Who doesn’t love cashback? Whether it is from your credit card issuer or a supermarket, the concept of receiving some form of rebate offers most people an incentive to remain loyal to the company in question.

Fortunately, the brokerage industry understands this premise, resulting in providing cashback or rebate programs of their own for forex traders. These are administered by brokers or third-party providers.

The aim is to save you money for every executed position over time, accumulating to hundreds of dollars or more. For the most part, these rebate programs are beneficial for traders.

Yet, like most things, there are some things worth considering, which this article will explore further.

How does a rebate program work in forex?

A rebate is a small monetary amount clients receive for every order they execute regardless of whether the position ends up profitable or not. In some cases, it may be a small portion of the spread.

Regardless, this money is withdrawable as real cash after a few days or monthly, depending on the broker or provider. Ultimately, the extent of your rebates relies primarily on your trading volume and the markets you trade, as the amount earned will vary according to the traded pairs.

The idea is as you trade, in the long run, the rebates should accumulate to substantial amounts in the tens, hundreds, or thousands of dollars, depending on your account size. You effectively lower your transaction costs by saving on spreads and commissions over time.

Moreover, some traders may consider rebates as additional profits, particularly if they execute frequently.

Rebates are provided by brokers and external rebate services, the latter of which are simply IBs (introducing brokers) or affiliates of the former. Importantly, the trading conditions should not change when a trader has signed up for a cashback scheme.

Should you receive your rebates directly from your broker or a third-party service?

Generally, it’s better not to go directly to the source but rather pick from any of the popular services on the market like PaybackFX, Cashback forex, PipsbackFX, etc.; and there’s a good reason why.

Brokers typically better incentivize IBs and affiliates as part of their client acquisition strategy. These groups or individuals receive higher rebates directly from the brokerages and pass most of this revenue to the clients signed up through them while they pocket the difference.

In other words, if you sign up directly to a broker’s cashback program, whether as a new or existing client, the company would have invested less effort in the procurement of you visiting their website. Therefore, the rebate rates are lower.

However, if you’re signed up for a rebate service, the rebates are higher as the acquisition process appears more difficult from the broker’s perspective.

The signup process for rebate programs

Fortunately, the signup process is simple with a third-party facility. Yet, it’s worth noting that in most cases, you’d need to open a brand-new account with your existing or different broker.

This is because the service (effectively an IB) wouldn’t receive rebates from the broker in question unless the account allocated to their program is a new one.

Of course, there are some inconveniences with this approach from a client perspective since you’d abandon your trading history from the old account. Nonetheless, the process is simple.

You create a straightforward login account with an email address and password through the rebate provider. Secondly, the client needs to create a new trading account through a referral link offered by the service after the signup stage.

Once the account has been created on the broker’s side, the IB should eventually confirm that the account has been linked. This ultimately means any positions from that point onwards will receive a rebate based on the predetermined schedule.

The alternative of signing up through a broker instead is a lot simpler. However, as previously mentioned, you are likely to receive less in cashback.

How much money can you make with a forex rebate program?

This question is open-ended and, as expected, cannot have a universally accepted answer. Your earnings depend on three things; the extent of the offered rebate, how frequently you trade, and the trade volume.

The rates are generally higher on less-traded markets like exotic pairs and silver. Each of the mentioned factors will be wildly different for every trader based on their circumstances.

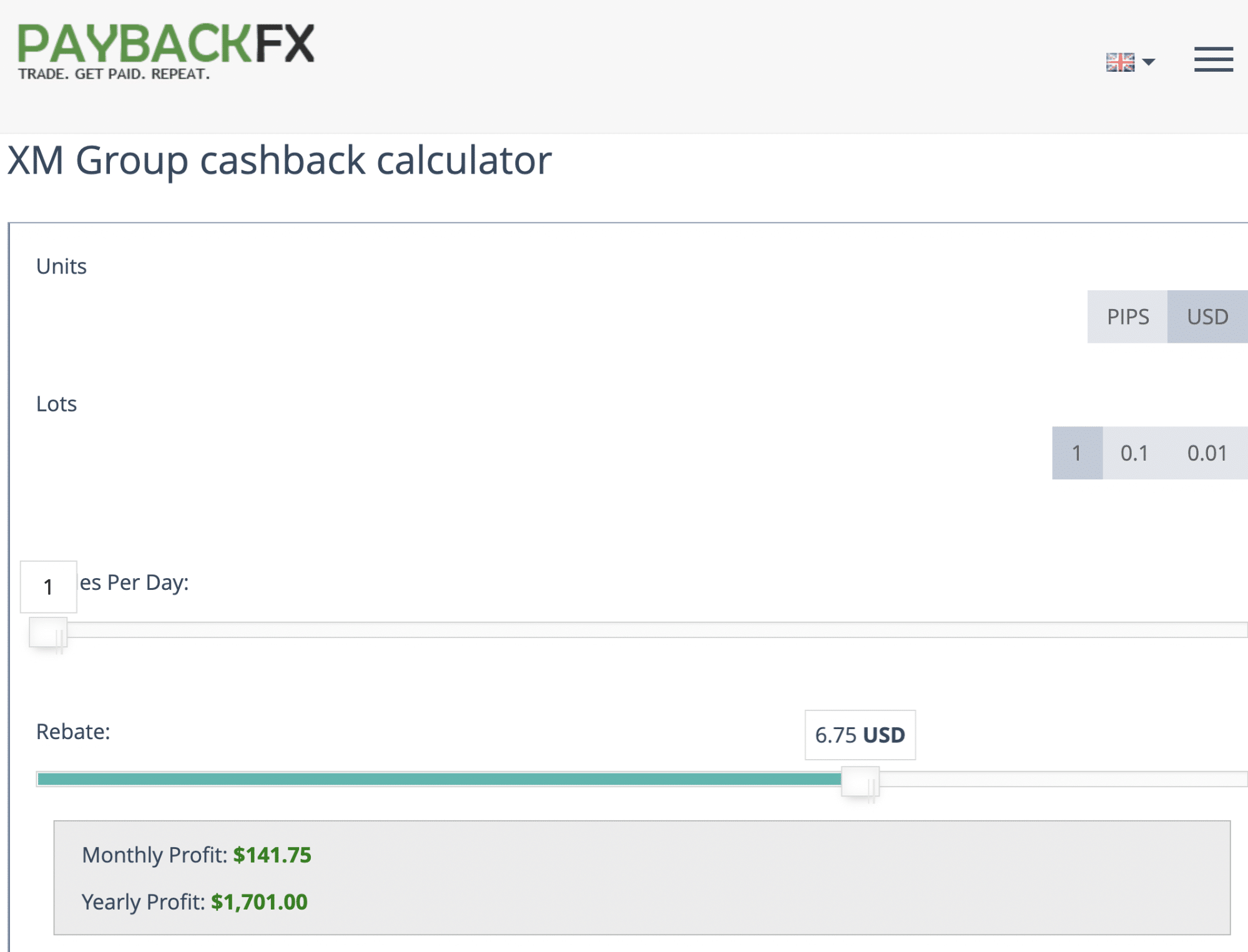

Let’s consider a simple example using EURUSD with one trade executed per day through XM on PaybackFX. Presently, the rate offered for clients per lot is $6.75 with this broker.

If one traded a standard lot every day, the monthly and yearly profits would be $141.75 and $1701, respectively.

We should remember a standard lot is relatively high for the average trader. Therefore, in reality, the potential earnings would be lower for most.

What about the frequency? Of course, these increase the gains, yet some traders may fall into the trap of ‘churning,’ where they purposefully open and close many positions to accumulate the rebates.

This practice is not allowed with brokers, and plus, there will always be a spread or commission for every order, which would naturally eat into any profits. Therefore, churning is not a sustainable way to make profits solely from rebates.

Another factor to consider is the spreads on different accounts. A broker might provide a higher rebate on a particular account but at the expense of incurring a wider spread on the actual position.

The latter may not be beneficial as it would reduce your position size by a few lots, significantly affecting your overall natural gains.

Final word

Ultimately, rebates can be an excellent strategy for reducing your transaction costs, to the point where it feels like you’re trading spread or commission-free. Traders can use the savings as spendable cash on essentially whatever they please, whether trading or non-trading related.

To decide on whether joining a rebate program would be worthwhile, you’d need to consider how frequently you execute, the markets you trade, and your trading volume. Holistically analyzing these aspects should provide you with a clear picture of how worthwhile the profits might be so you can decide accordingly.