There are many moving parts to each nation’s monetary policy, but these are the biggest two: monetary and fiscal policies. A currency value is greatly influenced by both policies. Other considerations include the GDP economic growth rate and the overall economic position of each country. Below are the key indices used to measure the US dollar’s strength:

Bloomberg Dollar Spot Index (BDXY)

The BDXY measures the performance of the USD versus a composite of 10 of the world’s other currencies. The index analyzes a pool of currencies that is more representative by factoring in the liquidity of the forex market and the countries with which the US does business.

A wide range of currencies that are relevant from the standpoint of global commerce and liquidity are represented in its composition, which is revised on a yearly basis. Bloomberg asserts that their index better reflects the US dollar because it more accurately reflects the broader monetary mix and has a wider selection of currency weights than other dollar indices. The currencies in the basket, and their relative weights, are adjusted annually depending on their global trade and forex liquidity.

Every year, the index is recalibrated using fresh data from the Federal Reserve’s yearly review of the state of key trading partners’ relative currency value to the dollar.

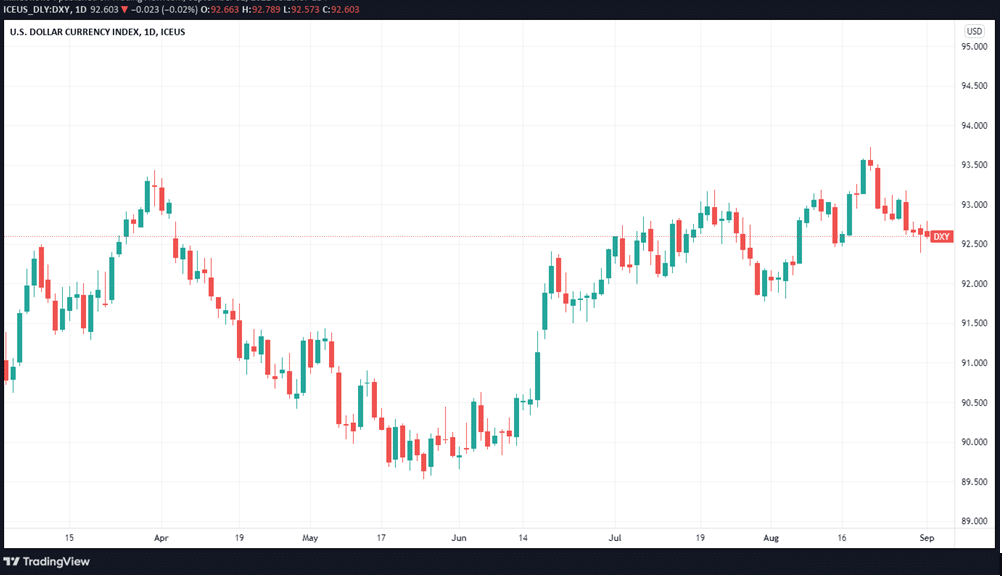

ICE US Dollar Index (DXY)

Intercontinental Exchange Group (ICE) is a group managing several markets and services across nine distinct asset classes and owns exchanges, clearinghouses, financial data providers, and software companies.

ICE keeps track of, calculates, and sets the standards for the US Dollar Index, which involves weighing and assigning values to the various components. This index is updated within fifteen seconds of a transaction and is relayed in real-time. All of the data vendors receive an instant analysis of this new calculation.

The value of the USD Index depends on how many and how much of the dollar and other currencies make up the basket. How much currency is in circulation, together with how much is being traded, will impact the value of each currency pair in the basket.

The market determines the values of DX futures contracts, which are based on interest rate differentials between the separate currencies and the United States dollar (or vice versa).

The spot currency market provides the liquidity for the USD futures contract, which is traded on the exchange. The DXY doesn’t have any scheduled rebalancing or revisions.

A common complaint about the DXY is that it does not provide an accurate image of the countries that trade with the United States on the basis of the strengths of their currencies. The index has weakened as a measure of strength based on commerce, but it has stayed helpful as a way to measure money flow.

The DXY was always seen as being dependent on dollar strength or weakness; but, with the emerging economies becoming increasingly influential in international trade and finance, the relationship between the DXY and the dollar became less obvious, which continued to make the DXY’s utility increasingly questionable.

Trading with the index

The DXY resembles any other currency pair because it too has its own chart. Its efficiency is built on the fact that it enables traders to view how the USD measures up versus six major currencies using just one chart. This helps them to protect themselves against any potential risks associated with the dollar. Also, USDX trading strategies that incorporate futures or options can be constructed.

When the DXY is generated, a distinct weighting percentage is given to each of these currencies. The euro is assigned the largest portion, at 57.6%, while the yen comes in second at 13.6%, and GBP winds up the top three with 11.9%. Other constituent currencies in the index include the SEK, CAD, and CHF.

The DXY is measured against a 100.000-point scale. Therefore, when the dollar’s value falls by 15%, it decreases to 85.000, and when it rises by 15%, it increases to 115.000.

Many FX traders use the index to track currency rates as it allows them to follow market moves and gauge their success without needing to watch each USD pair daily. When the dollar index appreciates, it is a strong signal that the US dollar has gained ground against a significant number of the currencies in the index pool.

Of course, a more heavily weighted currency like the EUR would have a greater impact on the index movement than a “lighter” currency like the Swiss franc. Based on the market’s view on the US dollar, one could infer that the market thinks the entire economy is in good shape. Additionally, depending on whether the index is rising or falling, you may want to modify your long and short bets.

Trade Weighted Dollar Index

In 1998, the Federal Reserve introduced the Trade-Weighted Dollar or Broad Index, which is a more flexible measure of the dollar’s usage in worldwide trade. For comparison, rather than only the big six currencies, this index includes the currencies of countries such as Israel, Taiwan, India, South Korea, and Saudi Arabia, among others.

The index is kept current with the help of IMF trade data, and this happens on a regular basis. Some of the countries that are included in the trade-weighted index are developing nations. In light of the trends in international trade, this index is arguably a better measure of the global value of the USD.

In summary

The knowledge of how the US dollar weighs against other global currencies is a key step to understanding not only global financial markets but also the US economy. Forex traders, in particular, can certainly find the indices indispensable. However, to which index to use is a matter of the factors you want to incorporate in your analysis.