Forex robots are automated tools that help professional traders make decisions. A robot can automatically open and close trades or send signals when certain market conditions are met. In this article, we will look at what these forex robots are, how to build or buy one, and how to use them in the forex market.

What is a forex robot?

A forex robot, also known as a bot or expert advisor, is software that helps people automate their processes in the financial market. The robot is created by combining two or more technical indicators and setting other parameters such as recommended order sizes and risk management strategies.

There are other robots that are designed to send automated signals. For example, if you only buy a currency pair when the 25-day and 15-day moving averages make a crossover, you can build a robot that sends you an alert when the situation happens. After receiving the signal, you can do other types of analysis to determine whether it is worth buying the currency or not.

The benefit of having such a robot is that it will work behind the scenes and scan hundreds of currency pairs whenever the crossover happens.

How to build a forex robot

Building a good expert advisor requires a lot of experience in the financial market and software development skills. The trading experience is necessary since the robot will simply implement your successful trading strategy. The software development experience is important because you will code the software.

There are several programming languages that are required when building a forex robot. Among the most popular ones are Python, Pine, C++, and MQL4/5. The latter language is the most appropriate if you use the MT4 or MT5 trading platforms. Pine is ideal for building robots for the TradingView platform.

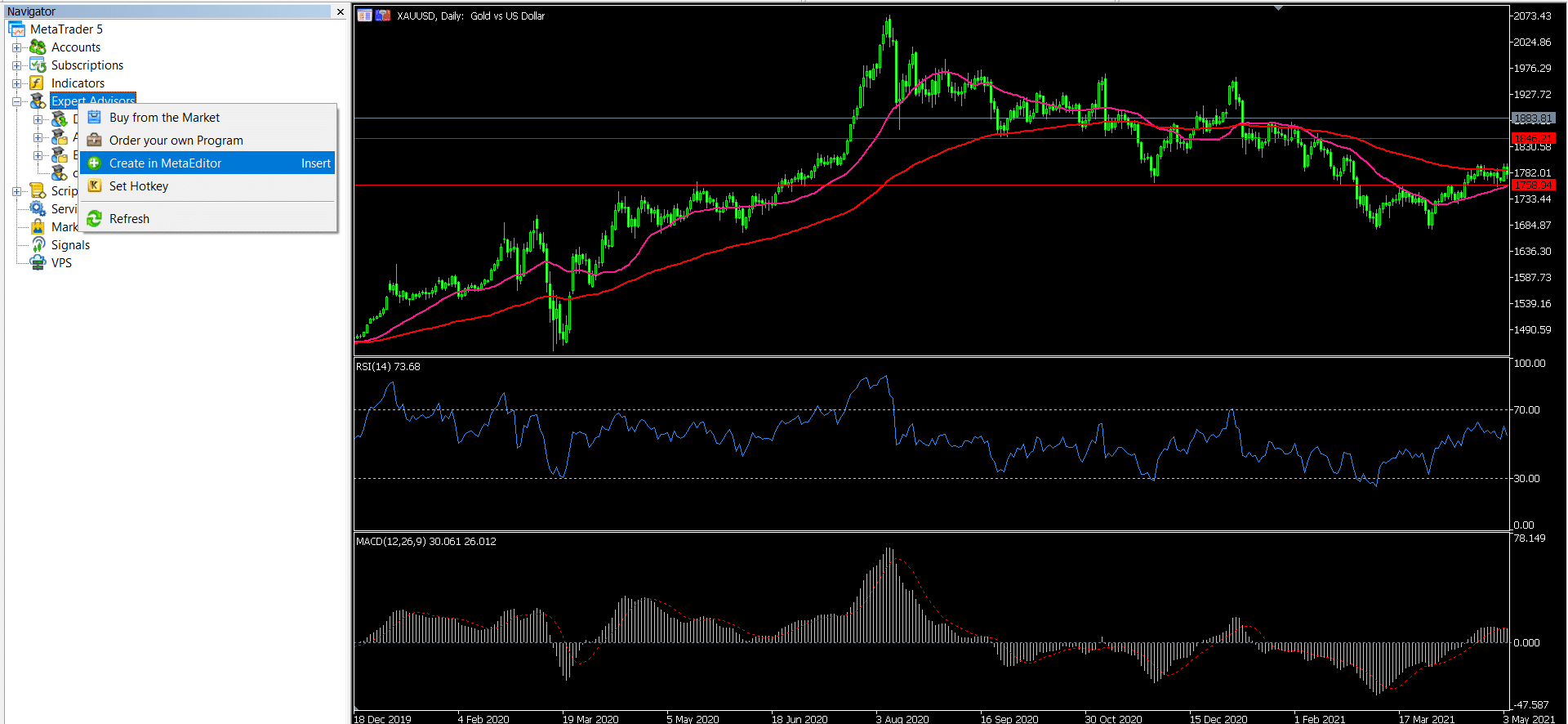

The first stage of building a forex robot is to have a good strategy that you know well. After this, you need to write down the indicators you want to build the robot on. These could be popular indicators like moving average, Relative Strength Index (RSI), and MACD, among others.

Third, select the programming language you want to use and start building. If you are using the MQL5 platform, you should go to the Navigator, then expert advisors, and then create new, as shown below.

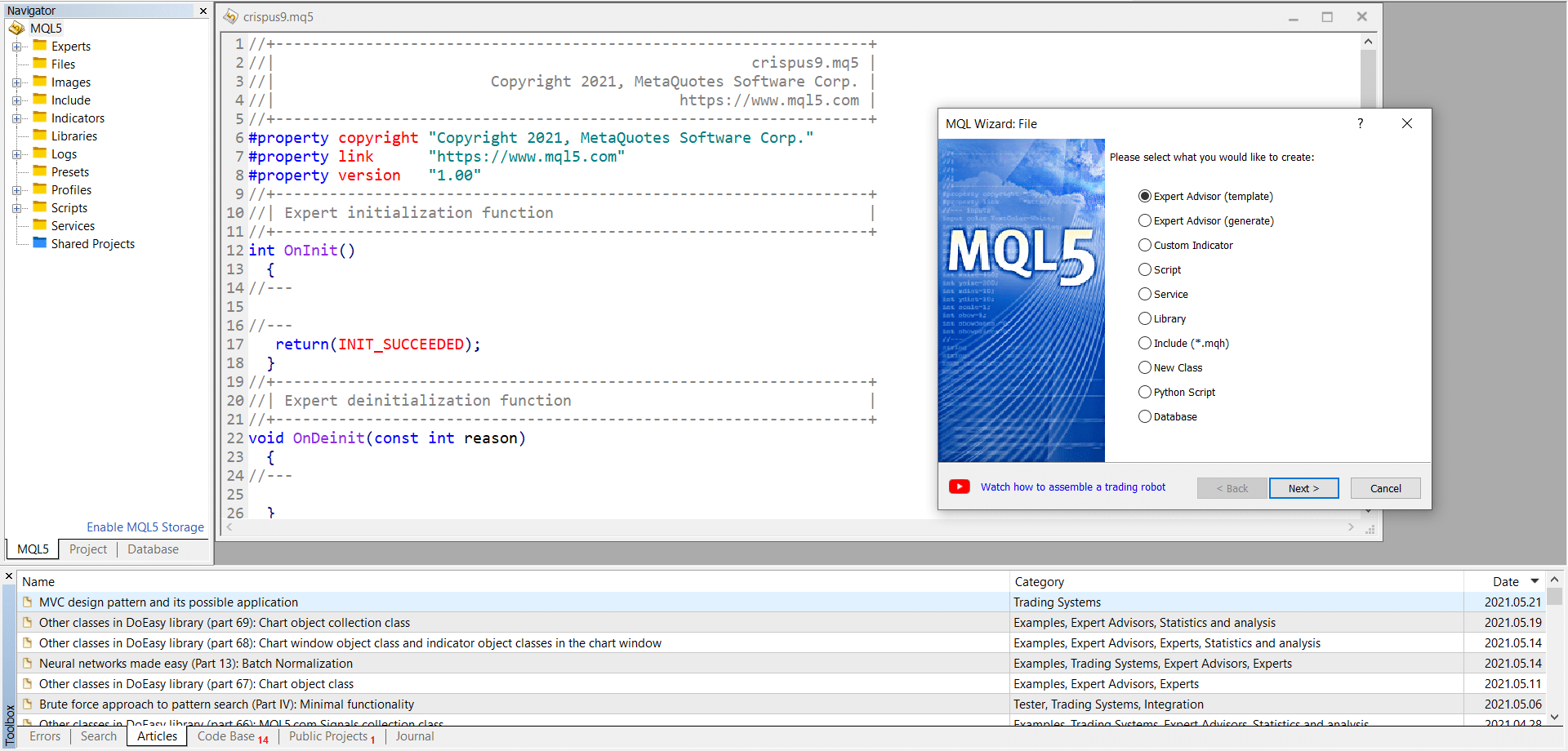

Creating a robot in MQL5

It will take you to the following page, where you can start your coding process. As you can see below, you can create one from scratch or use a template that is already in the system.

Creating a robot example

If you are building it from scratch, you should do the coding. If you are using a template, you should input the figures and customize them to your liking.

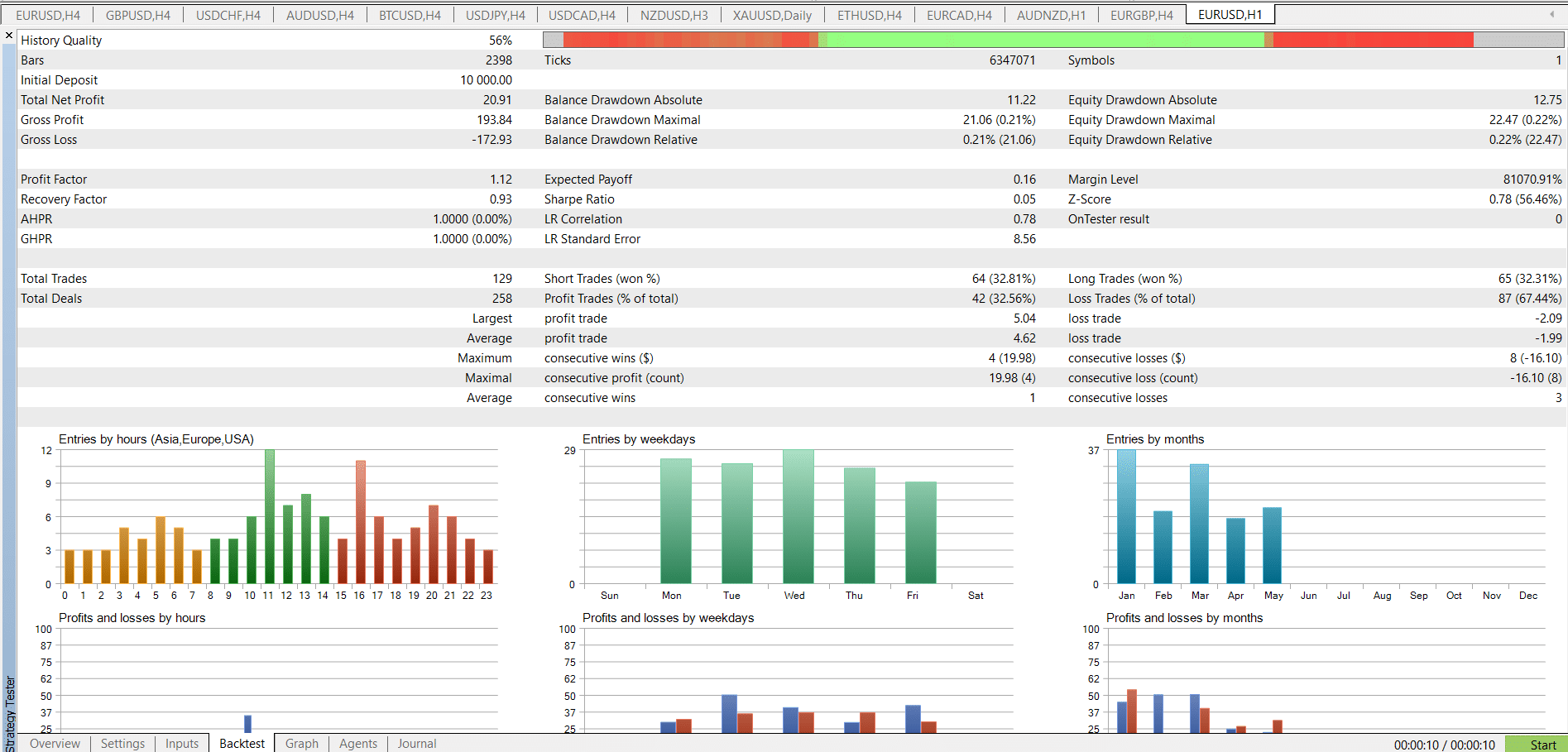

The final stage of building the robot is to backtest it to see whether it works as you hoped. Fortunately, most trading platforms like TradingView and MetaTrader have a free strategy tester tool. You should spend a substantial amount of time doing this testing before you start using it in a live account. The chart shows the results of a forex robot. As you can see, the robot opened 129 trades and generated a gross profit of $193.

Strategy tester example

As you do the backtest, ensure the following:

- Test the currencies that you will be trading.

- Have the same amount of money that you will use the robot with.

- Test it using the same time frames that you will use. A robot on a 30-minute chart can produce different outcomes from a 1-hour chart.

- Test it in different market conditions.

How to buy a forex robot

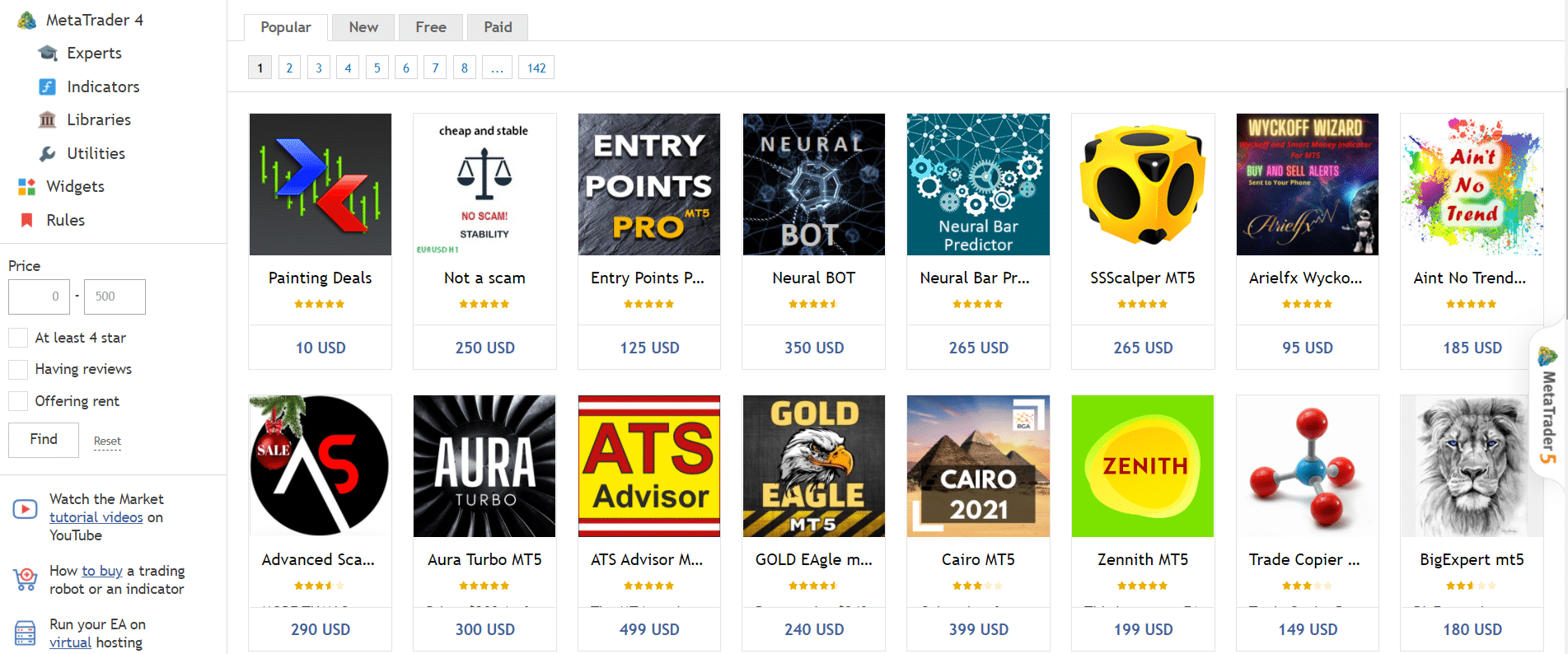

Like most people, there is a possibility that you don’t know how to build a forex expert advisor. Fortunately, there are thousands of forex expert advisors that you can buy on the internet. You can buy the robot directly from a developer or through a marketplace. The most common marketplace for forex robots is the MQL5 and MQL4. It has thousands of robots whose price ranges from $0 to hundreds of dollars. The chart below shows some of those expert advisors in MQL5.

MQL5 advisors

Buying a forex robot is a relatively easy process. However, you should be extremely careful because of the rising cases of robot scams. You can avoid these scams using the following strategies:

- Use a marketplace – Instead of buying a robot directly from the developer, do it from a marketplace. This will help you protect your payment details and ensure that you are buying pre-vetted bots.

- Read reviews – Before you buy a robot, take time to read reviews from past users. Be careful to ensure that the reviews are genuine.

- Request a free trial – Always request a free trial before you buy a robot. This will give you time to backtest the robot and see whether it works for you.

- Read the description – Take your time and read the description that accompanies the robot.

Forex robot best practices

After buying or developing a forex robot, there are several best practices that you need to follow. First, always use a robot with a Virtual Private Server (VPS) to ensure that your trades are executed fast. Fortunately, you can get a good VPS for as little as $15 per month.

Second, always ensure that your trades are not overleveraged. This will help you minimize the loss potential in case your trades don’t go right. You should start with small leverage and expand it as you test it. Third, in your early days, keep a keen eye on the robot to see whether it is working out well.

Summary

A forex robot is a tool that allows you to automate your trading. The tools are increasingly popular among quantitative hedge funds like Renaissance Technologies and 2 Sigma, among others. In this article, we have looked at what they are, how to build or buy them, and some of the best practices when using a bot.