Nowadays, forex robots have taken over the bulk of the work from forex traders. By simply defining a feasible strategy, traders can automate the process of technical analysis and generation of trade signals. What’s more, these robots, or expert advisers, are capable of executing trades on behalf of the trader. We will be looking at how one can tweak their robot to trade the European session, but first, let’s define what this session entails.

The European session

London is the world’s largest FX financial center. It accounts for more than a third of all worldwide FX transactions. The European session runs from the opening of the London FX market to its daily close. As a result, the terms European session and London session are interchangeable. This session’s concluding hours happen to coincide with the start of the New York session.

Trading hours

This session is open from 7:00 AM GMT to 4:00 PM. Traders from New York who aim to catch this session will need to be active from 3:00 AM to noon. This is the time of day when the forex market records the most activity.

Characteristics

1. It is highly volatile

This session is usually preceded by the Asian session, which sees much lower volumes, liquidity, and volatility. In other terms, the Tokyo session manifests as a range-bound market. When the London session opens, price fluctuations tend to be much bigger, and large price moves often occur in short periods of time. This is especially true for major currency pairs, especially those involving European currency crosses.

The high volatility characteristic of this session causes to support and resistance levels to be easily broken out of. This forms the basis of most traders’ strategies, as they will be mostly looking to trade the breakouts common with this session. Such breakouts, if correctly predicted, could present them with huge potential for profit.

2. The New York overlap

As aforementioned, the last four hours of the European session coincide with the first four of the New York session. This happens between the hours of noon and 4:00 PM in London time. Due to the large size of both markets, the biggest price moves will usually manifest during this overlap. For this reason, traders often look for breakouts to trade during this 4-hour window.

3. High liquidity

Due to a large number of banks and other liquidity providers in London, this session often enjoys very high liquidity. Furthermore, the large volumes and number of market participants cause most major pairs to trade at competitively low spreads. This is especially attractive to day traders who do not target huge pips in profit. Additionally, the overlap with the New York session only serves to increase this session’s liquidity.

Choosing currency pairs

Most currency pairs will see increased trading activity during this session. Be that as it may, the best pairs to trade are those that record the highest volatility and volumes. These include major pairs like EURUSD, GBPUSD, and USDCHF, just to mention a few.

When the overlap with the New York session comes around, pairs like EURUSD, USDJPY, and GBPUSD see the most increase in volatility. This can be traced back to the increase in interbank transactions between European and American banks. This makes such pairs the most suitable to trade during this four-hour period.

Trading strategy

As previously stated, a breakout strategy is an ideal approach to use during the London session. To use this method, find a market that is currently trending upwards. The market should be trading below the resistance line if it consolidates right before the London open, as it typically does.

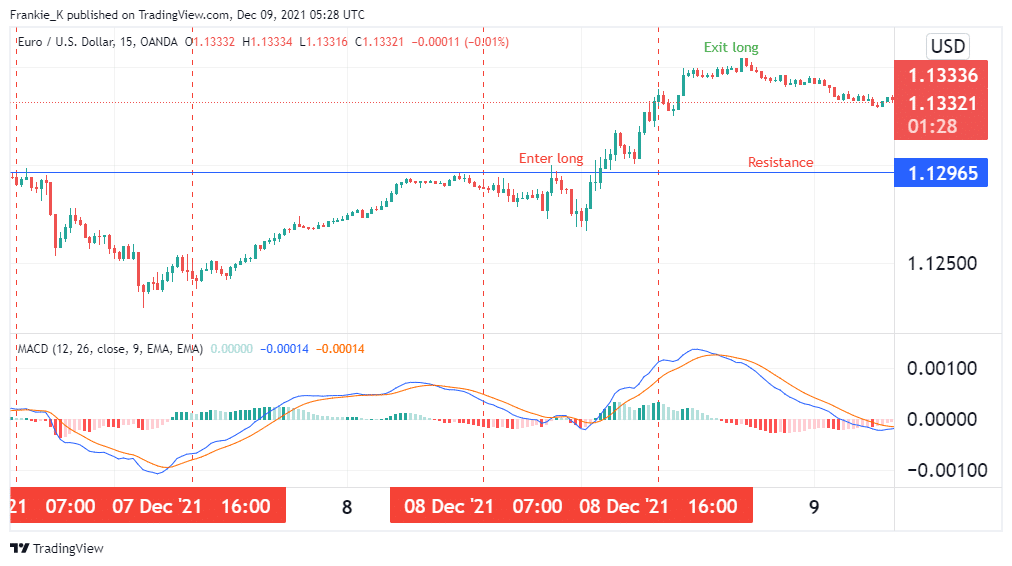

After the London session begins, wait for prices to break above the resistance line. Next, wait for another candle to close above the resistance line to confirm the breakout. You may also use an indicator like the MACD to confirm the entry signal. Once confirmed, enter a long trade and place your stop-loss just below the breakout line. You can place your profit target at the next major resistance or wait for MACD to indicate a trend reversal.

This strategy can also be employed for a market in a downtrend, except you’ll wait for a breakout from support before entering a short trade.

The example above shows the breakout strategy in practice. The London session is enclosed within the red lines. We can observe the breakout of 8th December happened right after the blue MACD line crossed above the signal line, which usually is a bullish flag. This gave the entry signal. The exit signal came right after London’s close when the MACD line crossed below the red signal line, and the histogram went from positive to negative. This marked the end of our uptrend.

Adjusting a forex robot to trade the London session

The inputs given to a forex robot constitute the trader’s strategy for entering trades. For a robot meant to trade the London session, the first instruction you’d need to enter is to limit its trading hours between 7:00 AM to 4:00 PM GMT. Next, for a long trade, define the resistance level’s price and instruct your robot that if prices go above this level and MACD goes positive, to enter a long trade. To exit, you may instruct it to take profit at the next valid resistance level, or if MACD goes negative, to close the trade.

Similarly, for a short trade, identify the support level and instruct your robot to open a position once this level is broken out of and MACD goes negative. The exit will be marked by the next valid support or when MACD’s histogram goes positive.

Conclusion

The London session is marked by high volatility and high liquidity due to a large number of market participants. Since it is preceded by the much slower Asian session, trading usually involves waiting for a breakout in either direction. Traders may use resistance and support lines in conjunction with trend-following indicators such as the MACD to obtain entry and exit signals. Once they have defined their strategy, they can then input it into a forex robot to automate their trades during this session.