Many individuals who are against the hands-on approach, prefer a managed account service to handle their investment in Forex. The FX Deal Club offers such managed account services. As part of its services, the FXDC Hedger EA uses price movement and resistance levels with the hedging method of approach. With nearly two decades of experience in the field, the FXDC assures a proven strategy and efficient trading that results in nearly 50% ROI. You can find more information about the MT4 trading tool in this review compiled by our expert analysts.

Product Offering

As an automated trading tool, FXDC Hedger EA has simple settings combined with effective trading methods. According to the info available on the site, this ATS is 100% adaptive. The trading approach includes the use of a unique hedging method alongside price movement and resistance levels. While hedging trades are used, the FX EA protects the account from having high drawdowns. A daily profit of 10% and more is guaranteed by the vendor.

Regarding the vendor, the FX Deal Club promotes itself as a service with no hidden aspects or misleading information offering proprietary solutions without margin call probability. The company is located in Dubai, United Arab Emirates. For support, an online contact form and email address are provided by the vendor.

FXDC HEDGER EA

| Type | Fully-automated EA |

| Price | $499 |

| Strategy | Hedging |

| Compatible Platforms | MT4 |

| Currency Pairs | EUR/JPY |

| Timeframe | 1 Hour |

| Recommended Min. Deposit | $100 |

| Recommended Deposit | $1000 |

| Leverage | from 1:400 |

This FX robot costs $499 which includes unlimited accounts and a lifetime license. Free updates and 24/7 customer support are provided with this EA.

Trading Strategy

As an MT4 tool using hedging as the main strategy, this FX robot works exclusively on the EURJPY pair. There is not much info available regarding the approach used except for a few words on the approach.

The recommended time frame is one hour and you need a minimum of $100 to start trading with this EA. However, the recommended balance is $1000 with the leverage starting from 1:400 and more. You can use any broker as the ATS is compatible with all brokers.

The vendor states that this FX robot is programmed to work separately. You cannot open manual trades or use other EAs along with this system.

Trading Results

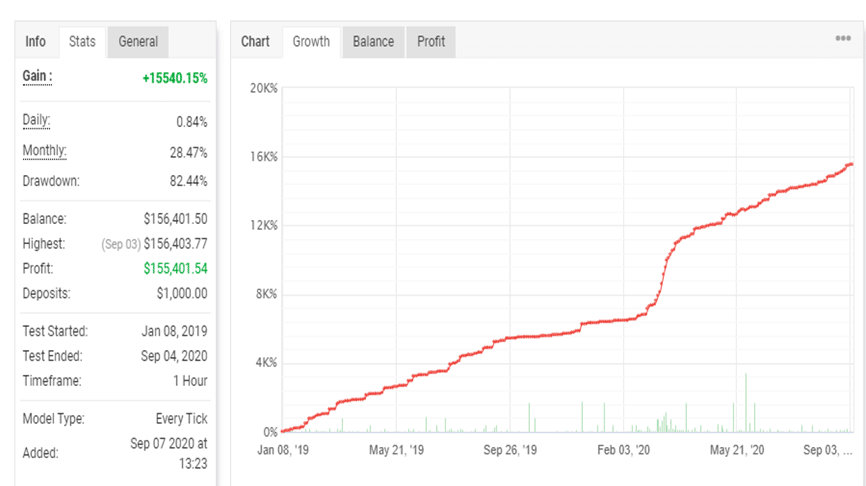

Three different backtesting results are displayed on the official site with different starting balances. But the link appears to be broken. However, we found a few backtests on the myfxbook site. Here is a screenshot of the backtesting report.

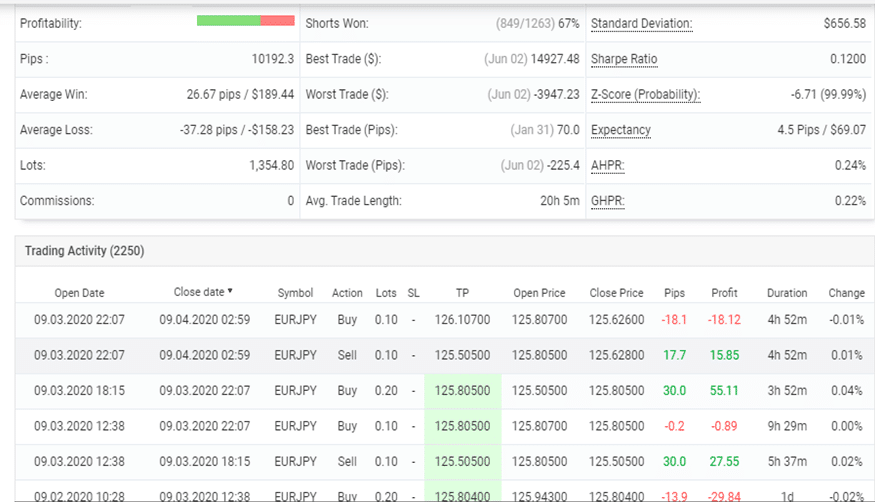

From the strategy settings, we could see lot sizes are of 0.1 size and there is information about slippage, take profit, and other settings. The trading results show an overall gain of 15540.15% for the test started on January 08, 2019, and ended on September 04, 2020. A daily gain of 0.84% and a monthly profit of 28.47% are shown. The drawdown is 82.44% and the profit factor is 2.26. From the trading history, we could see the lot sizes range from 0.1 to 3.40 and more. The high drawdown and lot sizes indicate the approach used has a very high-risk level.

We could not find trading results of a real account verified by the myfxbook site or sites such as FXStat and FXBlue. Without verified results, it is not possible to compare the results with the backtesting results. Further, the live account stats reveal important info about the trading done such as the drawdown, the lot size, equity, etc.

Customer Reviews

There are no user reviews for this FX robot on reputed sites like Forexpeacearmy, Trustpilot, etc. Reviews from users throw light on the efficacy of an expert advisor. You can find info such as the approach used and its effectiveness, the kind of support offered, and more. The lack of user reviews indicates the system is not that popular among traders.