Euro Hedge works on the MT 5 platform and uses a combination of a hedge, averaging, pyramiding, martingale, and anti martingale strategies. The robot has multiple settings that can be adjusted to the trader’s liking. It is available on the MQL 5 marketplace.

Product offering

The seller arranges the information under a single website tab. He presents links to other pages where traders can find further knowledge about the algorithm. The necessary parts are scattered here and there, and it may take some time to understand the performance and strategy.

Vendor transparency

Living in Indonesia, Sugianto is the author of the product. He has a total rating of 4.8 for six reviews. The developer has 30 products published on the MQL 5 marketplace and has a total of nine subscribers. He has experience of six+ years. The vendor doesn’t provide any other information about himself or proof of track records which is poor.

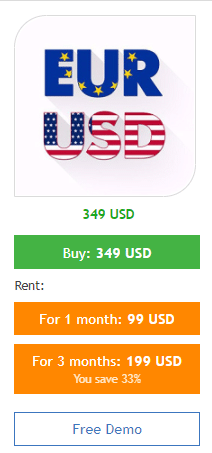

Price

The product can be downloaded from the MQL 5 community for an asking price of $349. It is also possible to rent it for 1 and 3 months for $99 and $199 respectively. There is no money-back guarantee according to the rules of the MQL 5 marketplace.

Trading strategy

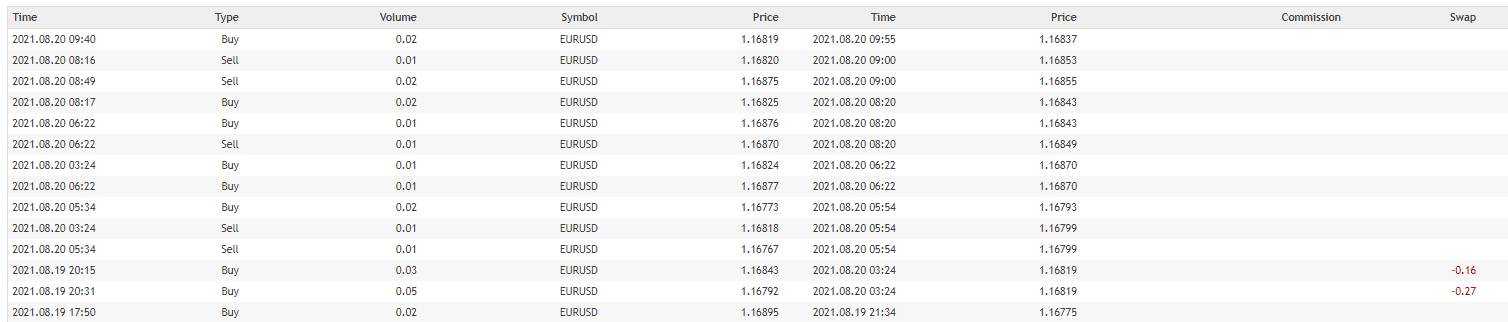

The developer states that the robot uses a combination of hedging, averaging, pyramiding, lot martingale, and anti-martingale strategies. It gets in and out of the markets quickly to not have to tackle any uncertain price movements. From the history on the MQL 5 signals page, we can see that the robot enters and exits positions that same day. It does not use a stop loss or a take profit. The EA works best on EURUSD, GBPUSD, and XAUUSD. The developer points out that the minimum required balance to make the robot work is $5000. The required minimum deposit is quite high. Traders with little to no market experience can lose such a high amount of capital quickly. Considering the fact that there are no refunds for the EA provided it is quite risky to invest in this trading tool.

Trading results

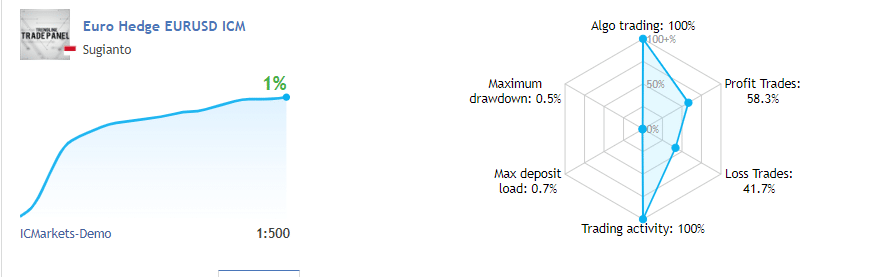

Verified trading records are available on the MQL 5 marketplace that shows the output for August only. The robot has recently started its performance on a demo account which is a poor practice. Virtual portfolios are not enough to understand the real output of the system.

The system made an average monthly gain of 1.24% during the period, with a drawdown of 0.5%. The stated drawdown values should not be taken seriously as the records are only for a short duration. The value will increase in the future, which is the case with EAs that use risky martingale and grid strategies. The winning rate stood at 58.30%, with a profit factor of 1.40. The best trade was $28.64, while the worst was -$18.91. There were a total of 283 trades. The developer made $5000 in deposits to test out the system.

Customer reviews

There are only two reviews present on the MQL 5 marketplace. A customer states that the robot is only profitable on a demo account and does not work on the live. He states that he had received several margin calls on the portfolio. He also states that the robot only works during the backtesting.