When Bitcoin launched in 2009, many investors who bought into it took it with a grain of salt. Of course, at the time, it wasn’t worth as much as it is now, so it was easier to hop on the bandwagon and hope for the best.

As soon as it started gaining value and its profit potential was realized, several similar projects cropped up. Some of these were just copies of this first market mover, while others aimed at solving its shortcomings. Other projects, like Ethereum, were designed to fill a whole other niche in finance and ended up with their own unique utility. Today, there are thousands of cryptocurrencies, but not all of them are worth throwing your financial might behind.

About shitcoins

Among the thousands of cryptocurrencies in the market today, some projects were created as rug pull scams. Some were created as a joke, while others were straight-up copies of established projects. Such coins are characterized by little to no innovation and no specific real-life utility. Generally, all such coins are referred to as shitcoins.

Granted, some of these coins actually manage to accumulate some value. This is usually a product of their extensive marketing campaigns, which buy them enough hype to attract unsuspecting investors. However, after a while, almost all of them suffer a huge price decline, leaving investors holding on to worthless digital assets.

Why avoid them?

As of March 2022, there are more than 18,000 cryptocurrencies in existence. Truth be told, not all of these projects will get to live up to the likes of Bitcoin, BNB, or ETH. Some of these coins have plenty of practical use cases and viable project goals, and they’ll likely soar to their full potential.

Unfortunately, there are also numerous projects within this number whose developers have malicious intentions for bringing them to market. Typically, these developers gather considerable hype around their projects with the hope of attracting investors who are driven by FOMO; as soon as the coin’s value spikes substantially, they liquidate their positions, which causes the coin’s price to crash. For this reason, lest you want to lose all your capital, you should always do your due diligence before investing in any project. Additionally, never invest more than you can afford to lose.

How to identify a shitcoin

First, a crypto developer who intends to pull a scam will seldom identify themselves. They prefer to stay anonymous or hide behind pseudonyms. This is because if their identities were known, they would most likely end up in jail after orchestrating their rug pull scams. Therefore, the first sign that you’re dealing with a shitcoin is a mysterious developer team.

Further, a shitcoin may be marketed as having specific goals and missions, yet there is no clear framework on how the project will achieve those goals. This eats into such a project’s trustworthiness. What’s more, its whitepaper – the document that’s supposed to contain all the details of the project, maybe copied from another established project. Another trick these fraudulent developers use is filling their whitepaper with so much technical jargon that it’s hard to understand what their project entails.

Shitcoin developers may also not put much effort into their project’s website. Therefore, a generic website or one hosted on a free domain is a big red flag. Such projects also do not manage to gather many holders, which throws doubt on their decentralization. If a project does not have more than 300 holders, then the easier it is to crash once it rallies significantly. Another indicator is the project’s liquidity pool. If a coin’s pool does not hold at least $30,000, then you’re likely dealing with a shitcoin.

Top shitcoins in 2022

Magic Internet Money (MIM)

Magic Internet Money is essentially a stable coin that can be exchanged with others of its kind, such as Tether, USDT, and USDC. We classify it as a shitcoin owing to the anonymity of its founding team and its lack of support from most exchanges. Further, there are far more established stable coins that better serve their purpose.

SafeMoon

This is a token hosted on the Binance Smart Chain (BSC) network. It serves three functions: reflection, burn, and liquidity pool acquisition. Its rise in value can be attributed to celebrities such as rapper Lil Yachty who effectively marketed its slogan, “Safely to the Moon.” However, it suffers from low liquidity, which is the reason we classify it as a shitcoin.

Dogelon Mars

This is a coin that was designed as a clone of the popular king of meme coins, Dogecoin. Its developers hoped to ride the wave of Elon Musk’s influence, as evidenced by the nomenclature behind their project. What’s more, this coin is marketed as the first interplanetary currency, following the tech mogul’s dream to colonize Mars. How they plan to achieve this dream is not clear, which sends a huge red flag.

Baby Doge Coin

This is yet another clone of the original meme coin, Dogecoin. Thanks to Elon Musk’s influence, this coin enjoyed a 1,000% price spike just a fortnight after its launch. This was after the tech billionaire, and SpaceX CEO took to Twitter to promote this new coin. Its developer team claims to have achieved faster transaction speeds than Dogecoin.

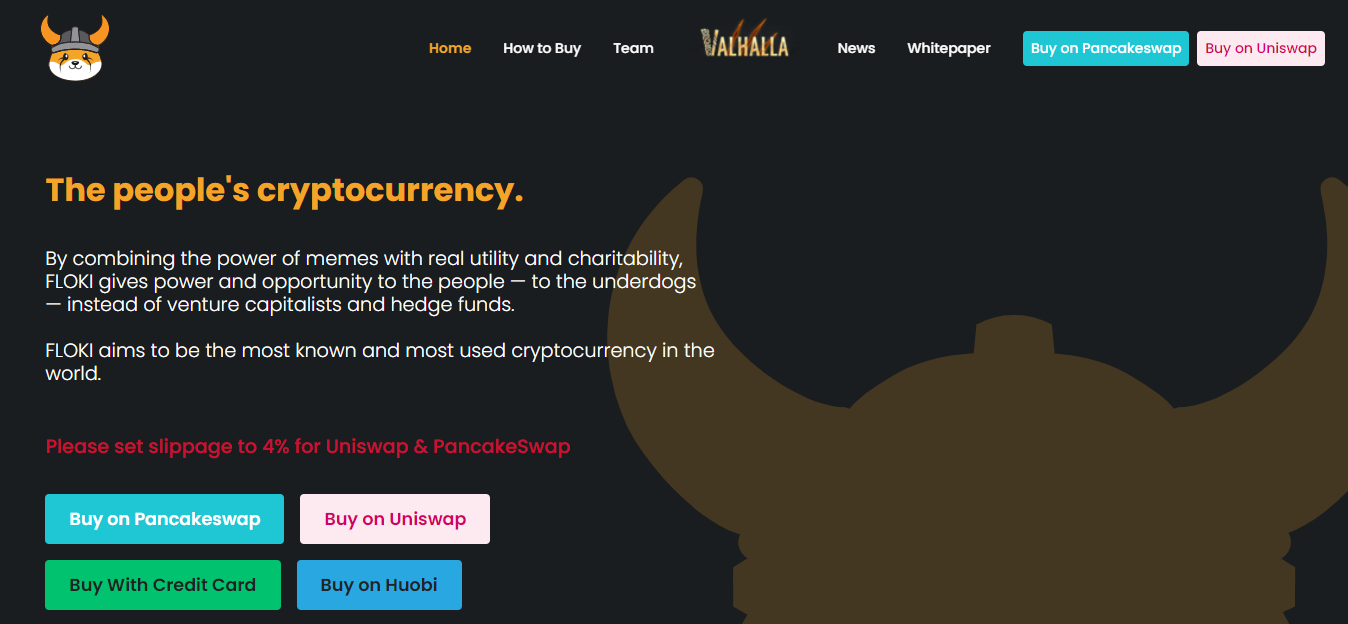

Floki Inu

This is a dog-inspired cryptocurrency, joining the ranks of Dogecoin, Baby Doge Coin, and Dogelon Mars. This coin enjoyed a significant price spike just a few months after its launch. This was after Elon Musk adopted a pet Shiba Inu, and named him Floki. However, as is common with most shitcoins, this rally was short-lived.

However, Floki stands out in its involvement in several humanitarian projects. It is partnered with Garden Movements to tackle food insecurity and also offers an education platform dubbed Floki Inuversity.

Conclusion

Shitcoins are cryptocurrencies with no real utility, and they serve no discernible purpose. Some of these coins gather enough hype to lure in unsuspecting investors, so much so that they undergo significant rallies. However, such rallies seldom last long, and investors who buy into them end up getting burnt. For that reason, due diligence should be paramount before investing in any crypto project.