Apart from the spot and futures trading that most FX traders participate in, there are a number of other derivative instruments that use FX pairs as the underlying. Many of these derivatives are meant to offer leverage to the traders, that is to say, that using these derivatives, traders can take large positions with relatively small capital. One of such derivatives is a forward contract.

FX forward contract

Forward contracts are over-the-counter (OTC) derivatives, which means that they are not freely traded on the exchange but rather are traded directly among FX participants. In this contract, two parties decided to trade an underlying currency on a pre-decided date.

For example, trader A might have the view that EURUSD will go up while trader B might have the view that the currency pair price will go down. Let us say EURUSD is currently trading at 1.20. Trader A enters the contract with a long position and trader B enters with a short position with a $100,000 notional amount and both decide to close the contract at the end of 1 month. At the initiation of this trade, there is no exchange of cash flows which gives significant leverage to both parties as they don’t have to put any capital.

Marking as a clearing mechanism

Now since the contract is not traded on the exchange, there is a risk of counterparty default. If EURUSD moves up to 1.25, giving profit to trader A, trader B might simply refuse to honour the contract at the end of the period or could be defaulting for some other reason. To avoid this situation, forward contracts have a mechanism called mark to market.

In this mechanism, both parties exchange cash flows typically at the end of each day based on that day’s price moves. For example, let us say that the price moves from 1.20 to 1.212 which is a 1% gain. So, on the $100,000 notional, this marks a gain of $1000 for trader A and a $1000 loss for trader B.

But rather than waiting for the contract to end after 1 month, both parties mark this profit & loss. So, at the end of the day, trader B will transfer $1000 to trader A. This process is repeated every day till the end of the contract. At the end of the contract, the parties then deliver the underlying currency, thus closing the contract.

Issues with emerging market currencies

Despite the leverage provided by forwards, most traders prefer trading on the exchange in the spot or futures market. This is because these markets are highly liquid and do not have any counterparty risk. So, unless one needs to do a customized trade specific to their needs or hedge a large FX exposure, futures are preferred over forwards.

However, there are several currencies especially in the emerging markets which have a degree of restrictions for foreign participants. These economies are still in their growth stage and any large capital flows could cause a disruption. To prevent outflows, these economies create several barriers for foreign participants.

This is especially true for several of the large Asian and Latin American economies. For example, the Chinese yuan (CNY) is not allowed to be traded outside mainland China. The Indian rupee (INR), South Korean won (KRW), Taiwan dollar (TWD) and Brazilian real (BRL) all have varying degrees of restrictions making their futures contract inaccessible or less liquid.

Non-deliverable forwards (NDF)

To gain exposure to these currencies without breaching the restrictions, market participants came up with ‘non-deliverable forwards’. As the name suggests, these are forward contracts but they do not involve the delivery of the underlying currency. So, even though the profit and loss are based on the appreciation or depreciation of the currency, the cash exchanged at the end of the trade is typically a developed market currency that has no restrictions, such as the US dollar or the Euro.

This provides a rather neat solution to trading the currencies without breaching any of the capital controls. As a result, the currencies which do not have liquid futures or spot markets often have a highly liquid NDF market.

Let us take an example of a USDCNY NDF. Let us say that the notional for this trade is $1 million and the currency USDCNY with an exchange rate of 6.5. Now, suppose the rate moves to 6.4 that is to say that the yuan strengthens against the USD. In this case, the NDF participants too will follow a mark to the market mechanism. But the exchange would be in US dollars and not in yuan.

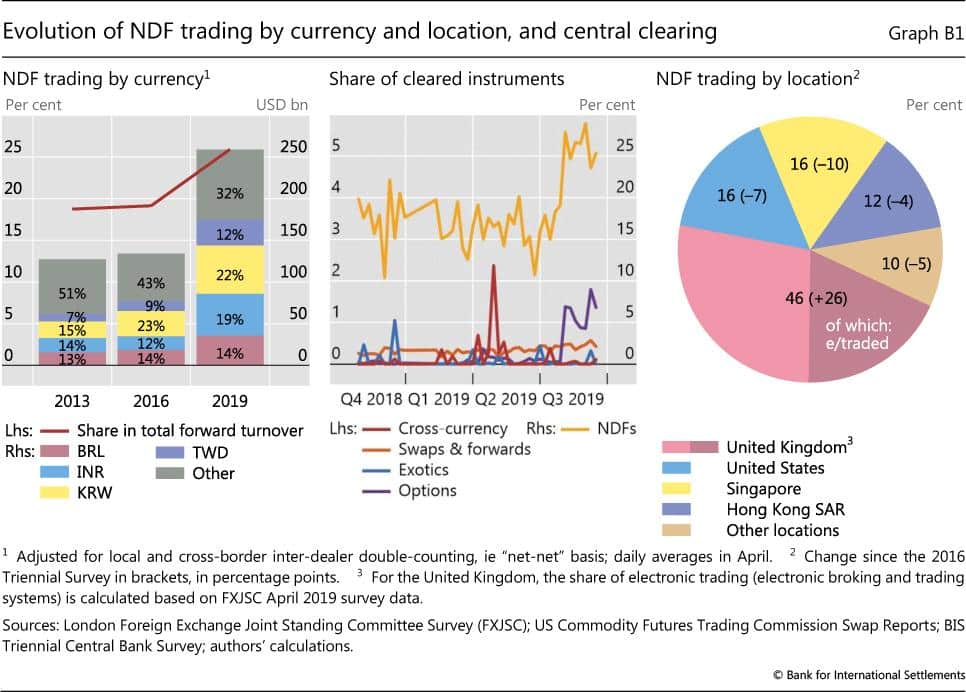

The largest NDF markets are the Chinese yuan, Indian rupee, South Korean won, New Taiwan dollar, Brazilian real and Russian ruble. The largest segment of NDF trading takes place in London, with active markets also in New York, Singapore and Hong Kong. Some countries, including South Korea, have limited but restricted onshore forward markets in addition to an active NDF market. The largest segment of NDF trading is done via the US dollar. There are also active markets using the euro, the Japanese yen and, to a lesser extent, the British pound and the Swiss franc.

NDF Trading

As can be seen below, KRW leads the NDF trading in terms of turnover, followed by INR. The total volume of NDF trading has also seen a significant jump over the past few years.

This might be because of the emerging economies being more integrated with global trade. The United Kingdom is by far the most preferred location for NDF trading and a significant portion of it is done in the form of electronic trading. The United States and Singapore also see a significant amount of NDF trading.