After English brokers established the CFD, it enabled many people to trade any commodity as long as they had an account that is created with any of the brokers. CFDs do not grant one ownership of the primary asset. Instead, they allow one to bet on the asset’s price fluctuation. This quality makes CFDs more efficient, less expensive, and easier to trade than traditional futures or options.

What is a contract for difference (CFD)?

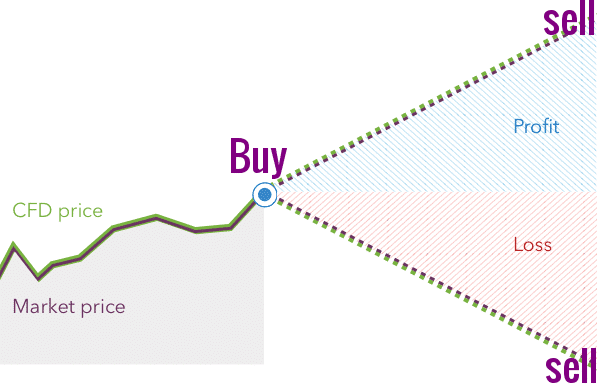

A CFD is a consensus between parties where they exchange the price difference in an asset from the start of a trade to the end of a trade. The seller pays the difference in the case where the closing price is higher than the opening price, and the buyer pays the difference where the closing price is lower than the opening price. In essence, CFDs are financial derivatives that permit traders to make a profit from price swings, whether they are positive or negative.

How do CFDs work?

CFD trading is taking a position, also known as entering into a trade, by selecting the number of CFDs you want to trade and then waiting for the market to progress in your favor, allowing you to benefit. A profit is made depending on your forecast.

If your projection and price action evaluations indicate that the price is more likely to rise, you click to purchase and go long. In this situation, the more the price rises, the greater your gains.

On the flip side, if your assessments fail or unforeseen news and events alter the price action movement of the trade, and it goes south, you will make a loss.

Example of CFDs in forex trading: Selling EUR/USD

EURUSD is trading at 1.17790/1.17520.

Assume that the EUR is set to weaken against the USD in the following days due to August’s German Manufacturing Purchasing Managers’ Index (PMI), which is bearish. Therefore, you decide to sell €20,000 because you feel the EURUSD exchange rate will fall.

The EURUSD has a 2% margin rate, and this means you just deposit 2% of the whole position value as position margin. As a result, in the example, the position margin will be $754.94 (2% x [€20,000 x 1.17655])

Outcome 1: Winning trade

If your guess is correct, the EURUSD drops to 1.17570/1.17290 in the following few days, and you decide to end the trade and buy at 1.7290 (the present buying price).

The price has moved 50 points (1.11790-1.17290) in your favor. Then ([€20,000×1.11790]–[€20,000×1.117290]) =$100 is your profit.

Outcome 2: Losing trade

Unfortunately, your guess was incorrect, and the EURUSD rate rises to 1.17980/1.18470 in the following few days. Because you sense the price will continue to rise, you decide to conclude the deal by buying at 1.18470, which is the current buying price.

The price has moved 90 points against you (1.18470-1.17570). Then your loss is ([€20,000 x 1.18470] – [€20,000 x 1.17570]) = – $180 is your loss.

One should keep in mind that you’ll have to pay a commission fee as well as any overnight finance fee.

Advantages of Contracts for Difference (CFDs)

A higher level of leverage

In CFD trading, leverage refers to the amount of loan capital that a CFD broker is able to advance you to help you make large trades. In the traditional security market, if one wants to trade with $50,000, one will have to deposit $50,000 into the seller’s account, however in CFDs, one can make a similar trade with just $50 in the account.

Diverse range of markets

One can trade over 17,000 commodities using contracts for difference. You also don’t need to use several platforms to trade various marketplaces. Everything is accessible using a single log-in, anywhere in the world.

There is no restriction and high flexibility

A CFD trade is more flexible than other types of trading since it involves an agreement to exchange the difference between your position’s initial and closing prices. This enables you to trade on markets that are trending both up and down. Additionally, there are no restrictions on how many day trades can be executed in a single account.

Has a direct connection to the market

You can acquire direct market access if you’re an experienced trader. This permits you to view and interact with the stock exchange and FX providers. Instead of trading at investment grade buy and sell prices, you can view all available bid and offer prices at any moment and trade at the market prices you like.

Disadvantages of contract for difference (CFD)

Increased risks

CFD’s offer a higher risk in the sense that the funded portion must always be accounted for, in addition to the higher losses leverage can bring. If the market declines a few points, the leverage portion of the deal must still be made up, as well as the financial charges, which remain constant, and any capital damage experienced during the trade.

Industrial regulation is weak

There isn’t a lot of regulation on the CFD market. Rather than the government’s status or liquidity, a CFD broker’s legitimacy is judged by their reputation, longevity, and financial condition. There are some excellent CFD brokers out there, but it’s vital to do your homework.

CFDs trading vs. share trading

Stock trading differs from trading contracts for difference in that when you trade a CFD, you’re speculating on a market price instead of owning the asset itself.

CFD’s are also leveraged, which means you need only to put up a fraction of the whole trade value (the margin) to get full exposure. Profits will be multiplied as a result, but losses will also be amplified. When trading stocks, however, you have to pay the whole cost of your position upfront to avoid losing more money than you put in.

Conclusion

A contract for difference (CFD) is a deal between a CFD broker and an investor to trade the difference in the value of a financial asset between the contract’s closing and opening days. It is often used by forex traders due to its numerous advantages. These advantages include having a higher level of leverage, offering a diverse range of markets, being very flexible, and having a direct connection to the market. However, CFDs have limitations, such as magnified risks and feeble industrial regulation.