The strength of a currency is a measure of currency’s worth. Economists use it as a measure of purchasing power, while financial traders use it as an indicator of several aspects, such as the fundamental aspects of a country’s macroeconomic performance. One of the most commonly used reference sources of currency strength is the currency index, such as the dollar index (DXY).

Consumers benefit from higher purchasing power when the economic worth of their currency rises. Meanwhile, those who acquire that currency benefit from higher wages and greater financial independence.

The strength of a currency is influenced by a wide range of local and global circumstances.

Below are three ways to evaluate a currency’s strength when all elements are considered.

- Value: the comparative purchasing power of commodities and services in relation to foreign currencies.

- Utility: This is a currency’s usefulness as a tool for valuing and exchanging financial assets in other countries.

- Reserve: The extent to which the currency is accepted as an international mode of exchange. This is what makes some currencies more appropriate than others for holding in reserves than others.

Your trading will be more profitable if you know which currency is weak or strong. Like other financial products, currencies have a tendency to fluctuate in response to market conditions.

Even though some countries’ economies can be unstable due to political concerns, public unrest, famine, pandemics, etc., certain countries have strong currencies even under tough circumstances. Such currencies are termed as “safe haven.”

Absolute currency strength (ACS)

To analyze foreign exchange markets, technical analysts examine the absolute strength of currencies. ACS is designed to show the current and historical gains or losses of a currency. There are 28 cross-currency pairs that have been mathematically decorrelated. It depicts the power and momentum of certain major currencies.

The default computation period for ACS is 15-period, and it is a percentage of the resultant profit or loss. Relative currency strength does not apply to this indicator. However, depending on your trading objective and style, you may adjust the timescale to suit your needs. The currency has a stronger momentum if its high and low values occur less frequently.

In most circumstances, the ACS is employed as a support indicator for the relative currency strength.

Relative Currency Strength

The Relative Currency Strength (RCS) weighs how strong or weak a particular currency or a currency pair is. When the results are in, traders have useful information to decide on the currency pairs to trade and the best trading positions to take.

For the purpose of charting currency strength or weakness over time, the closing prices of recent trading periods are taken into account. The foundations of this strategy are RSI and 28 cross currency pair mathematical decorrelation. It illustrates the currency’s relative strength and momentum.

The RCS is commonly employed on a 14-period timescale, with 70 denoting high levels and 30 denoting low levels on a scale of 0 to 100 like RSI. You can readjust the time frame to a different period to give you the desired outlook, in line with your trading style.

Working example

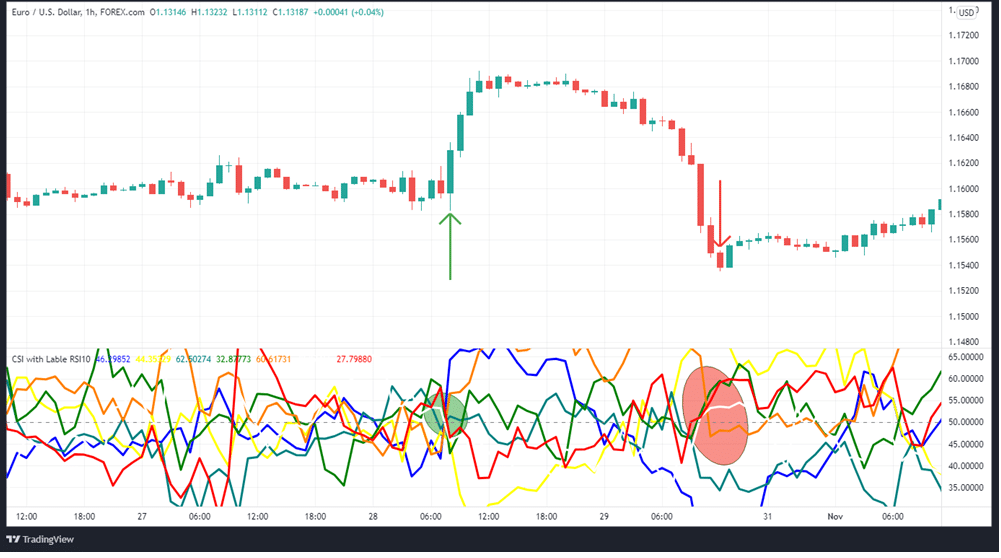

Example 1: The RCS buy strategy follows the following guidelines:

- The base currency’s value should be at least 60.

- The denominator currency’s value should not exceed 40.

- Wait for the candle to close in a bullish position.

- Place the stop loss at the recent bottom of the swing area.

- Make sure that your take profit is double the size of your stop loss in order to get a good risk/reward ratio.

In the chart above, the market entry for the EURUSD pair is shown by the green arrow, while the exit is shown by the red arrow. Notice the corresponding convergence and divergence by the indicator.

At the point highlighted in green, the green line representing the euro is above the yellow line representing the dollar. At that point, EUR is stronger than USD, and hence we go long. However, at the point highlighted in red, the two lines switch positions, with the euro strengthening against the dollar. Therefore, we exit the market at that point.

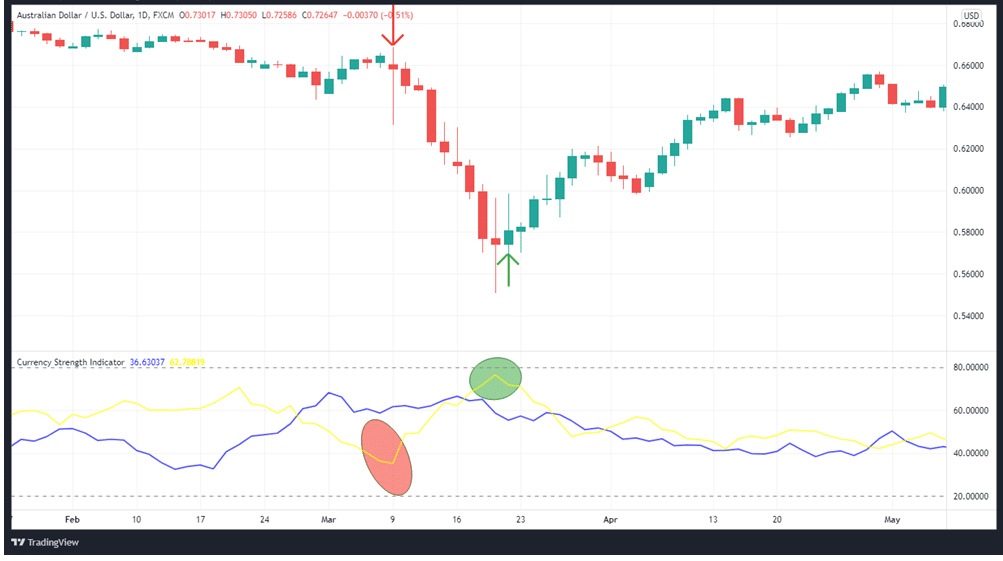

Example 2: RCS Sell strategy. It follows the following guidelines:

- The base currency’s value should be no more than 40.

- The denominator currency must have a value of at least 60

- Take your time and see if the candle closes as bearish before making a decision.

- Place a stop-loss order at the recent high of the swing area.

- Maintain a take-profit that is double the amount of your stop-loss in order to maintain a good risk/reward ratio.

In the AUDUSD chart above, the red arrow shows where to enter a sell order, and the green arrow indicates where to exit.

At the point highlighted in red, AUD is at its weakest, following the earlier crossover of the blue USD line above the AUD line. This shows that putting a sell order at the crossover was the right move.

However, at the point highlighted in green, the AUD peaks against the USD. This justifies putting the exit point on the price level corresponding to the second crossover point.

Macro currency strength

Macro currency strength is an assessment of the strength of currencies based on macroeconomic fundamentals. As a result, it is often the aggregate of an evaluation of different periodic economic publications. If the value of a currency rises and falls within wide margins due to economic factors, it can cause major market turbulence.

When an economic event is imminent, the prior outcomes and predicted numbers are presented in the economic calendar. As long-term investors extensively analyze the resultant forecasts and take their positions, the market sentiment becomes more prominent.

There are times when expectations are met and currency strength increases or decreases as a result, and this can have an impact on currency pairs. When investors are surprised by the outcome, severe volatility might develop.

Examples of major economic publications

-

ISM reports

Forex trading relies heavily on the ISM manufacturing index, which influences currency values around the world. Consequently, understanding the ISM’s manufacturing, construction, and service indices is vital for forex traders.

It is standard practice for traders and investors to compare projections against the previous month’s figures. The US dollar tends to rise if the reported PMI number exceeds the previous one and is higher than the projected one.

-

Consumer Surveys (UMCSI)

Using the Consumer Sentiment Index from the University of Michigan, consumers are able to assess the current and future state of the economy. Preliminary and amended versions of this data were released two weeks apart. More weight is given to early findings. The results are based on a poll of about 500 people.

If reading is greater than predicted, it should be seen as a positive sign for the USD, while lower readings should be viewed as a negative sign.

-

Interest rates

The perception of a currency’s value is influenced by interest rates. It’s common for higher interest rates to lead to an increase in demand for a currency, causing investors to buy more of it. Consequently, any change in the interest rate would have an impact on the foreign exchange market; therefore, forex traders should keep an eye on central bank interest rate announcements. When interest rates rise, the currency strengthens; when they fall, the currency loses value.

In summary

Currency strength affects economies in different ways and also has a great impact on consumer purchasing power. Knowing the relationship between the strengths of different currencies is essential to succeeding as a trader.