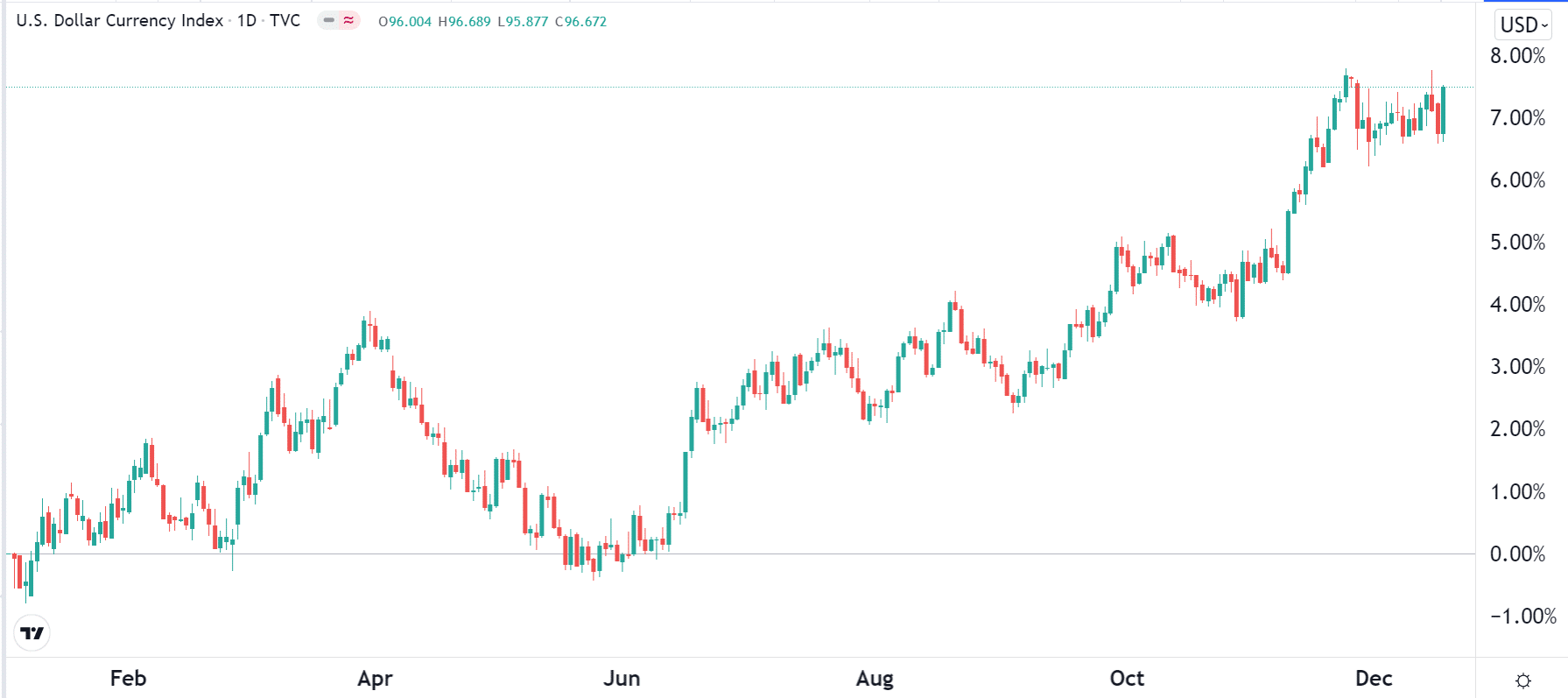

The forex market had a great year in 2021 as investors focused on the reopening of most countries and the stubbornness of the Covid-19 pandemic. After tumbling in 2020, the US dollar bounced back in 2021 as investors predicted that the American economy would have a better recovery than other countries.

The dollar index jumped by more than 7% in 2021. So, let us look at the key themes that will influence the forex market in 2022.

CBRT madness

A key theme that emerged in 2020 was the “madness” in Turkey. Turkey is considered to be one of the most promising emerging markets, but in 2020, its currency tumbled by about 100%.

The tragic decline of the Turkish lira started in March 2020 when President Erdogan decided to fire the then respected central bank governor. He replaced him with a little-known economist and opinion-writer who believes in his unorthodox monetary policy.

Since then, the central bank has slashed interest rates from about 20% to 14%. In monetary theory, a central bank should tighten financial conditions when the economy is going through a period of high inflation. In Turkey, official statistics place inflation at about 20%. Many economists believe that real inflation is above 50%.

Turkey will go to a presidential election in 2022, and the president has committed to keeping the interest rates low. His thinking is that low rates will help to curb the current inflationary pressures. Therefore, investors will pay close attention to the Turkish lira and whether it will continue falling.

Bank of England (BOE)

The Bank of England (BOE) held its final meeting on 16th December. The central bank delivered a relatively hawkish decision that pushed the British pound substantially higher against the euro and the US dollar.

In a statement, the BOE decided to hike interest rates by about 0.25%. This was a surprise since most analysts were expecting that the bank would remain relatively cautious.

The decision came at an interesting time for the UK economy. On the one hand, recent data showed that the economy did better than most countries. For example, UK home prices have surged to a record high while the labor market has tightened. The unemployment rate declined to about 4.2%, meaning that it could fall to about 3.5% in 2022.

At the same time, the UK economy is seeing significant inflation while the number of Covid-19 cases is rising. Recent data showed that the country’s inflation jumped to more than 5.2% in November 2021. The country is also recording more than 60,000 new Covid-19 cases every day.

Therefore, forex traders will focus closely on how the Bank of England will react in 2022 and some of its key policies. In addition, the thorny issue of Brexit will continue to influence the British pound.

Federal Reserve

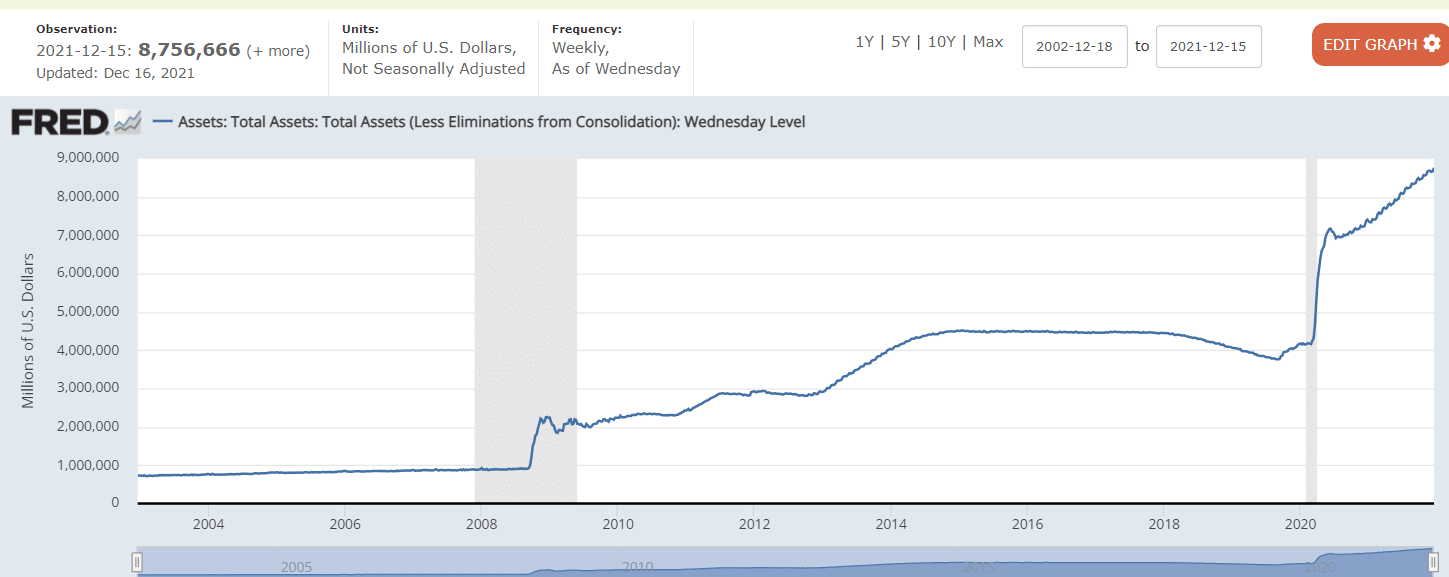

The Fed is the most important central bank in the world because of the role of the US dollar. In response to the pandemic, the Fed decided to unleash its full might. It did that by lowering interest rates to between zero and 0.25%. It also decided to launch the most ambitious quantitative easing program. In this QE, the bank purchased more than $120 billion of assets every month. This trend helped to push the bank’s total assets to more than $8.7 trillion, as shown below.

In its December meeting, the Fed decided to double its tapering by about $30 billion. It also signaled that it will end its quantitative easing policy in March 2022 and then implement about three rate hikes in 2022. Some analysts believe that the first-rate hike will come as soon as in March.

Therefore, the forex market will change in 2022 as the Fed and other central banks move from being dovish to being hawkish. This trend will have significant ramifications for key currencies.

Midterm elections

The next key theme that will have an impact on key currencies and the stock market in 2022 will be the US midterm elections. This is when Americans go to their polling stations and vote for their senators and house of representatives.

The upcoming midterm elections will be important because we could see the House and Senate change leadership. The Senate is currently at 50-50 between Democrats and Republicans, while Democrats have a thin margin in the House.

A change that tilts too Republicans means that it will be difficult to have any important policy breakthroughs in Washington. This could have an implication on the Biden administration even as his poll numbers sink.

Other central banks decisions

In addition to the BOE, CBRT, and the Federal Reserve, there will be other central banks to watch in 2022 will be the Bank of Japan (BOJ), the Bank of Canada (BOC), and the European Central Bank (ECB).

Among the major central banks, the ECB sounded a bit dovish when it held its meeting in December. In a statement, Christine Lagarde hinted that the bank would not hike interest rates until 2023. It intends to continue with its asset purchases program because of the Omicron variant. The recovery of European countries has been mixed, with some countries still struggling.

In Japan, the BOJ surprised investors by sounding a bit hawkish in its final rate decision of the year. It decided to end some of its pandemic response tools involving companies’ support. Still, with the country going through a period of low inflation, there is a likelihood that the bank will struggle to normalize.

In Canada, the BOC has already implemented two interest rate hikes, and there is a likelihood that the bank will be hawkish in the coming year.

Summary

2022 promises to be a busy year in the currencies market. Analysts will be focusing on the great unwinding of the easy-money policy that has existed in the past two years. At the same time, they will be focusing on the Omicron and other variants that will come out. At the same time, they will watch out for emerging market currencies like the South African rand, Brazilian real, and Mexican peso.