Bonanza EA works on gold at the H1 time frame and is better suited for ECN brokers. The robot does not use grid and martingale strategies, according to the developer. Let us see if the expert advisor is profitable and if we can use it to our advantage for trading.

Product offering

The seller shares all the information on the robot through the MQL 5 page. They are hesitant in providing us with good knowledge on the operation of the system. Lack of good statements is poor practice by the vendor.

Vendor transparency

Elizaveta Erokhina is the author of the product who resides in Russia. She has a total rating of 4.4 for 11 reviews. The developer has six products published on the MQL 5 marketplace and has a total of 44 subscribers for his services. According to the website, she has no experience, which raises concerns about her market analysis and development abilities.

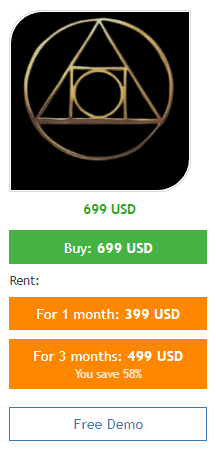

Price

Traders can get the EA for $699 that gives a license for a single account where the trader logs in. It is also possible to rent it for one month at $399 and 3 m months at $499. There is no money-back guarantee.

Trading strategy

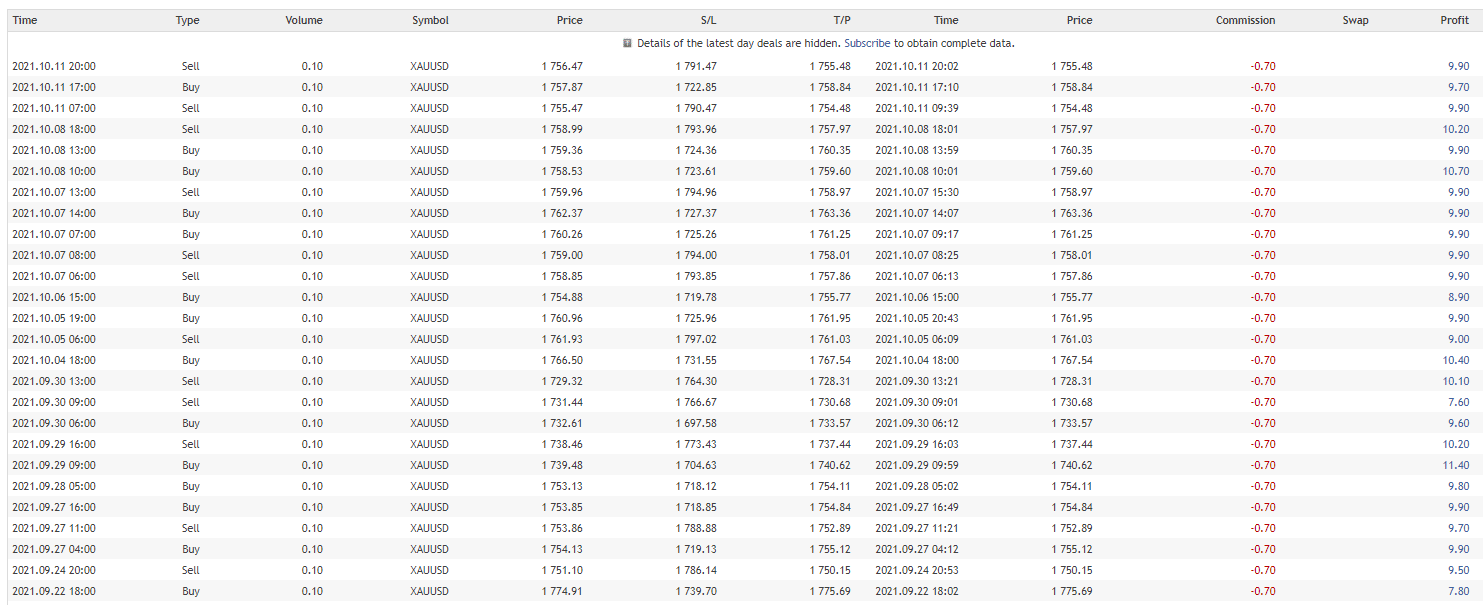

The robot works on the H1 time frame on XAUUSD. According to the developer, there is no involvement of grid and martingale strategies, and there is a fixed stop loss and take profit for each position. It employs a custom indicator and uses price action methods for long-term trading. We can observe that the robot uses a grid methodology that goes against the vendor’s statement through the trading history. This raises alarms on the genuineness of the system.

Trading results

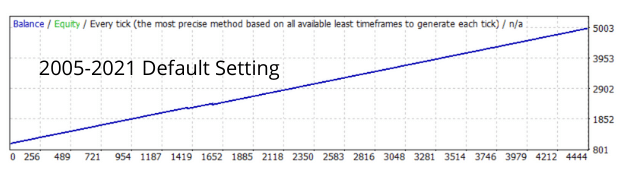

The developer only shares the balance curve of the backtests. There is no performance statistics or a detailed statement which is again a bad practice. It seems she is trying to sell without showing actual performance.

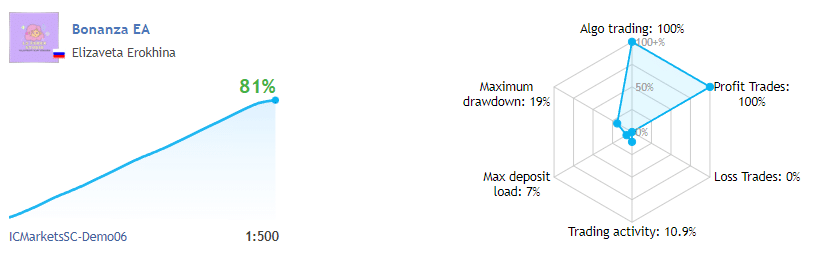

Verified trading records are available on MQL 5 that show performance from August 14, 2021, till the current date. The system made an average monthly gain of around 20%, with a drawdown of 20%. The winning rate stood at 100%, with an unknown profit factor.

The best trade was $14.20, while the worst was -$0 in a total of 92 trades. The developer made $1000 on a demo account. The average trade duration hangs at 5 hours which points out towards the day trading methodology.

The system has records on a demo account that does not respect real market liquidity. We can not confirm the same output if we put it on a live portfolio. The take profit is extremely small, and the stop loss is high, which can mean that the algorithm can and will have a high drawdown in the future.

Customer reviews

There are multiple reviews available at the MQL 5 marketplace. A trader says that the robot has a high stop loss of 350 pips and a take profit of only 9.9 pips. He says that investors will have to try out the system on MT 5 to know the real drawdown of the robot.