Hippo Trader Pro is a trading solution that focuses on executing orders on the terminal, using a trend-based strategy. The presentation looks standard. We have some intel explaining how the system functions.

Product offering

The following list unites much information about what we should expect from the robot on a real account:

- It works on the charts completely automatically for us.

- We still have a discount of $300.

- The current price is $299 when the next price will be $599.

- The system focuses on Asian and European sessions.

- The test was executed on the 17-year of tick data.

- We may get a free copy of another advisor for free.

- It works with EURUSD on the H1 time frame only.

- It works using FIFO rules.

- “It analyzes the market without using obsolete indicators and patterns, looking for the main trend, entering the market based on volatility (ATR Filter) and some Trend Pattern to predict the likely future trend.”

- We can work with it on MT4 and MT5.

- The default settings are a 0.01 lot for each $1000.

- We can work with any broker house we want.

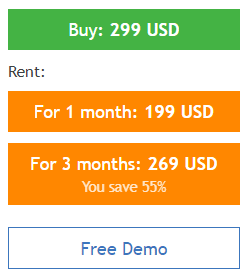

The system is available for $299. There’s a single lifetime license provided. We have rental options available for $199 (1 month) and $269 (3 months). We may use it for demo usage as well. There’s no refund policy provided.

Trading strategy

- The system works with a trend strategy.

- The main cross pair is EURUSD.

- It works on the trend time frame – H1.

Trading results

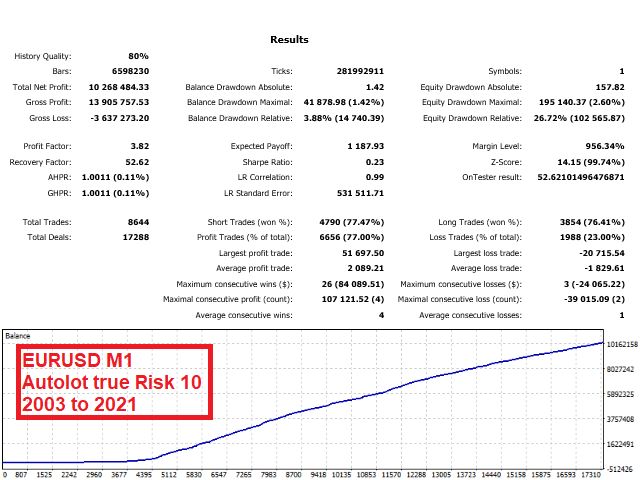

We have a backtest report that informs us that the pair was EURUSD on the M1 time frame. The devs mentioned that the backtest was executed with high risks – 10%. The data period was from 2003 to 2021. The history quality was 80%. The robot traded with a profit factor of 3.82 and recovery factor of 52.62. The maximum drawdown was 3.88%. There were 8644 deals traded. The accuracy was 77.47% for shorts and 77.47% for longs.

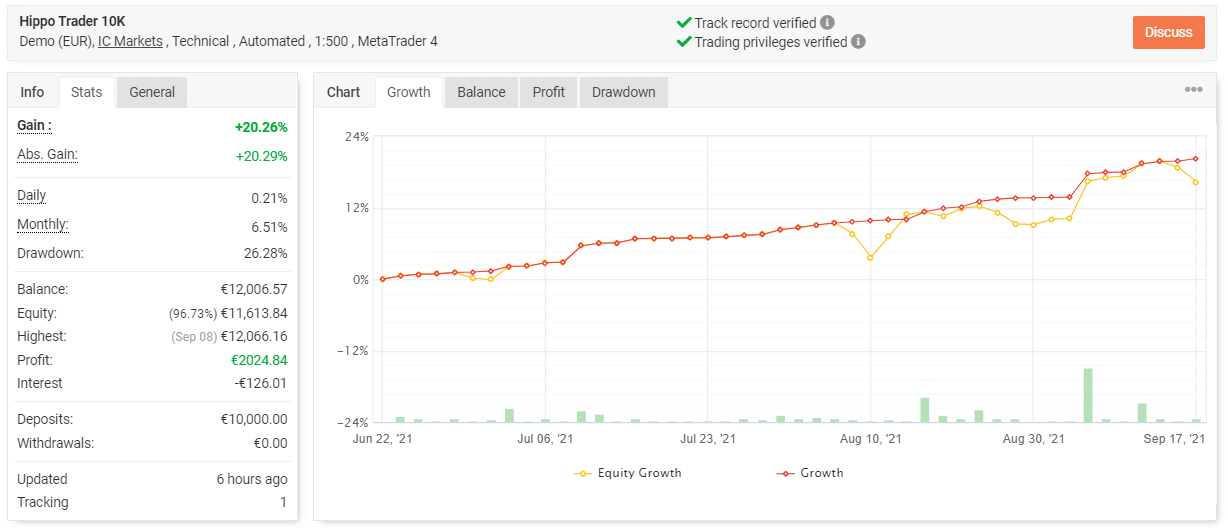

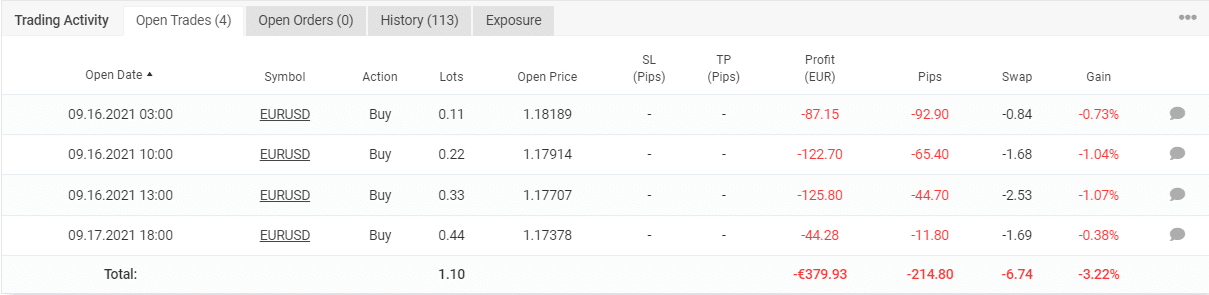

Trading results are important for us to see a whole picture of what the robot is. We have to check many details to be sure that the system is safe and stable enough to invest into it. The advisor was set on a demo EUR account on IC Markets. The leverage is 1:500. The platform is MT4. The account has a verified track record and verified trading privileges. It was created on June 22, 2021, and deposited at €10,000. Since then, the absolute gain has become 20.26%. The maximum drawdown is 26.28%. An average monthly gain is 6.51%.

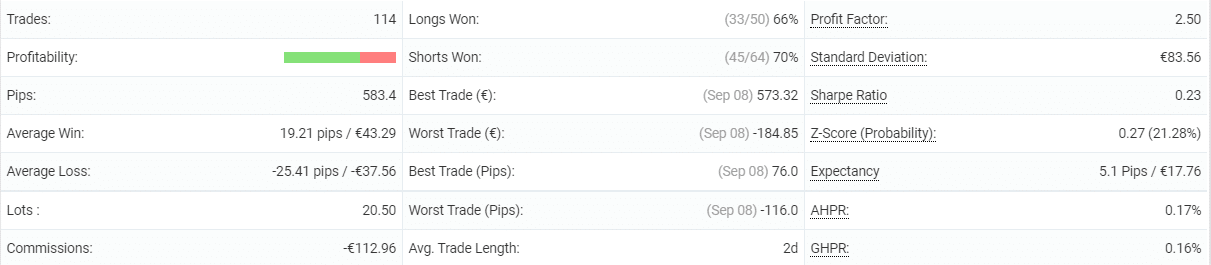

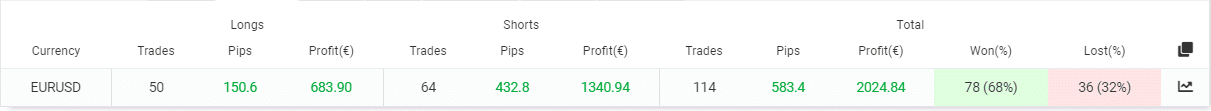

The system has executed 114 deals with 583.4 pips. An average win is 19.21 pips when an average loss is -25.41 pips. The accuracy rate is 66% for longs and 70% for shorts. An average trade length is two days instead of 12-14 hours. The profit factor is 2.50.

It has traded the short direction twice more frequently than the long direction.

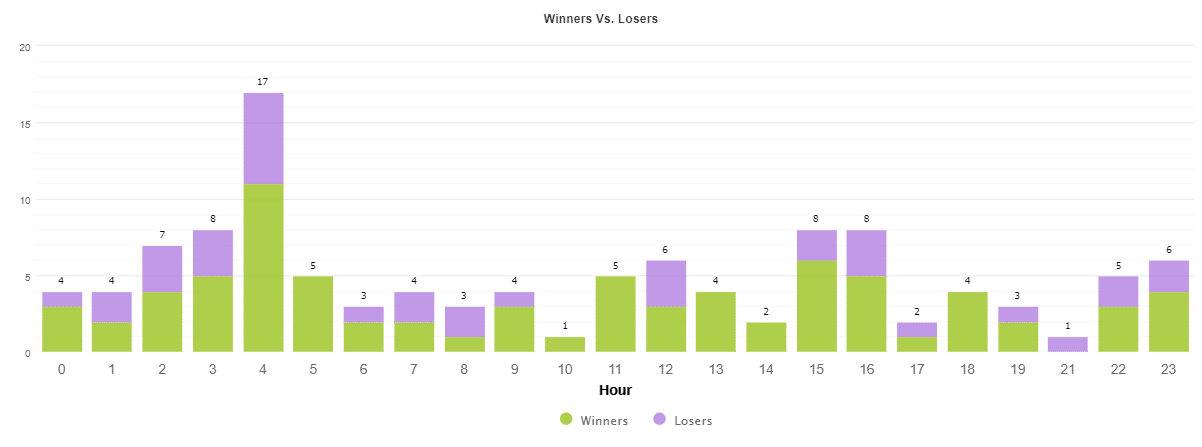

As was mentioned, it works mostly on Asian and American sessions.

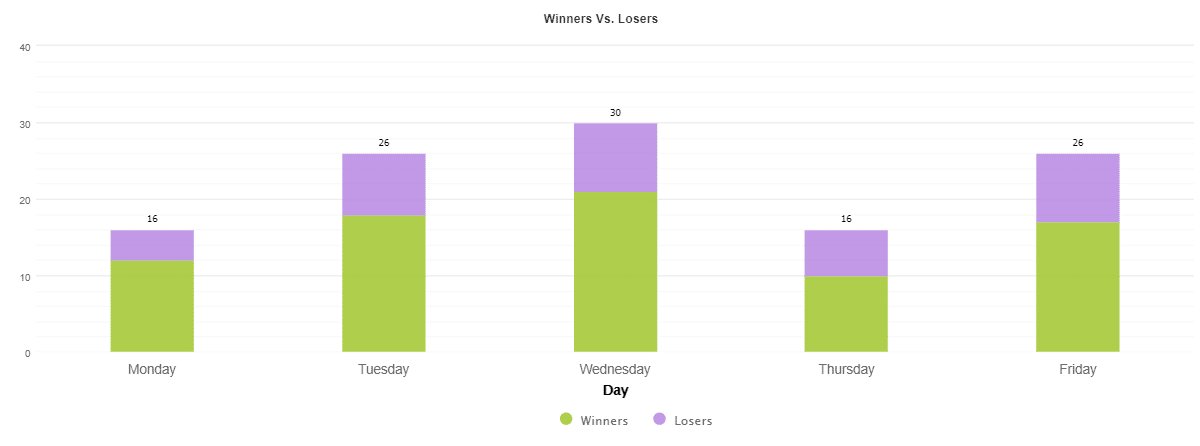

We may note that Monday and Thursday (16 both) are the less traded days.

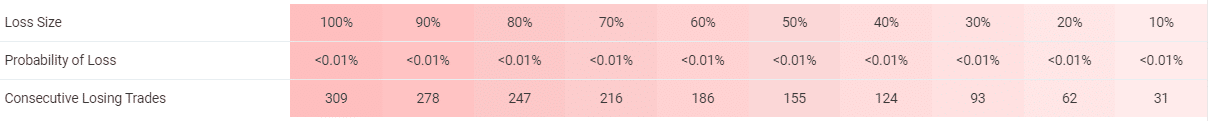

The system works with low risks to the account balance.

We may note that the money management system covers stop loss and take profit levels from the broker side.

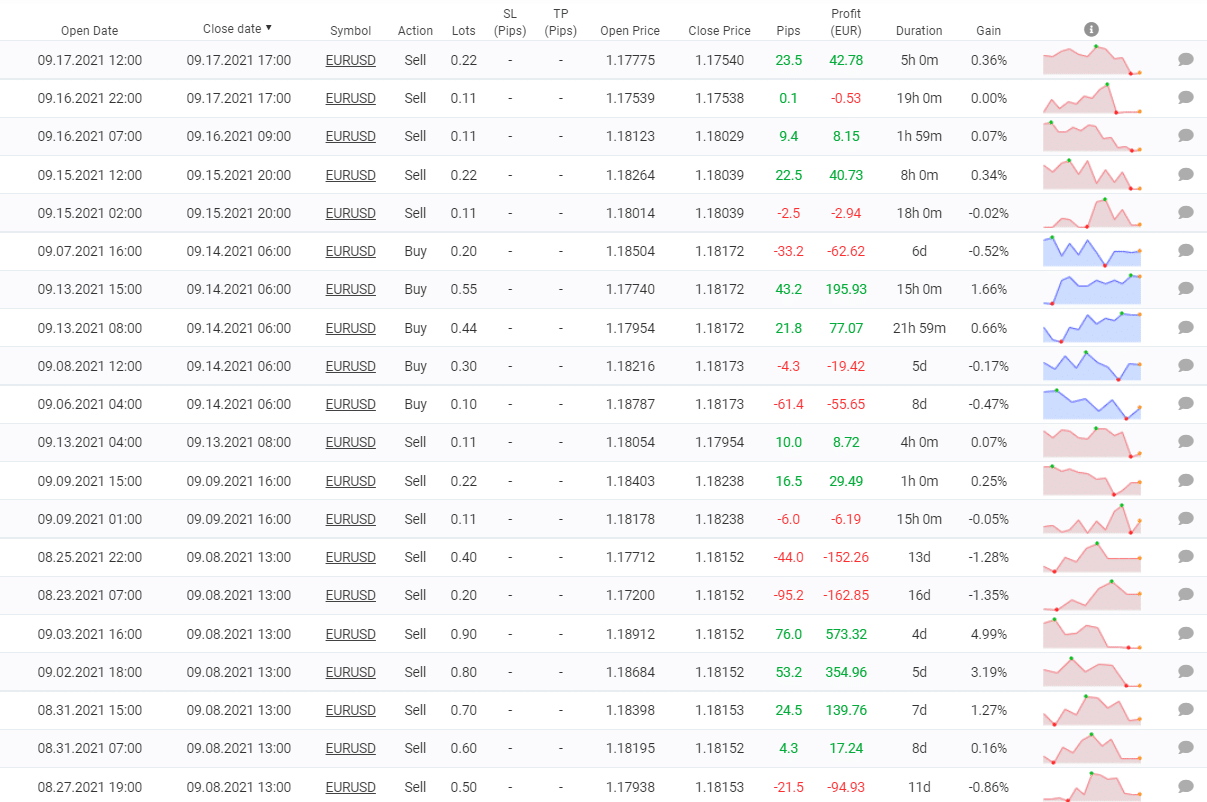

There are some floating orders on the market revealed.

September 2021 keeps going well.

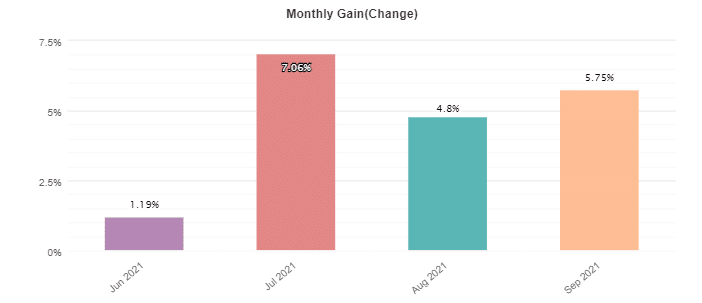

Customer reviews

The presentation includes only positive feedback from faceless people. We cannot be sure they are relevant.