With claims of being profitable with its combined strategies of various risk level settings, FX Fortnite EA focuses mainly on the EURCHF currency pair. Working in the H1 timeframe, this Metatrader 4 compatible Forex robot employs trend and hedge methods for its trading and purportedly uses the two to adjust risk and make appreciable returns. Does the combo strategy work as claimed by this expert advisor? Find out in our detailed review and know our recommendation on this automated Forex trading system.

Product Offering

According to the developer, FX Fortnite EA is a fully automated software that uses a proprietary algorithm which helps spot the divergences, convergences, and conducts a detailed market analysis. The vendor claims that the settings are easy to set up and use.

Round the clock online support is available. We could not find information about the vendor anywhere on the official site which raises a red flag. Contact can be made only via the email provided on the site.

This expert advisor is offered in three different packages, which include:

- Bronze package – Costs $149 and includes 1 real and 1 demo account

- Gold package – Costs $199 and includes 2 real and 2 demo accounts

- Platinum package – Costs $249 and includes 3 real and 3 demo accounts

All three packages are offered with free support, upgrades, manual PDF, EA SET files, and a money-back guarantee of 30 days.

FX Fortnite EA

| Type | Fully-automated EA |

| Price | $149 – $249 |

| Strategy | Trend/Hedge |

| Compatible Platforms | MT4 |

| Currency Pairs | EUR/CHF |

| Timeframe | H1 |

| Recommended Min. Deposit | $1000 |

| Leverage | 1:100 |

Trading Strategy

A trend-hedge combo trading method is used by this Forex robot. According to the vendor, the combined strategy is to safeguard against risky trades. A lookback straddle method is used for assessing the returns in the trend strategy.

There is also mention of exploiting high volatility levels for better gains. Based on the vendor information the best pair to trade using this combo strategy is the EURCHF and an H1 timeframe is suggested.

The settings used are of three types, namely low, middle, and high-risk levels. The vendor claims that the blend of hedge and trend methods provides the expert advisor more potential in fast-paced market conditions.

Trading Results

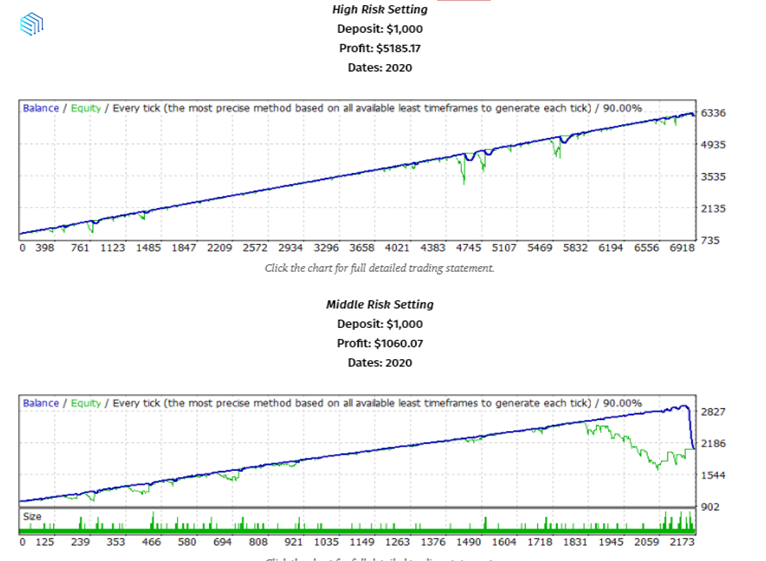

Backtesting results for the various settings are posted on the official page of the FX Fortnite EA site. We were disappointed with the 90% modeling quality as it does not provide detailed information on the spread, commission, etc.

All the backtests have been done over an 8-month period with a minimum initial deposit of $1000 on the EURCHF pair. A drawdown of 19.49% is recorded with a profit factor of 2.01. While these may make the strategy look effective, the backtests are historical data that cannot truly predict similar results in future trades.

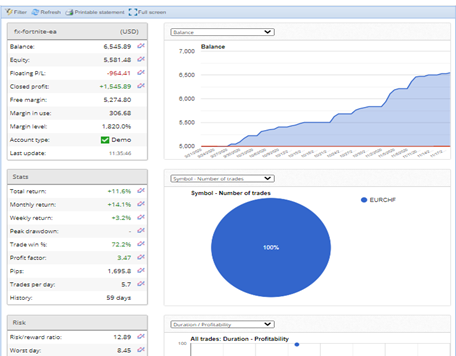

This expert advisor has a demo account running on the FXBlue site for 59 days. From the trading specs, we could see a total return of 11.6% and a monthly return of 14.1%. A reduced total return compared to monthly gains shown in the results look suspicious. So, are the numbers for the profit factor and risk to reward ratio, which are 3.47 and 12.89 respectively.

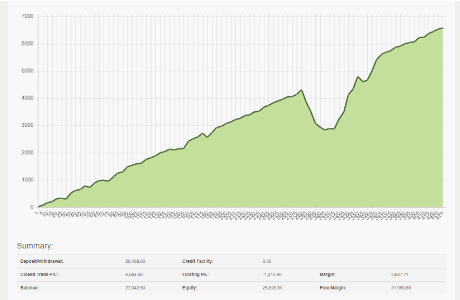

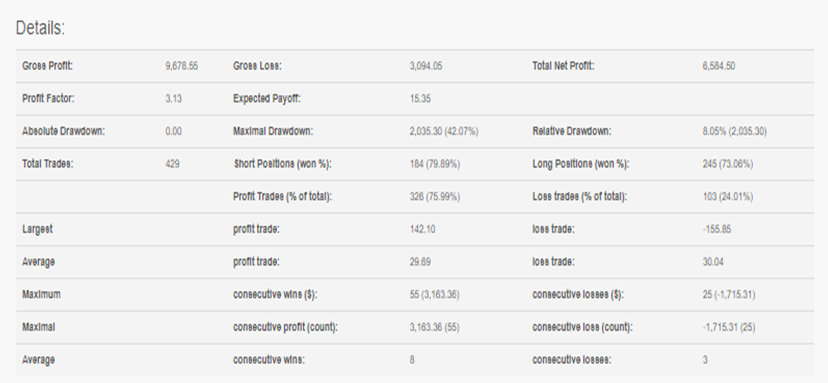

We found a real account on the Forexpeacearmy site with a profit factor of 3.13 and a maximal drawdown of 42.07%. The lot sizes used are very high at 0.20 per lot indicating the high-risk used. This is not feasible for the average trader looking at consistent profits with low-risk.

Customer Reviews

We did not find any user feedback for this expert advisor. Customer reviews provide useful insights into the effectiveness of a system. By the obvious absence of reviews, it is clear that this Forex robot does not have much visibility or reputation.