FXQuasar is an FX robot designed to provide high returns. Claimed to be a cosmic expert advisor, this software works on the MT4 and MT5 platforms. It is compatible with all brokers including NFA regulated ones. As per the vendor, the system has a reliable risk-limiting system and smart market analysis method for making profitable trades.

Product offering

The official website provides concise info. All details including the features, stats, price, and support are on a single page. However, there is no info on the vendor except the mention of the FX robot being powered by ForexStore. We could not find vendor details like the founding year, developer team, their experience, location address, and phone number. The lack of vendor info raises a red flag for this EA.

FXQuasar

| Type | Fully-automated EA |

| Price | $279 |

| Strategy | Price action |

| Compatible Platforms | MT4, MT5 |

| Currency Pairs | AUDUSD |

| Timeframe | H1 |

| Recommended Min. Deposit | N/A |

| Recommended Deposit | N/A |

| Leverage | 1:500 |

To buy this FX EA, you need to shell out $279. The features included in the package are a single lifetime license, a facility to change accounts and trade on live or demo accounts, and MT4 and MT5 versions. A detailed user guide, free updates, and 24/7 technical support are also present. The vendor offers a 30-day money-back guarantee for the product. When compared to similar products in the market we find the cost of this FX EA is expensive.

Trading strategy

The vendor does not mention the strategy used. Instead, there is mention of the indicator working directly using proprietary algorithms and quotes for identifying the accurate trades. The EA analyses the prevailing market situation and price movements of the immediate past to decide on the direction of the trade.

As per the vendor, this EA uses three sessions with long buy positions and three sessions with short sell positions. The sessions work separately allowing the EA to capitalize on market opportunities and earn high returns. The vendor claims that for controlling the risk, a special limiting system is used that protects from unexpected losses. There is no mention of the leverage, recommended deposit, and other related info. The vague strategy explanation and inadequate info raise a red flag for this FX robot.

Trading results

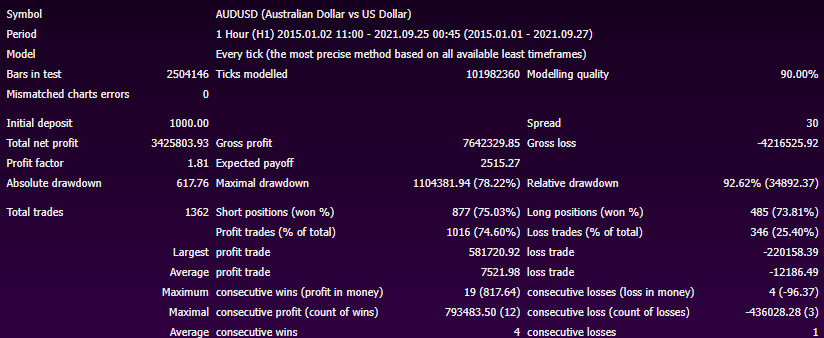

From the above report, we can see the backtesting report for the AUDUSD pair. It had generated a net profit of 3425803.93, from an initial deposit of $1000. For a total of 1362 trades, the maximum drawdown for the account was 78.22%. Profitability of 74.60% was present for the account with a profit factor of 1.81. From the results, it is clear that although the profits are high, the drawdown is equally high indicating a high-risk approach.

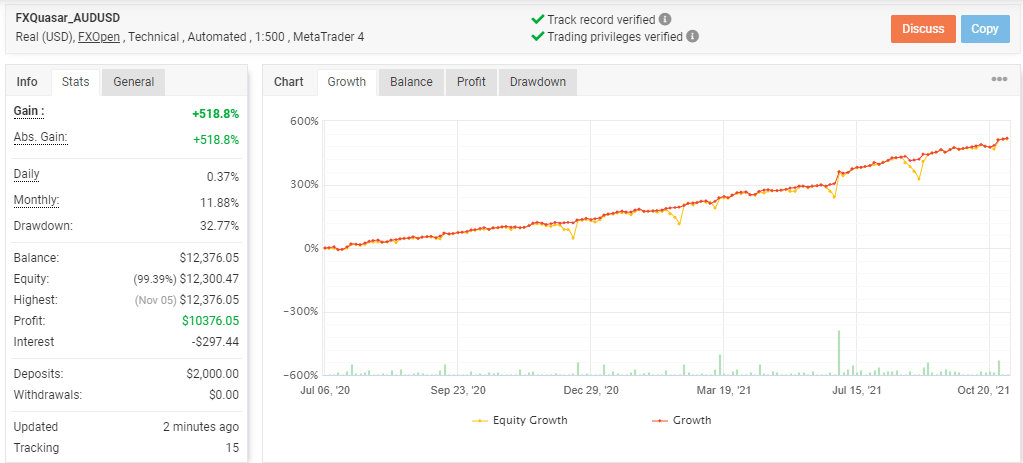

A real USD account using the FXOpen broker and the leverage of 1:500 on the MT4 terminal is provided by the vendor. The account verified by the myfxbook site is shown here:

From the above report, we can see the account has generated a total profit of 518.8% and an absolute profit of similar value. The daily and monthly profits are 0.37% and 11.88%, respectively. A drawdown of 32.77% was present for the account, which started with a deposit of $2000. The account that started in July 2020 has completed a total of 317 trades with 74% profitability and a profit factor of 1.80.

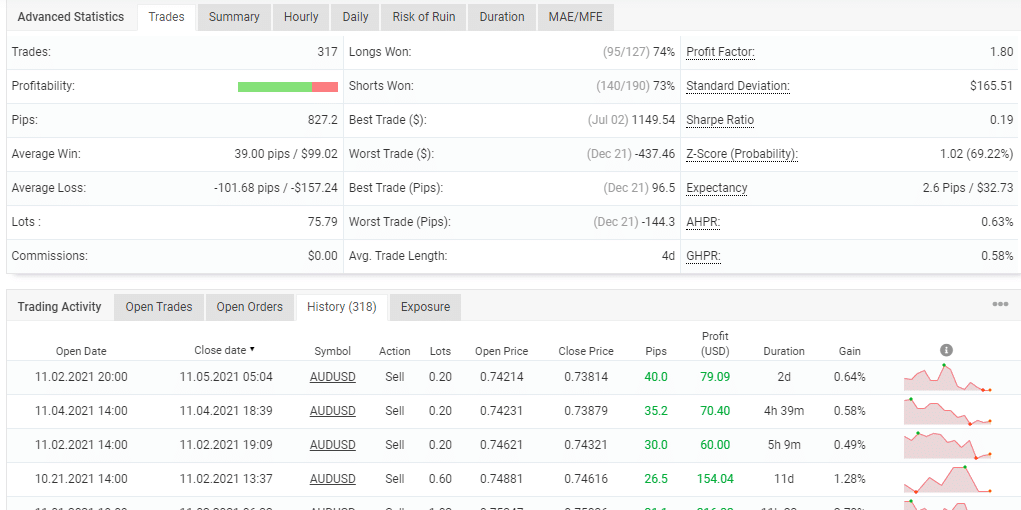

From the trading history, we can see the lot sizes vary from 0.20 to 1.02. The big lot sizes and high drawdown indicate the strategy used is of the high-risk category. Further comparing the backtesting result with real trading stats, we find the profitability and profit factor are similar indicating that the EA uses a risky approach that can result in poor performance.

Customer reviews

There are no reviews present for this FX robot on reputed sites like Forexpeacearmy, Trustpilot, etc. The absence of feedback shows this is not a popular EA among traders.