Trading orders are commands from traders to place specific buy or sell executions on the market. They help investors take their respective biases.

Previously, there were only a few options available to traders, but nowadays, you can implement various orders to your advantage.

As simple as it may seem, there is not one category to remember when it comes to order types. Most strategies are built explicitly around specific orders such as buy stop, sell stop, sell limit, buy limit, GTC, etc. Our article will discuss how you can take various executions to your benefit as a trader.

How does an order get executed?

Orders are sent via a trading platform to a brokerage for purchasing or selling any instrument.

For buying, a trader will have to pay the ask prices, whereas sell trades involve bid prices.

Once the order reaches the exchange through a designated server, they forward it to liquidity providers or banks who carry it out accordingly.

CFDs are also a form of execution where the broker keeps the order within itself and pays the investor any difference.

Market order

A market order is by far one of the quickest ways to enter a trade. Using such execution, a trader doesn’t have to wait for the market to come to a designated price; instead, they choose to get in immediately based on the available bid or ask.

These types of orders are best suited for a trader who uses scalping or day trading techniques. There may be slippage if the liquidity is not enough.

An example of the market order is when a trader decides to buy 100 lots of EUR/USD, trading at a current bid of 1.20000 and ask of 1.25000.

Due to thin liquidity, the execution may not take place precisely at 1.25000. But it may get a slippage of a few pips on the positive and negative end. For better quotes, stop and limit orders are a priority as they provide the best price.

Stop/limit orders

A stop order is placed above or below the market price. If the instruments hit the order form below, a buy trade is executed and vice versa.

On the other hand, limit orders perform opposite to stop orders by opening sell trades if the price strikes the asset from the bottom and vice versa.

It is possible to get the following advantages using stop and limit orders:

- A stop order works as a stop-loss and limits an investor’s exposure to a particular position. For instance, after buying 1000 shares of Microsoft at $200, a trader can place a stop-loss for 1000 shares at $198 for limiting the drawdown to a maximum of $2000.

- There are no extra charges from the exchange to implement stop or limit orders.

- Limit orders can work for taking a profit. On your buy trades, where a trader sets up a stop order to limit losses, he can also set a sell limit order for the position to close when it reaches the desired point.

- Risk management, which is one of the key components of trading consistency, follows limits set by stop and limit orders. There are varying winning probabilities that come with setting stop-loss and take profit targets.

- It is possible to implement stop and limit orders in automated trading software. By doing so, your Expert Advisor (EA) will follow proper risk management.

- The ability to set and forget orders allows you to have peace of mind by staying away from the charts. You can check the trade once it hits your order.

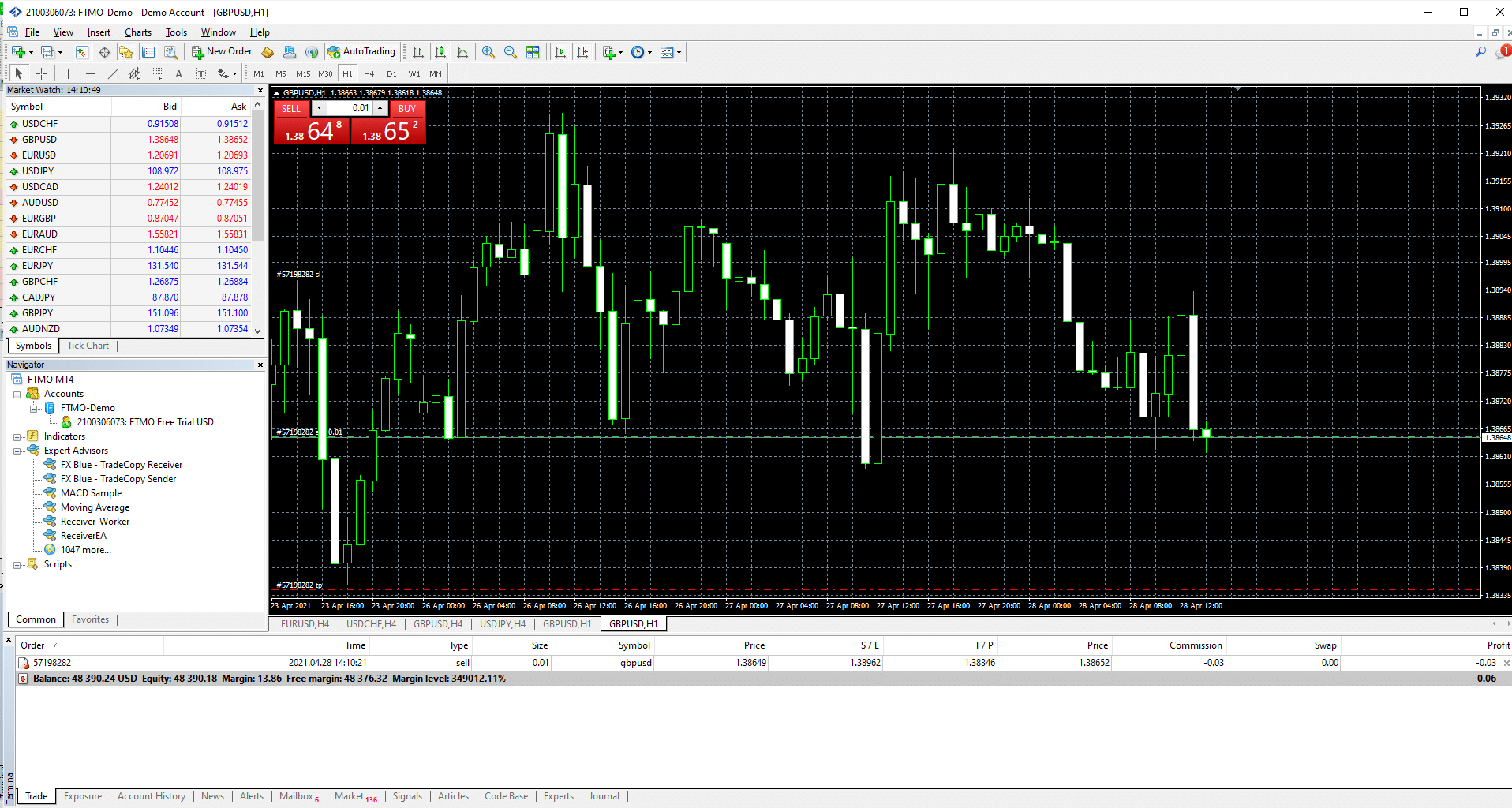

Image 1. A visual representation of stop loss and take profit orders are available on the MetaTrader chart. You can also see the values in the order window.

Day order

This type of order remains open until the end of the day. It will only get filled if the price hits the designated points; otherwise, it terminates itself as mentioned.

Day traders can get a huge advantage from these executions as they can monitor other instruments while their day order takes care of the rest. They also do not have to cancel the order manually.

Automated algorithms also support this type of execution as they cancel all the orders before the market hits a specific time frame.

Good ‘til canceled (GTC)

A GTC order remains open until a trader decides that they should cancel it themselves. Brokers usually allow investors to keep their good ‘til canceled orders for up to 90 days. They are a better alternative to the day orders which get terminated by the end of the day.

Immediate or cancel (IOC)

This order fills in your execution immediately at the available price and cancels the rest of the position size. Market participants will use this type of order when they have considerable lots to fill in at a specific price.

They are also best when the market conditions are highly volatile during news trading. Trading robots also have these types of orders built into their system.

All or none (AON)

As the name indicates, this type of order fills in your trade completely or rejects if there is a chance of several lots or shares to be left. Due to the contingent order, it may take a long time for such execution to get filled in.

Fill or kill (FOK)

A fill or kill order is best for scalpers as it enforces the broker to fill in your order immediately and completely. If the transaction is not carried out, the execution is canceled.