GerFX is a night scalping system that is optimized to ensure slippage is minimal. This MT5 tool uses a mean reversion system. The developer offers many parameters that help to optimize the trade entries and also include other enhancements. It works on multiple currency pairs and uses the M5 timeframe.

Product offering

Paul Exler is the developer of this FX EA. He is based in Germany and has more than five years of experience in developing FX trading tools. As the CEO of Exler Consulting GmbH, he and his team of traders have over 10 years of experience and have developed 10 products and 21 signals. The vendor does not provide details like location address, phone number, etc. Other than the messaging option on the MQL5 site no other support methods are present. The lack of vendor transparency and inadequate support raise a red flag for this EA.

GerFX

| Type | Fully-automated EA |

| Price | $2000 |

| Strategy | Night scalping |

| Compatible Platforms | MT5 |

| Currency Pairs | Multiple currency pairs |

| Timeframe | M5 |

| Recommended Min. Deposit | N/A |

| Recommended Deposit | N/A |

| Leverage | N/A |

To purchase this FX EA, you need to pay $2000. For traders who find the amount expensive, the vendor offers rental options. The one-month rental costs $140 and the three-month rental costs $370. For 6 months the rental cost is $700 and the annual rental costs $1250. No money-back- guarantee is present, which makes this an unreliable EA. Furthermore, compared to other competitor scalping products, the price of this FX robot is very steep and not worth it.

Trading strategy

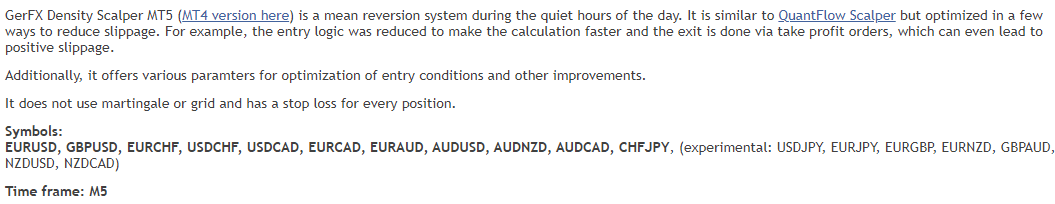

As per the developer, this FX EA does not use the grid or Martingale methods and uses an SL for each trading position. A timeframe of M5 is used for the real trading and the vendor recommends the use of H1 or a higher timeframe for backtesting. The main currency pairs this system works on are given below:

This ATS uses the night scalping approach which the developer states should be used with caution. Unexpected market news can cause big losses with this system and further, it needs low slippage and low spread conditions for better performance. There is no info present on the recommended deposit or the leverage you should use for this EA.

Trading results

Instead of a detailed strategy tester report, the vendor provides a backtesting report as shown above. From the table, we can see that the backtesting for this EA optimized from 2003 resulted in a profit factor of 2.76 and a return to drawdown ratio of 187. The lack of a detailed report prevents us from making a proper assessment of the strategy and performance.

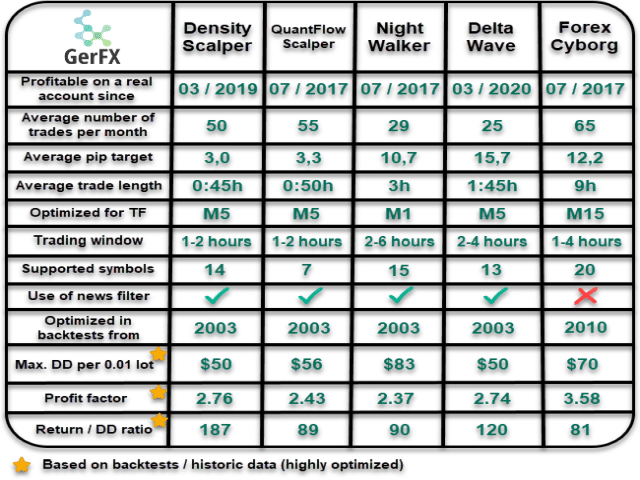

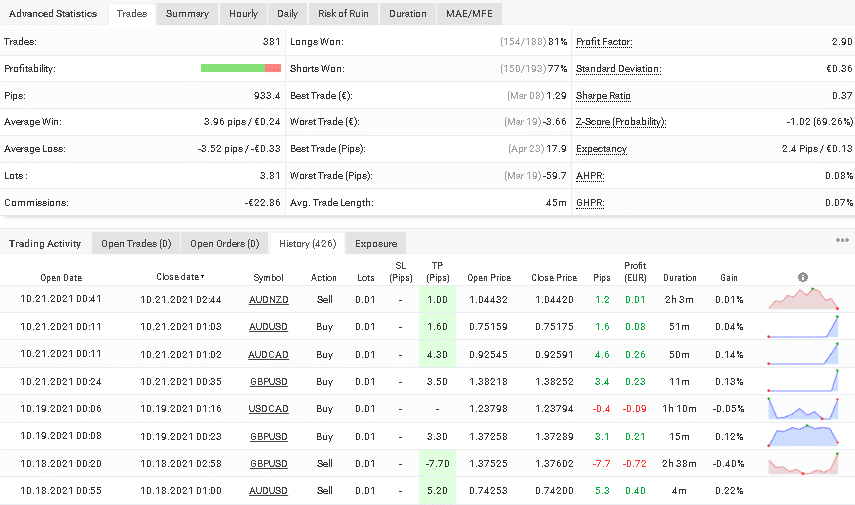

The vendor provides a real EUR account using the Pepperstone broker with the leverage of 1:1 on the MT5 platform.

From the above stats, we can see the system has generated a total profit of 33.21% and an absolute profit of 35.73%. The daily and monthly profits are 0.10% and 3.10% respectively. A drawdown of 2.18% is present for the account. For a deposit of €154.82, the account started in January 2021, has completed 381 trades with a profitability of 80%. The profit factor value is 2.90. From the trading history, we can see a lot size of 0.01 is used for the trades. While the drawdown is low, the profits are not high indicating an ineffective strategy. Comparing the backtesting and real trading results we find the profit factor is similar to both but due to the lack of a detailed backtesting report, we are unable to analyze the results further.

Customer reviews

We could not find user reviews for this FX EA on reputed review sites like Forexpeacearmy, Trustpilot, etc. The lack of reviews indicates this is not a well-known system. The MQL5 site has a few reviews. But since the site promotes the product, the feedback may be manipulated.