Footprint charts show price, including trade volume and order flow. Its multi-pronged nature provides investors with more data for study other than currency price.

The data encompasses volume, bid-ask spreads, and liquidity levels. The chart’s time frame can be adjusted to evaluate the currency’s movement over varying periods of time.

Finally, they have the advantage of examination of diverse variables in one diagram.

Footprint charts fundamentals

Currency worth is determined by an investor’s resolve, whether they deal or trade. If buying, the investor pays either the ask or the offer price.

The bid is the worth investors are paid when selling currency. The process of purchasing anything is recognized as accepting an offer or raising the ask. The expression “hitting the bid” refers to the venture of selling.

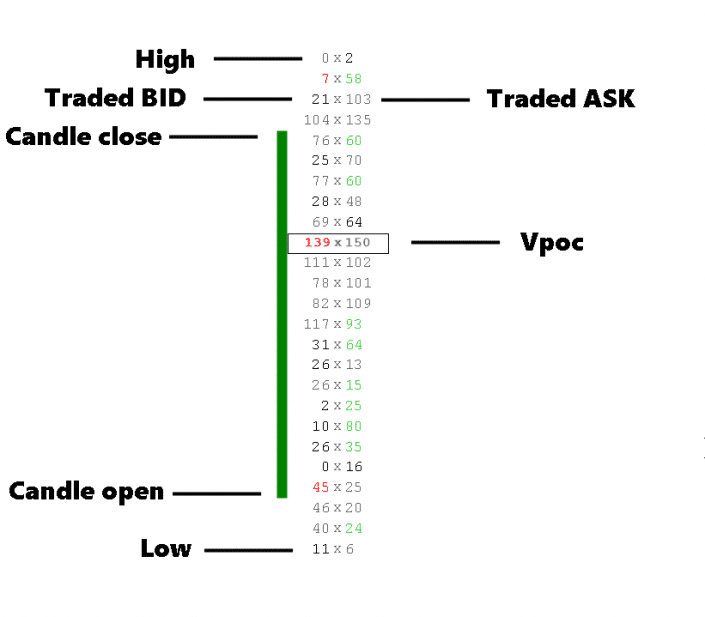

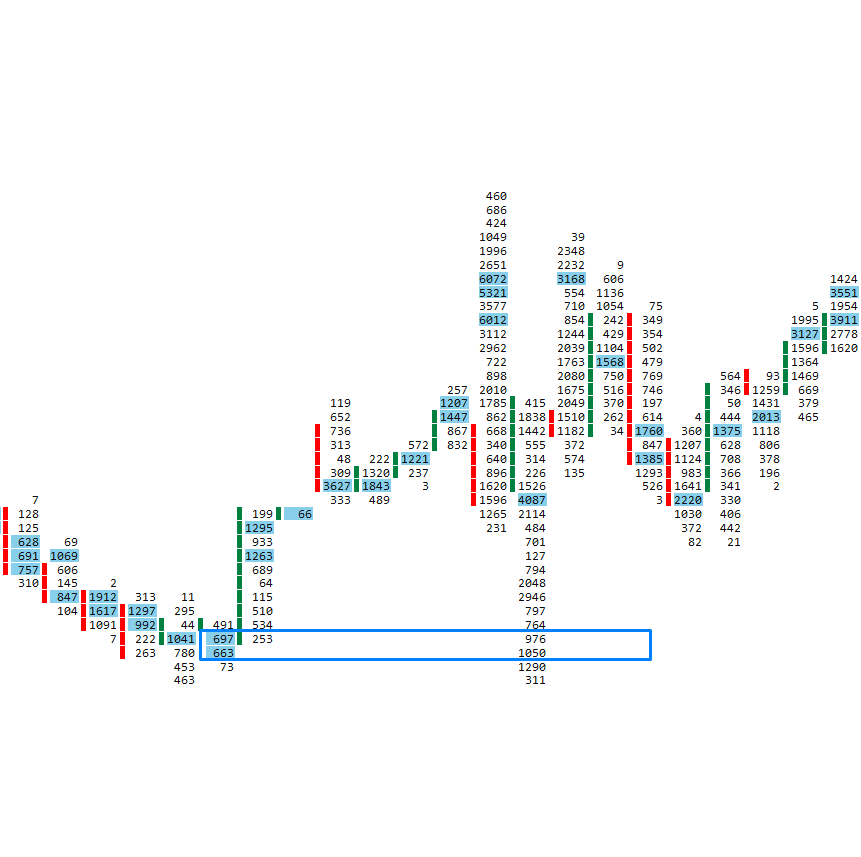

The specifics of the footprint chart are shown in the image above.

The Vpoc, the high and low of the candle, the open and close of the candle, and the traded BID and ASK are all present.

Vpoc – Point of control(volume): The term “Vpoc” stands for “Volume Point of Control.” It is the rate at which the greatest amount of money is exchanged. It’s a market with a box in the candle.

It shows the volume position on the candlestick if it’s at the top, middle, or bottom.

Price provides signals as to the order in which the trading is headed. This allows for multiple trade possibilities.

The high and low: The high and low points are displayed on the footprint chart.

Candle close and open: Footprint chart closes and opens in a coupled way as a standard candle.

Footprint chart variations

Typical footprint charts utilized by investors and sellers are discussed below.

Bid/ask footprint

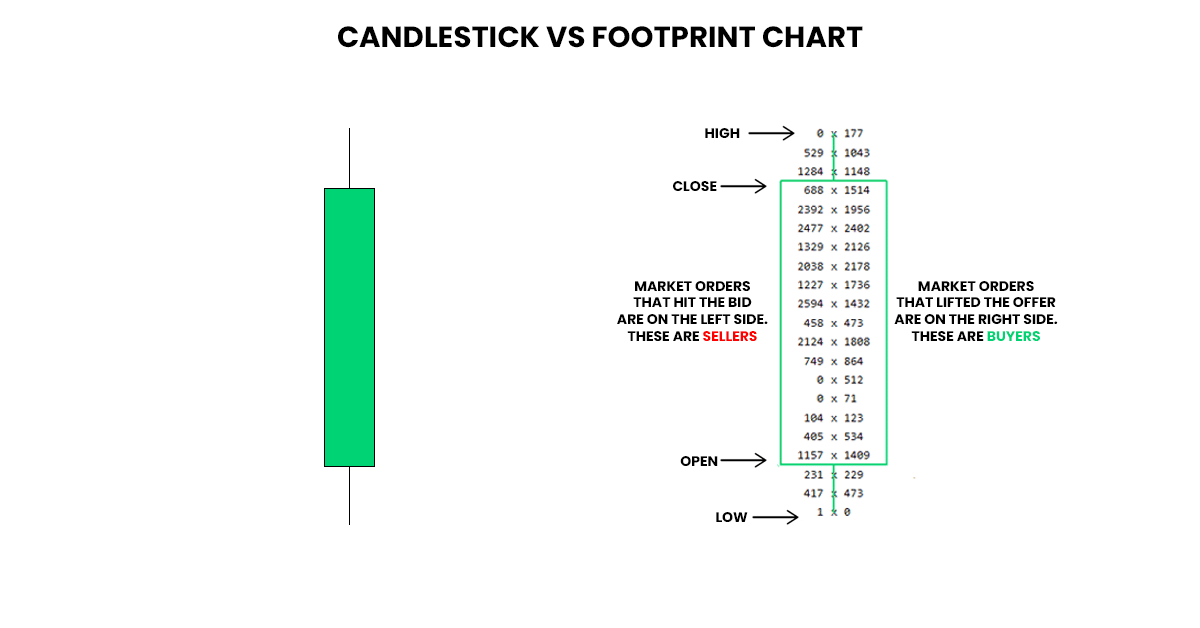

The bid/ask Footprint shows the sum of deals traded on the bid worth and the sum traded on the asking figure. It’s displayed in real-time for any period identified.

The chart changes when the bid/ask price changes for each bargain that is transacted.

It is important to view bid/ask values on the footprint charts. Round-the-clock-changing statistics can be perplexing at first, but they become clear once you put them in perspective with other conflux variables.

Dealers are on the left side of the bid/ask Footprint, while investors are on the right side. So, if we have a footprint of 405 x 534, we have 405 lots that struck the bid and 534 lots that lifted the offer.

Delta footprint

The net gap allying volume instigated by an investor and that which dealers originate is represented by method at each price point.

It authenticates that a cost movement has started and progressed so. Its interpretation can be made using cumulative volume delta, delta profile including delta footprint.

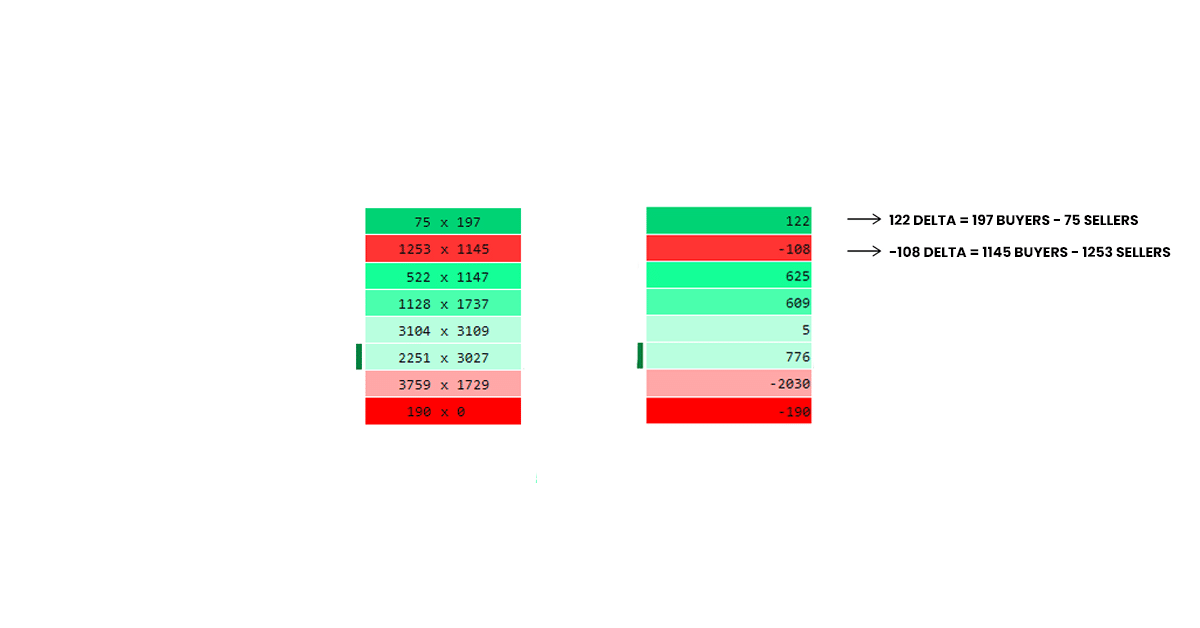

The delta method indicates the variance between concluded implementations of the bid and the offer, thereby indicating only a single value.

At any given price level, delta indicates where the stronger hand is, provides an easy way to see who won the war, and gives perceptible belligerence by color-coding approach.

As you can see, starting at the top and operating your way downwards, the delta is 122.

It implies that 197 investors have accepted the offer, while 75 dealers have accepted the bid.

The delta of 108 is shown in the chart above, implying that 1145 investors have made an offer, whereas 1253 dealers have made a bid.

Following that is 625 delta, which equals 1147 investors making an offer vs. 522 dealers making a bid.

Volume footprint

The volume footprint splits volume by cost and time. It is intended to assist merchants in determining capitulation points.

Simply, it displays the settlements transacted at each amount, notwithstanding if it was a bid or asked.

Additionally, it brings the perception on where buys and sells are focused, thereby knowing the attitude of ease of getting into trades. This is paramount because significant market partakers love to stack their orders at coupled balances.

Lastly, it’s useful for identifying true breakouts centered on high volume and repurposing them as liquidity pockets to be used as support and resistance levels.

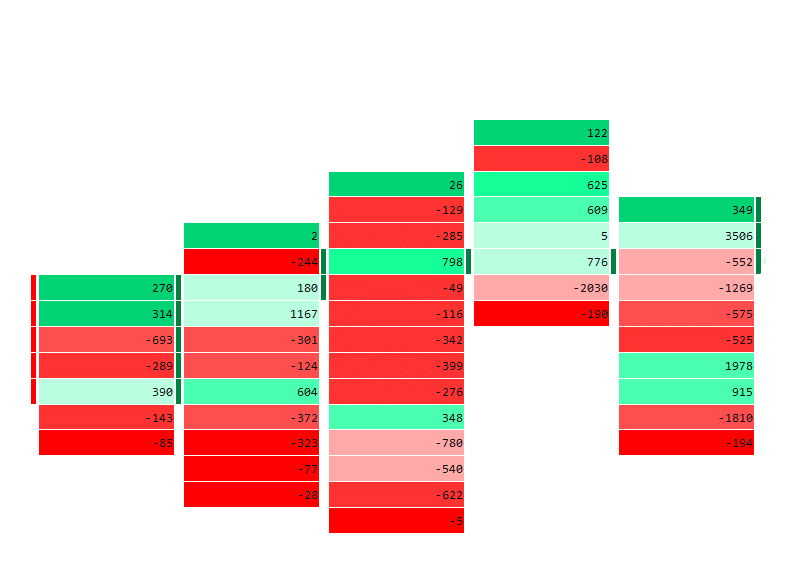

The high-enacted volume sections, as seen in the preceding illustration, are applied as support and resistance levels for the coming days.

Volume profile footprint

Volume profile is a charting study and indicator for expert businessmen. It displays the sum of the sold volume of a currency over a given time period and at various price levels.

All of the strategies and plans in the volume profile are based on historical data, and they are all based on previous traded volume.

It enables a brisk envisioning of inherent support and resistance regions, thus pinpointing ineptness in liquidity gaps and HVNs. These operate as support and resistance after the gap is filled.

Merchants use rejection and acceptance levels of High Volume Nodes, Low Volume Nodes, and POCs when using this charting study.

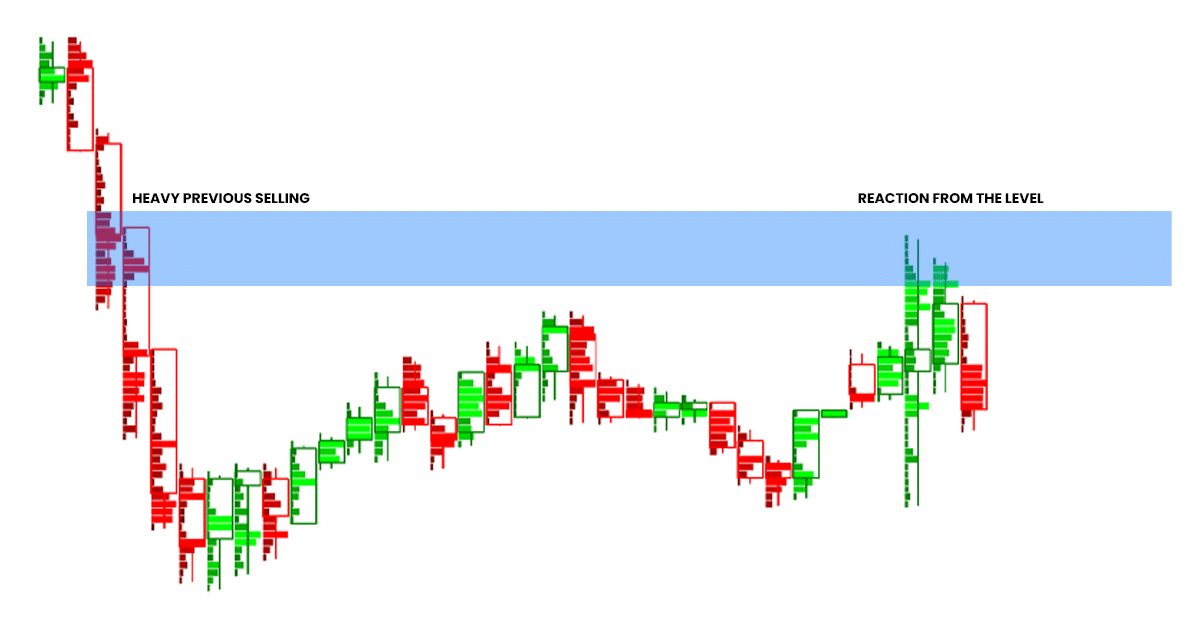

Trading is moving higher in the chart above, then swiftly reverses course after revisiting a place with formerly implemented large volumes and permeating the Low Volume Node.

Plans of action

Footprint charts help to know if there is a volatility reversal by looking at the majority of the volume traded, buy and sell imbalances, and no-unfinished auctions.

All these factors, when put together, allows for decision-making on when to place a bid /ask.

Secondly, footprint charts are good at picking out the intraday support and resistance levels. This is done by checking to see if there are unfinished auctions, stacked imbalances, and large buy/sell imbalances relative to the surrounding bars.

In the event of any of these occurrences and you sketch an expanded parallel line, you will get to know the intraday support and resistance levels.

Finally, a merchant can plainly know the long-term support and resistance levels by opening the daily footprint chart and highlighting the high volume nodes by using the volume.

Conclusion

Footprints charts are a great tool for doing business in forex, making it easy to understand bid/ask spreads and liquidity balances for the best decision-making to make profits in the forex market.