Released in 2011 by Spotware Systems, cTrader is a prominent award-winning derivatives charting platform, the closest competitor to the more popular MetaTrader 4.

cTrader is renowned for its minimally sleek, responsive interface and supercharged charting capabilities, providing transparent execution and direct market access pricing.

Unlike its predecessor, cTrader is supported only by a handful of top-tier brokers like Pepperstone, IC Markets, and FXPro. Among cTrader’s suite of innovative products is cTrader Copy, the platform’s social trading service.

The concept of social trading, a broad term encompassing copy and mirror trading, has been around arguably since 2010. It has been seen as a game-changing investment product primarily geared towards less-experienced investors to profit from the markets using the skills of knowledgeable traders.

Plus, anyone with a profitably proven track record can earn additional income through the trading they conduct every day. All this happens in a Facebook-like environment where users can share ideas and conversate with each other.

Let’s explore cTrader Copy in further detail and how it works in this article.

About cTrader Copy

cTrader Copy is fully integrated into all the versions (web, mobile, desktop) of cTrader for demo and real account accounts. However, with a demo, you can only copy from strategies that have been deemed free of charge by the respective providers.

As with most respectable social trading facilities, cTrader Copy allows for the autonomous copying of positions (for non-traders) and strategy providers (for active traders) to connect their trading accounts to be copied.

This feature prioritizes ease of use, transparency in fees, and highly detailed strategy information for everyone to derive the best trading experience. Using your cTrader ID, investors can simply proceed to the Copy section, see the available strategies and start copying in a few clicks.

When signing up to cTrader Copy, investors have two separate accounts, the latter of which is the copy trading account explicitly used for mimicking a particular strategy. Strategy providers execute positions from their own accounts, which are automatically simulated to the accounts of all the followers or investors on a specific model of equity-to-equity.

This ratio is simply defined by accounting for the equity balances of both the investor and strategy provider to ensure proportional position sizing.

Investors have no limits in how many strategies they can follow, provided they meet the minimum account and margin requirements for each.

As a copier, you are not bound to any long-term agreement, meaning you can invest in a strategy provider and cancel your subscription at any time.

Benefits of social trading with cTrader

Let’s explore the main benefits of partaking in social trading through cTrader in the list below.

- cTrader is among the most popular and advanced charting platforms traders and brokers use globally.

- The software uses time-weighted ROI (return on investment) calculations as per the Global Investment Performance Standards (GIPS), considered the industry standard for accurately quantifying investment performance.

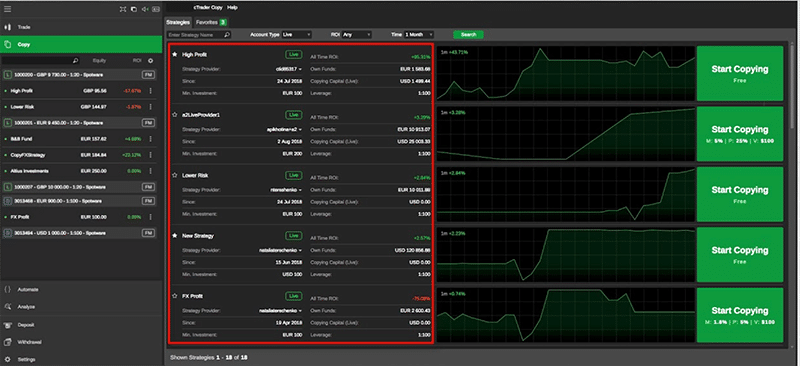

- Non-traders can filter strategies on many different factors such as demo/live, ROI percentage, time-frame, account age, number of copies, drawdown, etc.

- Membership is available for demo and live accounts.

- Any successfully profitable trader using a live cTrader account can become a strategy provider with reasonable entry requirements. Besides levying a discretionary monthly fee, you can also charge independent performance, management, and volume fees.

- Along with the website’s comprehensive help section, users can gain additional support from cTrader’s community forum.

The set-up process for investors

Investors need to have created a cTrader demo or live account with any of the following supported brokers: FxPro, Pepperstone, IC Markets, Varianse, Fondex, Scandinavian Capital Markets, Axiory, Tradeview Markets, and Skilling.

In doing so, you will have your cTrader ID that provides access to the platform’s products. Investors have two types of membership (regulated by the broker): Full and Demo.

The former permits you to copy live strategies (and may allow for demo strategies as well with certain providers), while the latter is only for non-live positions.

The payment methods for one to fund their accounts will depend on the broker. Once you’re in the Copy section of cTrader, you can see all the available strategies. At a glance, you can view when the account was started, the maximum leverage, minimum investment, all-time ROI, etc.

Of course, you can dive deeper by viewing detailed data. After you’ve agreed to the terms and conditions, investors can manage their copy trading account by adding/removing funds, setting specific parameters, or stopping copying altogether.

The set-up process for strategy providers

Potential strategy providers will understandably need an active cTrader account. The main performance statistics to meet for inclusion are:

- Positive balance

- More than -90% of ROI for all time

- A minimum of one executed position within the last 30 days

Strategy providers may charge whatever they wish for investors to copy according to the perceived value.

Interestingly, these individuals can set individual performance (up to 30% of the profits generated by followers), management (up to 10% of the followers’ equity), and volume (up to $10 per 10 lots traded by investors) fees.

Providers can allow anyone to copy their positions or set this so that only those with invitation links may join them. Also, they can stipulate the minimum investment needed by followers.

Curtain thoughts

Unlike PAMM, copy trading provides more wiggle room as you can simply and quickly withdraw your investment from any trader without any penalties. Plus, investors remain in complete control of their funds as they are not connected to the traders’ accounts they are copying.

What’s unique to cTrader from other social trading platforms is how strategy providers can charge additional fees aside from the monthly subscription costs, increasing the earning potential.

Nonetheless, while such an investment product is a win-win for all those involved, it still poses some financial risk, considering that past results do not accurately indicate future performance.

This is something newbies should be particularly aware of, meaning it’s still important to understand all the various performance metrics and have a basic understanding of how markets function.