EURUSD is the most traded pair in the forex market. FX traders looking to trade the pair will often pay attention to economic indicators from both the Eurozone and the US. This is all in a bid to predict the most likely direction of this pair’s price. One such indicator is the employment report. Arguably, the report which carries the most impact on the value of the dollar and, ultimately, all other pairs involving the USD is the Non-Farm Payrolls (NFP) report.

Importance of NFP data

The NFP report is released by the US Bureau of Labor Statistics (BLS) every first Friday of the month. It provides a measure of the change in the number of people employed by any registered business. The employees exempted from this count are those working for nonprofit organizations, private households, the government, and farm employees.

The reason this report is important is that it gives an indication of consumer spending, which ultimately speaks to the state of the economy. This is because the more disposable income the populace has, the more money they’ll have available to spend on various goods and services, thus stimulating economic growth.

The release of NFP data often coincides with the unemployment data, which is obtained by conducting a survey on employment across the country. Analysts can then correlate the two figures to find out the rate of employment in the country.

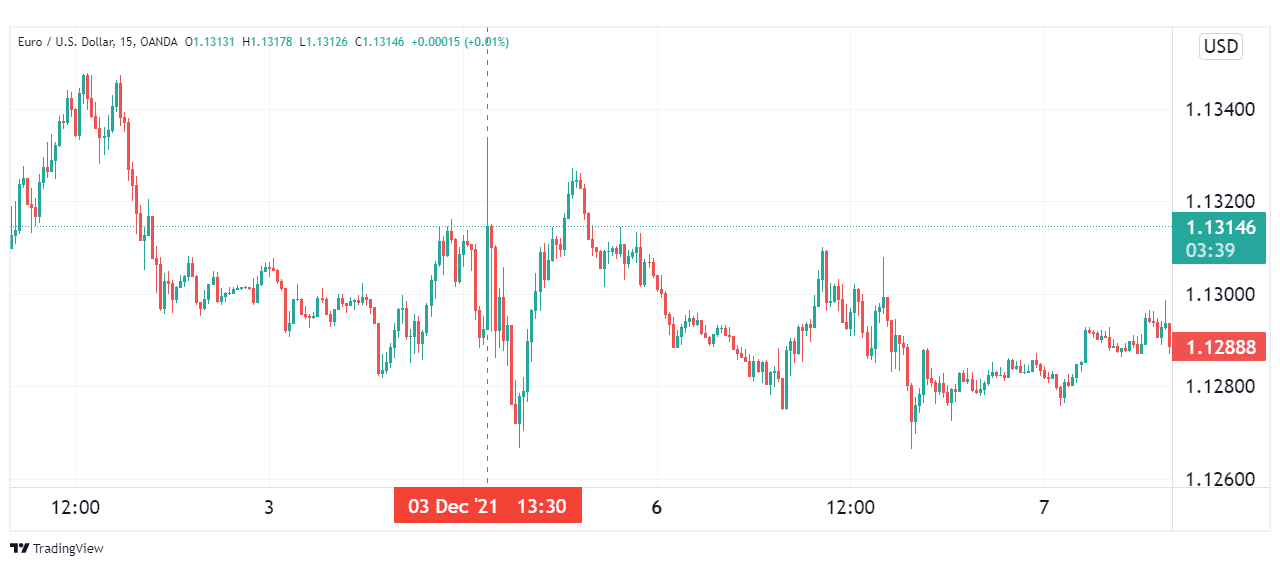

A good example of the impact of this report manifests on the EURUSD chart after the release of the December 2021 NFP report. Analysts had projected the report to show an increase in employment by 550,000, but instead, the report showed an increase to the tune of 210,000. Such a significant difference resulted in the rapid devaluation of the dollar against the euro, as can be seen on the below chart highlighted by the red vertical line.

Now, of course, this manifested as an increase in the pair’s price, as USD is only the quote currency in the pair. This goes to show that the level of consumer spending has a direct impact on the value of the greenback.

Further effects of the NFP report

A rapid increase in consumer spending may lead to inflation. In the US, the Fed is tasked with maintaining this rate of inflation at a certain threshold, usually around 2-3%. Therefore, a rapid increase in NFP numbers may prompt the Fed to step in with deflationary monetary policies, such as increasing interest rates.

Similarly, a significant decrease in these numbers may point to an economy headed to recession, which would compel the Fed into decreasing interest rates. Such Fed decisions tend to have the largest impact on the value of USD in the international currency market. Therefore, the impact of non-farm payroll data on forex trading cannot be overstated.

How to make sense of NFP data

Usually, the most telling aspect of the NFP report is the level of deviation from the estimates leading into the report. Usually, most traders look for employment growth numbers averaging around 100,000 each month. This is usually enough sign of steady growth of the economy and tends to be bullish for the greenback.

If the report shows a 150,000 increase in payroll numbers against an estimate of 100,000, you can expect a significant uptrend for the dollar. For our EURUSD pair, this should manifest as a bearish move following the report. Similarly, if the estimate was at 200,000, but the actual report comes out 150,000, this can prove bearish for the dollar and bullish for EURUSD. This is because though it surpassed the 100,000 threshold, investors take a lower than expected reading as a sign of a struggling US economy.

NFP trading strategies

There are two popular strategies for trading in this report that we shall look at today.

1. Fading the initial move

This move involves waiting for the report to be released to see how the market moves. Sometimes, there may be a knee-jerk reaction in the opposite direction, which usually fades out in a few minutes. For instance, in the case where the report comes out higher than expected, you may observe the EURUSD pair go on a rally instead of embarking on a downtrend.

To fade this move, you’d have to wait for the initial uptrend to exhaust its momentum, then enter a short trade with your profit target at the point where prices were before the report. Your stop-loss should be above this swing high, in case the uptrend persists.

2. Trading the trend

This approach involves assuming the initial trend from the report’s release is the correct one. To that end, traders may wait for it to break the previous day’s high before entering a swing trade, that is if the initial move was an uptrend for the pair. For a downtrend, you would have to wait for EURUSD prices to surpass the previous day’s low to enter a short trade.

Risk management

The NFP report usually causes rapid price moves, especially when the report deviates from expected figures. For that reason, it presents opportunities for quick profits, as well as the risk of a quick loss. Therefore, employing risk management measures such as stop losses is of paramount importance when trading these employment figures.

Conclusion

Employment figures are one of the most important fundamental indicators driving the price of EURUSD. The most impactful of these employment figures is the Non-Farm Payrolls report out of the US. It is compiled by the Bureau of Labor Statistics and is released every first Friday of the month. A higher than expected reading is bullish for the dollar and bearish for the pair, while a lower than expected reading tends to be bullish for EURUSD. Due to the volatility experienced after this release, one should always utilize risk management techniques when trading these figures.