Change is the only constant factor in the forex market. Prices and the underlying factors triggering fluctuations are constantly changing. For that reason, currency pairs don’t always trend in one direction. Rallies and pullbacks are common occurrences presenting an opportunity to buy an asset at a discount.

Buy the dips

Buy the dip is a common phrase in the forex market. It refers to entering a long or a buy position as soon as the market experiences a short-term price fall from a long-term uptrend. It is simply a dip that appears on the chart when the price falls after moving up significantly.

The short-term counter-trends that come into play after a currency pair has moved up significantly are often referred to as pullbacks or corrections. Buying such short-term trends bodes well with the idea of buying low.

Instead of buying a financial instrument when it has moved up significantly, the idea is to wait for it to pull back to a key support level, to be able to buy at a discount. In this case, one gets to buy at a much lower price, thus increasing the prospects of generating significant profit as price action resumes the upside action.

How to buy the dip

Forex majors are some of the most liquid instruments in the financial markets. What this means is that there will always be a sufficient number of buyers and sellers at any given time. Consequently, dips will always come into play, providing an opportunity to buy at a much lower price.

Step 1: Determine the trend

The first step to buying the dip entails ascertaining the underlying long-term trend. The trend will always be your friend, and the longer it has been in place, the more reliable it is for ascertaining pullbacks. One way to measure the direction the price is trending entails using Moving Averages such as the 200-day or 100-day Moving Average.

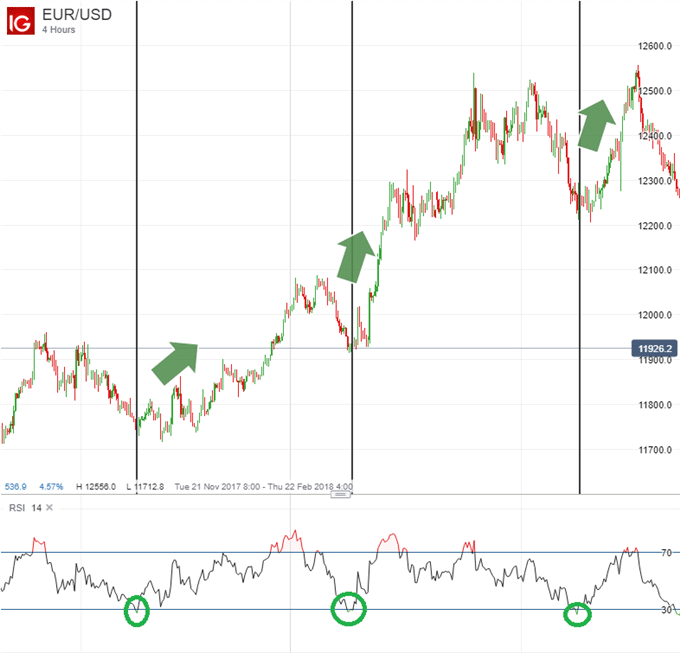

As long as the price is above these two Moving Averages, it means it is trending up and that bulls are in control. In addition to using Moving Averages to ascertain trends, you can also use the Relative Strength Index or Stochastic indicator to identify prevailing market conditions such as oversold and overbought where trades ought to be placed.

Step 2: Look for static support levels

Currency pairs don’t always trend up. Periods of consolidation and pullbacks are common regardless of the strength of the upward momentum. Consequently, it is important to identify key support levels whereby price is likely to pull back to after moving up significantly.

In an uptrend, the price will always pull back to the Moving Average after moving up significantly. The Moving Average will always act as a support level from which buyers will always come into play and try to buy more, thus pushing the price higher.

Additionally, the Relative Strength Index will always provide hints that price has pulled back to support level. When prices are moving up, the RSI will also trend up. When overbought conditions are hit, correction often comes into play resulting in price correcting lower.

The correction lower will most of the time continue until the RSI hits oversold conditions, as shown above. It is clear that as soon as price tanked significantly and the RSI signaled oversold, buyers came back into the fold and helped steer the price back up.

Step 3: Look for demand resumption

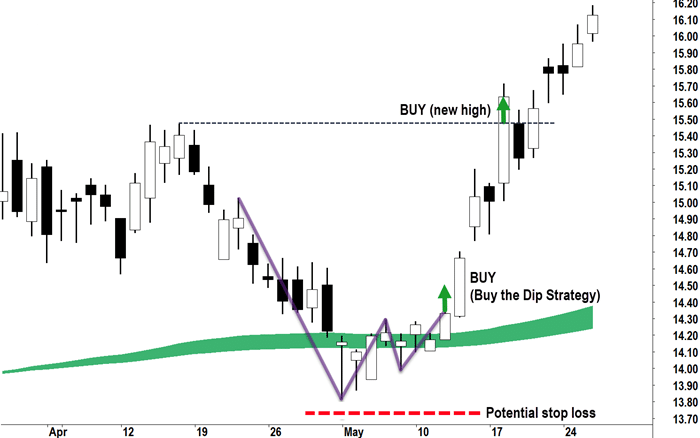

Once the price pulls to support zones, it is important to wait for signals to buy the dip. This is partly because the price can continue moving lower or be in consolidation mode at the support zone for an extended period.

Traders use Japanese candlesticks to identify if the price is ready to start moving up once again after a correction. A candlestick pattern such as Bullish engulfing at the support zone might as well signal a pile-up of significant buying pressure ready to take the price up.

Consequently, once a bullish engulfing pattern forms, one can look to enter a long position to try and profit as price bounces back and moves back to the top. In this case, buy positions can be triggered once the RSI indicator is at the lowest point, signaling oversold followed by a reversal pattern such as bullish engulfing.

Risk management

While buying the dip is a sure way of increasing the prospects of generating significant profit while trading the majors, risk management is also very important. No technical analysis or pullback is full proof. Therefore, it is important to be extremely cautious while buying the dip as the price can bounce back from support only to reverse and start edging lower again after entering a long position.

Some of the risk management plays that one can employ include placing a stop-loss order a few pips below where the long positions are triggered while buying the dip. The stop-loss order will, in this case, act as a buffer averting the risk of accumulating significant loss on the buying the dip strategy failing to hold and fuel a spike in price.

Additionally, position sizing is essential because buying the dip amounts to buying at some degree of weakness whereby anything can happen. In this case, you might want only to allocate a small portion of your capital until you are sure the pullback will hold and that price will continue moving up in line with the underlying uptrend.

Bottom line

While trading major currency pairs, the idea is always to buy low and sell high. Buying the dip provides an opportunity to buy a currency pair at a discount and increases the prospects of generating significant prospects as price corrects from a pullback and starts moving up.

Buying the dip entails ascertaining the underlying trend and ensuring it is an uptrend. Additionally, it is important to identify support levels whereby price is likely to bounce back after correcting lower. Waiting for confirmation at support levels to be sure that the price is set to correct higher after the pullback is crucial. In addition, it is important to deploy risk management strategies such as stop-loss orders while buying the dip.