the high price hikes in one direction or another.

Like any other indicator, the Unemployment Rate forms a clear price trend that will be observed over a certain period. It is worth noting that far from all countries can use this indicator to influence the market. For example, Japan or Canada can significantly change the balance of power in the financial market.

Jobless Claims

The fewer unemployed people require benefits; the more reliable the currency pair will be. Jobless Claims is a very important indicator in the foreign exchange market as it determines the trend movement in the future. Increased indicators indicate an unhealthy moment in the economy and may affect neighboring countries and currency pairs.

As with many other indicators, attention should be paid to the importance of the news. If this indicator affects the economy of the largest countries of the Big Seven, then this is a call to reformat your trading strategy. Otherwise, you can feel the high volatility and the need to change the trading plan quickly. All this is important to consider before official statistics are released.

Trade Balance

Trade Balance is the difference between goods that have been exported or imported into the country. It is worth noting that a positive indicator is a greater number of exported goods. This indicator is a mirror image of the current state of the country’s international trade. Most powerful states are designed to export products and services.

The higher this indicator is, the more reliable the country’s economy and a favorable microclimate. As in the case with many other indicators, it is worth looking at the indicator belonging to a particular country. The United States or the Big Seven is a key monitoring field for each trader. A significant difference from the predicted indicators can predict high market volatility. It will require significant efforts from traders to diversify risks.

Credit rating

A credit rating is an indicator of a country’s creditworthiness and ability to repay all debt obligations. It’s formed by big credit rating agencies and major investment banks. Formed based on various factors and their assessment such as: past and current financial history, financial obligations, inflation, economical activity and transparency of the government regulations.

Improvement of credit rating indicates that creditworthiness and the economy are experiencing a recovery. A negative change indicates that the country’s chances to fulfill its obligations are lowering. That can significantly reduce foreign exchange quotes. All traders need to study this aspect carefully and adjust your daily trading before and after the publication of statistics.

The Conclusion

Economic data indicators, in particular, have a very strong influence on the trading; you need to set up your trading robots so that they respond quickly to increased volatility due to certain financial indicators. It is necessary to take into account economic forecasts and indicators of the largest countries that are leaders of the global economy. They set the trend in the market and allow you to earn money funds and high volatility.

A trading strategy is not possible without the right statistics. Your trading robot should be configured in such a way as to quickly respond to economic surprises and suspend trading in the event of an ambiguous situation. It is, in this case, that you can reduce risks and trade with greater reliability. It is also necessary to control the trade balance to prevent the unexpected consequences of volatility from limiting your deposit from a significant drawdown.